|

|

|

|

|||||

|

|

Innodata INOD is scheduled to report second-quarter 2025 results on July 31.

The Zacks Consensus Estimate for second-quarter revenues is currently pegged at $56.36 million, indicating a 73.13% increase from the year-ago quarter’s levels.

The consensus mark for second-quarter earnings has remained unchanged at 11 cents per share over the past 30 days.

Innodata’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, delivering an earnings surprise of 156.77%, on average.

Innodata Inc. price-eps-surprise | Innodata Inc. Quote

Let’s see how things have shaped up prior to this announcement.

INOD’s second-quarter performance is expected to have benefited from strong momentum across its generative AI solutions, expanded customer engagements, and strategic investments.

INOD signed a second master statement of work (SOW) with its largest customer, enabling it to deliver generative AI services funded by a distinct and materially larger budget category. This expansion is expected to have driven significant revenue growth in the to-be-reported quarter.

The company plans to invest in AI technology supporting both current and prospective customers, as well as an expanding salesforce. In the second quarter of 2025, Innodata plans to invest $2 billion to support its largest customer. These investments are designed to enhance capabilities and position INOD to meet the evolving needs of customers.

Industry tailwinds from AI-driven capital expenditure among major tech companies are likely to have benefited Innodata in the second quarter of 2025, as the company continues to position itself as a key player in the growing AI services market. The company’s strong balance sheet, with $56.6 million in cash at the end of the first quarter of 2025, provides flexibility to execute its expansion strategy while weathering any short-term fluctuations.

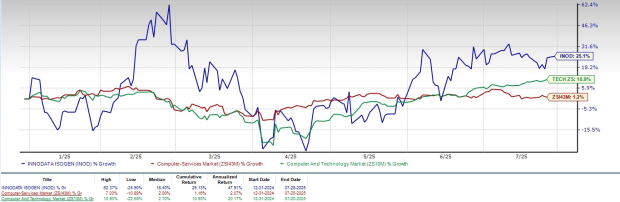

INOD shares have soared 25.1% in the year-to-date period, outperforming the Zacks Computer and Technology sector’s appreciation of 10.9% and the Computer - Services industry’s return of 1.2%.

Innodata shares have outperformed its closest competitors, such as Cognizant Technology Solutions CTSH, Infosys INFY, and ExlService EXLS in the year-to-date period. Cognizant Technology Solutions, Infosys, and ExlService shares have lost 2%, 21.7% and 4.9%, respectively, over the same time frame.

The INOD stock is not so cheap, as the Value Score of F suggests a stretched valuation at this moment.

In terms of the forward 12-month price/sales ratio, INOD’s shares are trading at 5.73X, higher than the Computer - Services industry’s 1.76X.

Innodata shares are trading at a premium compared to its closest peers, including Cognizant, Infosys, and EXLService. In terms of the forward 12-month P/S, Cognizant, Infosys, and EXLService are trading at 1.74X, 3.51X, and 3.14X, respectively.

Innodata benefits from expanding Generative AI (Gen AI) capabilities for enterprises in 2025 and beyond. Contracts with eight Big Tech for Large Language Models (LLMs) data engineering, including five of the “Magnificent 7” that position INOD for strong growth.

INOD’s launch of its Generative AI Test & Evaluation Platform, a new suite designed to help enterprises assess the safety and reliability of LLMs, has been noteworthy. Built on NVIDIA’s NIM microservices, the platform supports hallucination detection, adversarial prompt testing, and domain-specific risk benchmarking across text, image, audio, and video inputs, helping organizations build more trustworthy AI.

INOD is also onboarding several major clients, including top global firms in enterprise tech, cloud software, digital commerce, and healthcare technology, each with significant growth potential. The company expects 2025 revenues to jump 40% year over year to $238.6 million, driven by an expanding clientele.

Despite Innodata’s strong positioning in the growing generative AI safety domain and impressive revenue growth prospects, macroeconomic uncertainties and Innodata’s plan to invest in new programs before revenue realization are expected to weigh on near-term margins.

Innodata targets an adjusted gross margin of 40%, which is significantly lower than the 43% reported in the first quarter of 2025 and the 41% in the year-ago quarter. Revenues from the largest customer are expected to decline 5% sequentially in the second quarter, which is a headwind.

Innodata currently has a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point to start accumulating the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite