|

|

|

|

|||||

|

|

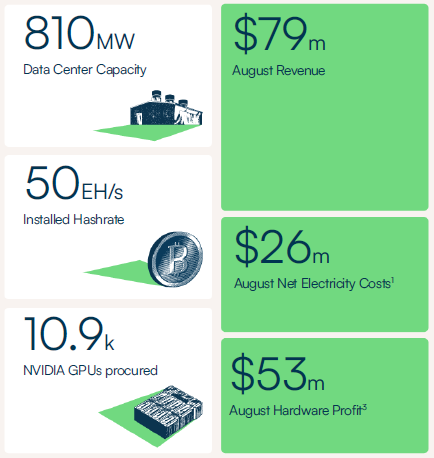

NEW YORK, Sept. 08, 2025 (GLOBE NEWSWIRE) -- IREN Limited (NASDAQ: IREN) (together with its subsidiaries “IREN” or “the Company”) today published its monthly update for August 2025.

August Highlights

| Key Metrics | Aug 25 | Jul 25* | ||||

| Bitcoin Mining | ||||||

| Average operating hashrate | 44.0 EH/s | 45.4 EH/s | ||||

| Bitcoin mined4 | 668 BTC | 728 BTC | ||||

| Revenue per Bitcoin mined | $114,816 | $114,891 | ||||

| Net electricity cost per Bitcoin mined2 | ($38,791) | ($32,266)* | ||||

| Revenue | $76.7m | $83.6m | ||||

| Net electricity costs1 | ($25.9m) | ($23.5m)* | ||||

| Hardware profit3 | $50.8m | $60.1m | ||||

| Hardware profit margin5 | 66% | 72% | ||||

| AI Cloud | ||||||

| Revenue | $2.4m | $2.3m | ||||

| Net electricity costs1 | ($0.04m) | ($0.04m) | ||||

| Hardware profit3 | $2.4m | $2.3m | ||||

| Hardware profit margin5 | 98% | 98% | ||||

| *Restatement of July 2025 net electricity cost per Bitcoin mined reflects revised Childress net electricity cost based on invoice received post issue of July 2025 investor report. | ||||||

Management Commentary

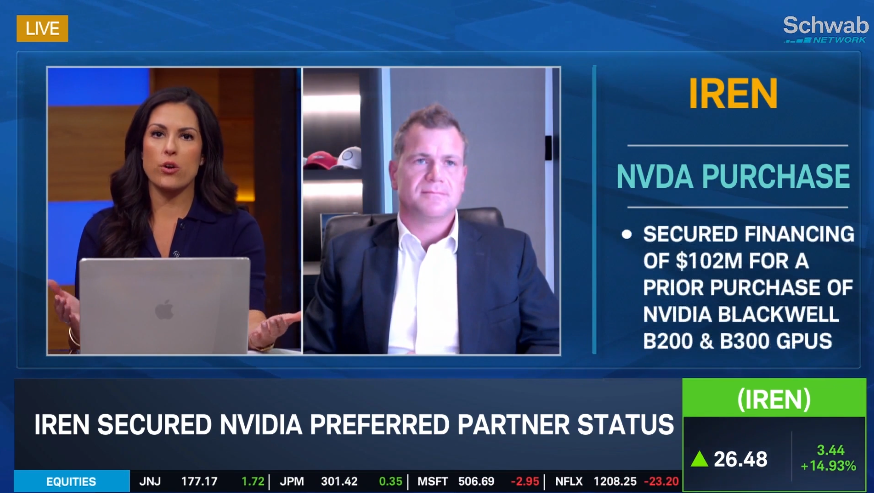

“Demand for our AI Cloud is accelerating as we prepare for the delivery of approximately 9,000 NVIDIA Blackwell GPUs over the coming months,” said Daniel Roberts, Co-Founder and Co-CEO of IREN.

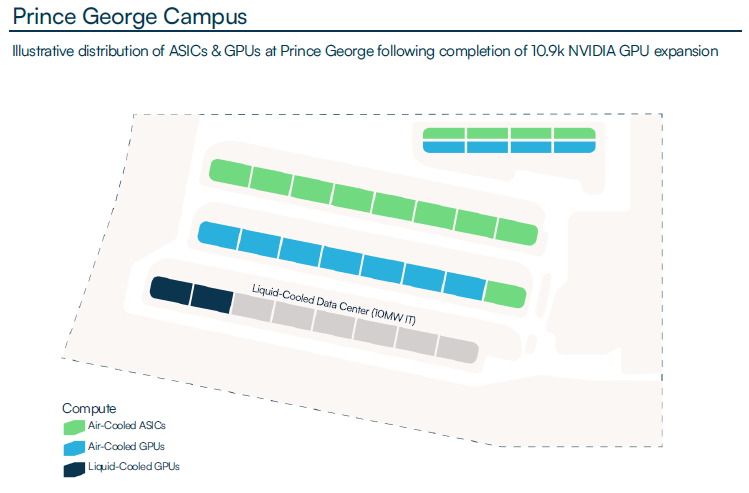

“At Prince George, retrofits to support this expansion are progressing to schedule, with construction of a new liquid-cooled data center for NVIDIA GB300 NVL72 systems well underway. Following record fiscal year and quarterly earnings, we delivered another month of solid performance, generating $53m of hardware profit in August despite seasonal curtailment and electricity prices.”

Technical Commentary

AI Cloud

Bitcoin Mining

Events

Project Update

Prince George Data Center (August 2025)

Horizon 1 & 2 (August 2025)

British Columbia (160MW)

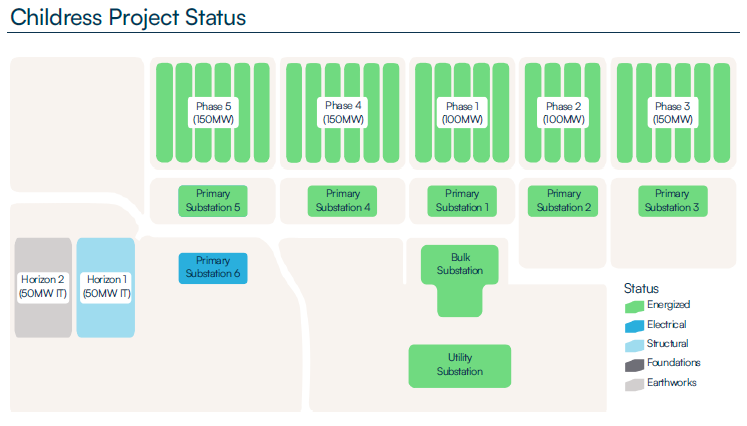

Childress (750MW)

Sweetwater (2,000MW)

Childress Project Status

Prince George Campus

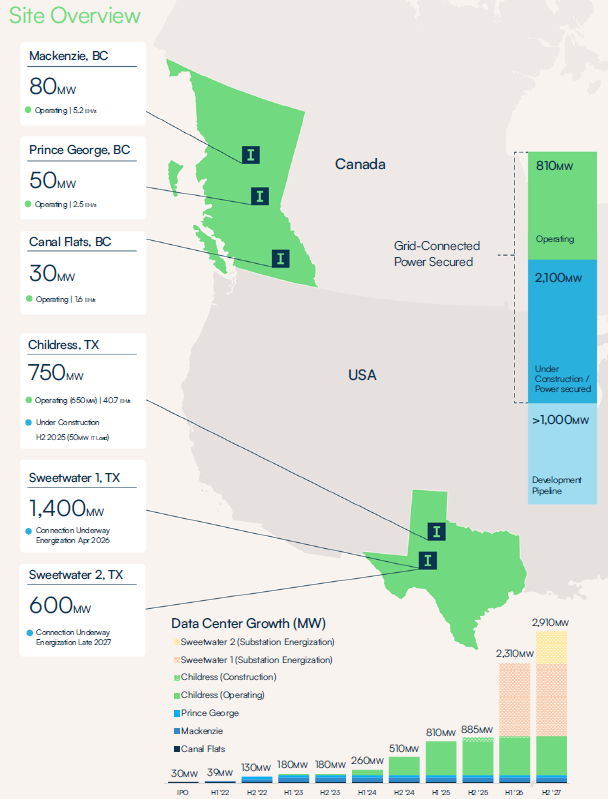

Site Overview

Assumptions and Notes

Reconciliation of Non-GAAP metrics

| Units | Aug 25 | Jul 25* | |

| Electricity charges | $’m | (27.2) | (24.7) |

| Add/(deduct) the following: | |||

| Demand response program revenue | $’m | 1.3 | 1.3 |

| Demand response program fees | $’m | (0.1) | (0.1) |

| Total net electricity costs1 | $’m | (26.0) | (23.5) |

| Net electricity costs – Bitcoin mining1 | $’m | (25.9) | (20.4) |

| Total Bitcoin mined | # | 668 | 728 |

| Net electricity costs per Bitcoin mined2 | $ | (38,791) | (32,266) |

| Bitcoin mining revenue | $’m | 76.7 | 83.6 |

| Add/(deduct) the following: | |||

| Net electricity costs – Bitcoin mining1 | $’m | (25.9) | (23.5) |

| Bitcoin mining Hardware Profit3 | $’m | 50.8 | 60.1 |

| Bitcoin mining Hardware Profit Margin5 | % | 66% | 72% |

| AI Cloud Services revenue | $’m | 2.4 | 2.3 |

| Add/(deduct) the following: | |||

| Net electricity costs – AI Cloud Services1 | $’m | (0.04) | (0.04) |

| Al Cloud Services Hardware Profit3 | $’m | 2.4 | 2.3 |

| Al Cloud Services Hardware Profit Margin5 | % | 98% | 98% |

| Total Hardware Profit3 | $’m | 53.2 | 62.4 |

| *Restatement of July 2025 net electricity cost per Bitcoin mined from $27,976 to $32,266 reflects final Childress net electricity cost based on invoice received post issue of July 2025 investor report. | |||

Contacts

| Media Megan Boles Aircover Communications +1 562 537 7131 [email protected] Jon Snowball Sodali & Co +61 477 946 068 +61 423 136 761 | Investors Mike Power IREN [email protected] |

To keep updated on IREN’s news releases and SEC filings, please subscribe to email alerts at https://iren.com/investor/ir-resources/email-alerts.

Forward-Looking Statements

This investor update includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), that involve substantial risks and uncertainties. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of our business plan and strategies and trends we expect to affect our business. These statements often include words such as “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “potential,” “could,” “would,” “may,” “will,” “forecast,” and other similar expressions. Forward-looking statements may also be made, verbally or in writing, by members of our Board or management team. Such statements are subject to the same limitations, uncertainties, assumptions and disclaimers set out in this investor update.

Forward-looking statements may also be made, verbally or in writing, by members of our Board or management team in connection with this investor update. Such statements are subject to the same limitations, uncertainties, assumptions and disclaimers set out in this document. We base these forward-looking statements or projections on our current expectations, plans and assumptions that we have made in light of our experience in the industry, as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances and at such time. The forward-looking statements are subject to and involve risks, uncertainties and assumptions and you should not place undue reliance on these forward-looking statements. Although we believe that these forward-looking statements are based on reasonable assumptions at the time they are made, you should be aware that many factors could affect our actual financial results or results of operations, and could cause actual results to differ materially from those expressed in the forward-looking statements. Factors that may materially affect such forward-looking statements include, but are not limited to: Bitcoin price and foreign currency exchange rate fluctuations; our ability to obtain additional capital on commercially reasonable terms and in a timely manner to meet our capital needs and facilitate our expansion plans; the terms of any future financing or any refinancing, restructuring or modification to the terms of any future financing, which could require us to comply with onerous covenants or restrictions, and our ability to service our debt obligations, any of which could restrict our business operations and adversely impact our financial condition, cash flows and results of operations; our ability to successfully execute on our growth strategies and operating plans, including our ability to continue to develop our existing data center sites, design and deploy direct-to-chip liquid cooling systems, and diversify and expand into the market for high-performance computing (“HPC”) solutions (including the market for AI Cloud and potential colocation services such as powered shell, build-to-suit and turnkey data centers (“Colocation Services”) (collectively “HPC and AI services”)); our limited experience with respect to new markets we have entered or may seek to enter, including the market for HPC and AI services); our ability to remain competitive in dynamic and rapidly evolving industries; expectations with respect to the ongoing profitability, viability, operability, security, popularity and public perceptions of the Bitcoin network; expectations with respect to the useful life and obsolescence of hardware (including hardware for Bitcoin mining and any current or future HPC and AI services we offer); delays, increases in costs or reductions in the supply of equipment used in our operations including as a result of tariffs and duties, and certain equipment being in high demand due to global supply chain constraints; expectations with respect to the profitability, viability, operability, security, popularity and public perceptions of any current and future HPC and AI services we offer; our ability to secure and retain customers on commercially reasonable terms or at all, particularly as it relates to our strategy to expand into markets for HPC and AI services; our ability to establish and maintain a customer base for our HPC and AI services business and customer concentration; our ability to manage counterparty risk (including credit risk) associated with any current or future customers, including customers of our HPC and AI services and other counterparties; the risk that any current or future customers, including customers of our HPC and AI services or other counterparties, may terminate, default on or underperform their contractual obligations; changing political and geopolitical conditions, including changing international trade policies and the implementation of wide-ranging, reciprocal and retaliatory tariffs, surtaxes and other similar import or export duties, or trade restrictions; Bitcoin global hashrate fluctuations; our ability to secure renewable energy, renewable energy certificates, power capacity, facilities and sites on commercially reasonable terms or at all; delays associated with, or failure to obtain or complete, permitting approvals, grid connections and other development activities customary for greenfield or brownfield infrastructure projects; our reliance on power and utilities providers, third party mining pools, exchanges, banks, insurance providers and our ability to maintain relationships with such parties; expectations regarding availability and pricing of electricity; our participation and ability to successfully participate in demand response products and services and other load management programs run, operated or offered by electricity network operators, regulators or electricity market operators; the availability, reliability and/or cost of electricity supply, hardware and electrical and data center infrastructure, including with respect to any electricity outages and any laws and regulations that may restrict the electricity supply available to us; any variance between the actual operating performance of our miner hardware achieved compared to the nameplate performance including hashrate; electricity market risks relating to changes in regulations and requirements of market operators and regulatory bodies, including with respect to grid stability, interconnection and curtailment obligations; our ability to curtail our electricity consumption and/or monetize electricity depending on market conditions, including changes in Bitcoin mining economics and prevailing electricity prices; actions undertaken by electricity network and market operators, regulators, governments or communities in the regions in which we operate; the availability, suitability, reliability and cost of internet connections at our facilities; our ability to secure additional hardware, including hardware for Bitcoin mining and any current or future HPC and AI services we offer, on commercially reasonable terms or at all, and any delays or reductions in the supply of such hardware or increases in the cost of procuring such hardware; our ability to operate in an evolving regulatory environment; our ability to successfully operate and maintain our property and infrastructure; reliability and performance of our infrastructure compared to expectations; malicious attacks on our property, infrastructure or IT systems; our ability to maintain in good standing the operating and other permits and licenses required for our operations and business; our ability to obtain, maintain, protect and enforce our intellectual property rights and confidential information; any intellectual property infringement and product liability claims; whether the secular trends we expect to drive growth in our business materialize to the degree we expect them to, or at all; any pending or future acquisitions, dispositions, joint ventures or other strategic transactions; the occurrence of any environmental, health and safety incidents at our sites, and any material costs relating to environmental, health and safety requirements or liabilities; damage to our property and infrastructure and the risk that any insurance we maintain may not fully cover all potential exposures; ongoing proceedings relating to the default under certain equipment financing facilities, ongoing securities litigation, and any future litigation, claims and/or regulatory investigations, and the costs, expenses, use of resources, diversion of management time and efforts, liability and damages that may result therefrom; our failure to comply with any laws including the anti-corruption laws of the United States and various international jurisdictions; any failure of our compliance and risk management methods; any laws, regulations and ethical standards that may relate to our business, including those that relate to Bitcoin and the Bitcoin mining industry and those that relate to any other services we offer, including laws and regulations related to data privacy, cybersecurity and the storage, use or processing of information and consumer laws; our ability to attract, motivate and retain senior management and qualified employees; increased risks to our global operations including, but not limited to, political instability, acts of terrorism, theft and vandalism, cyberattacks and other cybersecurity incidents and unexpected regulatory and economic sanctions changes, among other things; climate change, severe weather conditions and natural and man-made disasters that may materially adversely affect our business, financial condition and results of operations; public health crises, including an outbreak of an infectious disease and any governmental or industry measures taken in response; damage to our brand and reputation; evolving stakeholder expectations and requirements relating to environmental, social or governance (“ESG”) issues or reporting, including actual or perceived failure to comply with such expectations and requirements; that we do not currently pay any cash dividends on our Ordinary shares, and may not in the foreseeable future and, accordingly, your ability to achieve a return on your investment in our Ordinary shares will depend on appreciation, if any, in the price of our Ordinary shares; and other important factors discussed under the caption “Risk Factors” in IREN’s annual report on Form 10-K filed with the SEC on August 28, 2024 as such factors may be updated from time to time in its other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investor Relations section of IREN’s website at https:// investors.iren.com.

The foregoing list of factors is not exhaustive and does not necessarily include all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. The forward-looking statements included in this investor update are made only as of the date of this investor update and should be read carefully in conjunction with other uncertainties and potential events described in “Item 1A. Risk Factors” in our Annual Report on Form 10-K, filed with Securities and Exchange Commission (the “SEC”) on August 28, 2025 and our other filings with the SEC. Except as required by law, we do not undertake any obligation to update any forward-looking statements to reflect subsequent events or circumstances.

Preliminary Financial Information

The financial information presented in this investor update is not subject to the same closing procedures as our unaudited quarterly financial results and our audited annual financial results, and has not been reviewed or audited by our independent registered public accounting firm. The preliminary financial information included in this investor update does not represent a comprehensive statement of our financial results or financial position and should not be viewed as a substitute for unaudited financial statements prepared in accordance with International Financial Reporting Standards. Accordingly, you should not place undue reliance on the preliminary financial information included in this investor update.

Non-GAAP Financial Measures

This investor update includes non-GAAP financial measures, including net electricity costs, net electricity costs per Bitcoin mined, hardware profit, hardware profit margin, Bitcoin Mining annualized revenue and AI Cloud annualized revenue. We provide these measures in addition to, and not as a substitute for, measures of financial performance prepared in accordance with GAAP. There are a number of limitations related to the use of non-GAAP financial measures. For example, other companies, including companies in our industry, may calculate these measures differently. The Company believes that these measures are important and supplement discussions and analysis of its results of operations and enhances an understanding of its operating performance.

Net electricity costs are calculated as GAAP electricity charges, demand response program revenue and demand response fees. Figures are based on current internal estimates and excludes the cost of RECs. Net electricity costs per Bitcoin mined is calculated as Net electricity costs for Bitcoin mining divided by Bitcoin mined. Hardware Profit is calculated as revenue less net electricity costs (excludes all other site, overhead and REC costs). Hardware Profit Margin is calculated as revenue less net electricity costs divided by revenue (excludes all other site, overhead and REC costs).

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/081e100c-6a84-4a3f-a5f2-b2a09fcee630

https://www.globenewswire.com/NewsRoom/AttachmentNg/ba1299cd-e73b-4a9b-99ef-93af22fb2f1b

https://www.globenewswire.com/NewsRoom/AttachmentNg/97b0529d-c28e-4476-b516-c35fa8d07bb8

https://www.globenewswire.com/NewsRoom/AttachmentNg/fdf63a15-8d7b-4e1f-b2b0-1dcc65882186

https://www.globenewswire.com/NewsRoom/AttachmentNg/82829a41-fbb8-48d0-b1a6-6e3b080cf0dc

https://www.globenewswire.com/NewsRoom/AttachmentNg/09fde392-3b48-4ce8-af4a-e51eee9aca20

https://www.globenewswire.com/NewsRoom/AttachmentNg/74edac46-13cf-4665-9a7b-f0c901dd85c7

https://www.globenewswire.com/NewsRoom/AttachmentNg/3ebdb848-5a79-444c-b883-4af5b6b36083

| 4 hours | |

| 9 hours | |

| 13 hours | |

| Feb-11 | |

| Feb-11 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-08 | |

| Feb-08 | |

| Feb-07 | |

| Feb-06 |

Bitcoin Miner IREN Rebounds After Q2 Miss; AI Services Pick Up

IREN +10.33% IREN +5.13%

Investor's Business Daily

|

| Feb-06 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite