|

|

|

|

|||||

|

|

Beam Therapeutics BEAM incurred a loss of $1.00 per share in the second quarter of 2025, which was narrower than the Zacks Consensus Estimate of a loss of $1.04. The company had reported a loss of $1.11 per share in the year-ago quarter.

Total revenues, comprising license and collaboration revenues, came in at $8.5 million in the second quarter compared with $11.8 million reported a year ago. The top line fell short of the Zacks Consensus Estimate of $14 million.

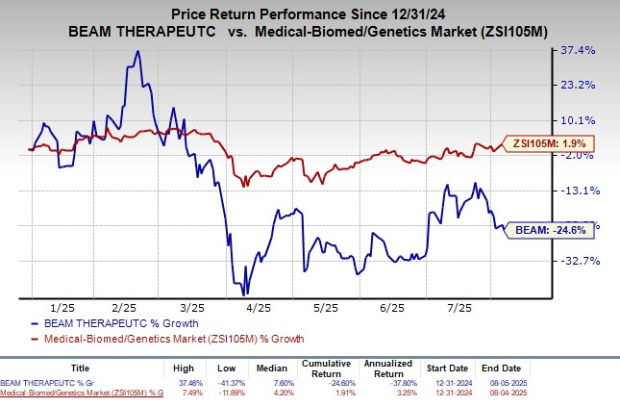

Shares of Beam Therapeutics have declined 24.6% so far this year against the industry’s rise of 1.9%.

Research and development expenses were $101.8 million in the second quarter, up around 17% from the year-ago quarter.

General and administrative expenses totaled $26.9 million, decreasing around 9.1% year over year.

As of June 30, 2025, Beam Therapeutics had cash, cash equivalents and marketable securities worth $1.2 billion compared with the same $1.2 billion as of March 31, 2025. The company expects its existing cash balance to fund its operating expenses into 2028.

Beam Therapeutics is developing its leading ex-vivo genome-editing candidate, BEAM-101, in the phase I/II BEACON study for the treatment of adult patients with sickle cell disease (SCD), an inherited blood disorder.

Enrollment has been completed in both the adult and adolescent cohorts of the BEACON study. Updated data from the BEACON study is expected to be presented by 2025-end.

The FDA granted an orphan drug designation to BEAM-101 for the treatment of SCD in June.

Beam Therapeutics is also expanding its genetic disease pipeline by developing BEAM-301 and BEAM-302 for treating glycogen storage disease type 1a (GSD1a) and alpha-1 antitrypsin deficiency (AATD), respectively.

Dosing is currently ongoing in a phase I/II study evaluating BEAM-301 as a potential treatment for patients with GSDIa in the United States.

It is developing BEAM-302 in a phase I/II dose-escalation study for treating AATD. Currently, there are no approved curative treatments for the given indication.

In March, BEAM announced positive initial safety and efficacy data from a phase I/II study, which is evaluating BEAM-302 for treating patients with AATD.

The phase I/II study consists of two parts. Part A of the study will investigate BEAM-302 in AATD patients with lung disease, while Part B will investigate BEAM-302 in AATD patients with mild-to-moderate liver disease with or without lung disease.

Along with the earnings release, management stated that it has initiated enrollment in Part B of the phase I/II study, which is designed to evaluate BEAM-302 in AATD patients with mild-to-moderate liver disease with or without lung disease.

Beam Therapeutics previously initiated dosing in the fourth cohort in Part A of the phase I/II study on BEAM-302. The company has now expanded dose exploration in Part A of the study.

A total of 17 patients were dosed in Part A of the above-mentioned study as of Aug. 1, 2025. Per management, treatment with BEAM-302 continues to demonstrate durable correction of the disease-causing mutation and restoration of AAT physiology, while indicating a well-tolerated safety profile.

Data from Part A and Part B of the phase I/II study and the updated clinical development plan for BEAM-302 in patients with AATD are expected in early 2026.

Beam Therapeutics Inc. price-consensus-eps-surprise-chart | Beam Therapeutics Inc. Quote

Beam Therapeutics currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the biotech sector are CorMedix CRMD, Arvinas ARVN and Immunocore IMCR, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CorMedix’s earnings per share have increased from 93 cents to 97 cents for 2025. During the same time, earnings per share estimates for 2026 have increased from $1.64 to $1.65. Year to date, shares of CRMD have rallied 48.8%.

CorMedix’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 25.82%.

In the past 60 days, estimates for Arvinas’ 2025 loss per share have narrowed from $1.51 to $1.50. Loss per share estimates for 2026 have narrowed from $3.08 to $2.98 during the same period. ARVN stock has plunged 60.3% year to date.

Arvinas’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 82.09%.

In the past 60 days, estimates for Immunocore’s 2025 loss per share have narrowed from 86 cents to 68 cents. Loss per share estimates for 2026 have narrowed from $1.34 to $1.10 during the same period. IMCR stock has increased 10.2% year to date.

Immunocore’s earnings beat estimates in three of the trailing four quarters while missing the same on the remaining occasion, the average surprise being 76.18%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite