|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

First quarter results highlight improved cost management, new primary capital transactions and strengthened financial foundation

DALLAS, Oct. 21, 2025 (GLOBE NEWSWIRE) -- Beneficient (NASDAQ: BENF) (“Ben” or the “Company”), a technology-enabled platform providing exit opportunities and primary capital solutions and related trust and custody services to holders of alternative assets through its proprietary online platform, AltAccess, today reported its financial results for the fiscal 2026 first quarter, which ended June 30, 2025.

Commenting on the fiscal 2026 first quarter results, interim Chief Executive Officer James Silk said: “This quarter reflects meaningful progress strengthening Beneficient’s financial and operational foundation. We’ve taken deliberate steps to reduce expenses, complete new primary capital transactions and generate additional liquidity through asset sales as well as bringing the Company current on its SEC filings. These achievements demonstrate our renewed focus on disciplined execution as we work to provide value for our shareholders and seek to position the Company for long-term success.”

First Quarter Fiscal 2026 and Recent Highlights (for the quarter ended June 30, 2025 or as noted):

Loan Portfolio

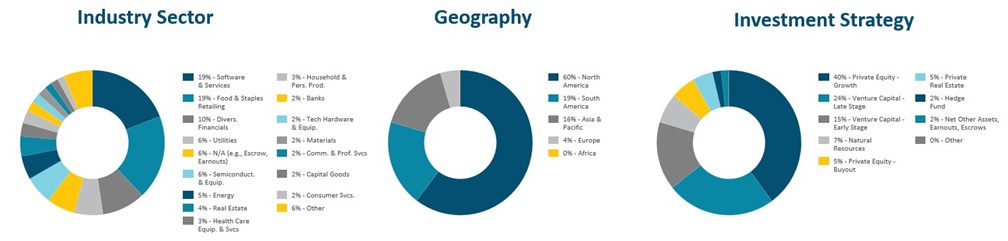

As a result of executing on our business plan of providing financing for liquidity, or early investment exits, for alternative asset marketplace participants, Ben organically develops a balance sheet comprised largely of loans collateralized by a well- diversified alternative asset portfolio that is expected to grow as Ben successfully executes on its core business.

Ben’s balance sheet strategy for ExAlt Loan origination is built on the theory of the portfolio endowment model for the fiduciary financings we make by utilizing our patent-pending computer implemented technologies branded as OptimumAlt. Our OptimumAlt endowment model balance sheet approach guides diversification of our fiduciary financings across seven asset classes of alternative assets, over 11 industry sectors in which alternative asset managers invest, and at least six countrywide exposures and multiple vintages of dates of investment into the private funds and companies.

As of June 30, 2025, Ben’s loan portfolio was supported by a highly diversified alternative asset collateral portfolio providing diversification across approximately 200 private market funds and approximately 590 investments across various asset classes, industry sectors and geographies. This portfolio includes exposure to some of the most exciting, sought after private company names worldwide, such as the largest private space exploration company, an innovative software and payment systems provider, a venture capital firm investing in waste-to-energy and clean energy technologies, a technology company providing net zero solutions in the production of advanced biofuels, a designer and manufacturer of shaving products, a large online store for women's clothes and other fashionable accessories that has announced intentions to go public, a mobile banking services provider, and others.

Figure 1: Portfolio Diversification

Diversification Using Principal Loan Balance, Net of Allowance for Credit Losses

As of June 30, 2025, the charts below present the ExAlt Loan portfolio’s relative exposure by certain characteristics (percentages determined by aggregate fiduciary ExAlt Loan portfolio principal balance net of allowance for credit losses, which includes the exposure to interests in certain of our former affiliates composing part of the Fiduciary Loan Portfolio).

As of June 30, 2025. The chart represents the characteristics of professionally managed funds and investments in the Collateral portfolio, which is comprised of a diverse portfolio of direct and indirect interests (through various investment vehicles, including, limited partnership interests and private and public equity and debt securities, which include our and our affiliates’ or our former affiliates’ securities), primarily in third-party, professionally managed private funds and investments. Loan balances used to calculate the percentages reported in the pie charts are loan balances, net of any allowance for credit losses, and as of June 30, 2025, the total allowance for credit losses was $352.7 million, for a total gross loan balance of $583.4 million and a loan balance net of allowance for credit losses of $230.7 million.

Business Segments: First Quarter Fiscal 2026

Ben Liquidity

Ben Liquidity offers simple, rapid and cost-effective liquidity products through the use of our proprietary financing and trust structure, or the “Customer ExAlt Trusts,” which facilitate the exchange of a customer’s alternative assets for consideration.

Ben Custody

Ben Custody provides full-service trust and custody administration services to the trustees of certain of the Customer ExAlt Trusts, which own the exchanged alternative assets following liquidity transactions in exchange for fees payable quarterly calculated as a percentage of assets in custody.

Capital and Liquidity

(1) Represents a non-GAAP financial measure. For reconciliations of our non-GAAP measures to the most directly comparable GAAP financial measures and for the reasons we believe the non-GAAP measures provide useful information, see Non-GAAP Reconciliations.

Consolidated Fiscal First Quarter Results

Table 1 below presents a summary of selected unaudited consolidated operating financial information.

| Consolidated FiscalFirstQuarter Results ($ in thousands, except share and per share amounts) | Fiscal1Q26 June 30, 2025 | Fiscal4Q25 March 31, 2025 | Fiscal1Q25 June 30, 2024 | Change % vs. Prior Quarter | ||||||||

| GAAP Revenues | $ | (12,623) | $ | (30,969) | $ | 10,046 | 59.2% | |||||

| Adjusted Revenues(1) | (12,622) | (30,963) | 10,411 | 59.2% | ||||||||

| GAAP Operating Income (Loss) | (92,648) | (45,295) | 44,338 | NM | ||||||||

| Adjusted Operating Income (Loss)(1) | (25,438) | (42,945) | (4,725) | 40.8% | ||||||||

| Basic Class A EPS | $ | (7.19) | $ | 12.11 | NM | |||||||

| Diluted Class A EPS | $ | (7.19) | $ | 0.17 | NM | |||||||

| Segment Revenues attributable to Ben's Equity Holders(2) | 13,058 | 14,253 | 16,235 | (8.4)% | ||||||||

| Adjusted Segment Revenues attributable to Ben's Equity Holders(1)(2) | 13,058 | 14,253 | 16,242 | (8.4)% | ||||||||

| Segment Operating Income (Loss) attributable to Ben's Equity Holders | (76,436) | (16,662) | 44,864 | NM | ||||||||

| Adjusted Segment Operating Income (Loss) attributable to Ben's Equity Holders(1)(2) | $ | (9,227) | $ | (13,851) | $ | (4,552) | 33.4% | |||||

| NM - Not meaningful. | ||||||||||||

| (1) Adjusted Revenues, Adjusted Operating Income (Loss), Adjusted Segment Revenues attributable to Ben's Equity Holders and Adjusted Segment Operating Income (Loss) attributable to Ben's Equity Holders are non-GAAP financial measures. For reconciliations of our non-GAAP measures to the most directly comparable GAAP financial measures and for the reasons we believe the non-GAAP measures provide useful information, see Non-GAAP Reconciliations. (2) Segment financial information attributable to Ben’s equity holders is presented to provide users of our financial information an understanding and visual aide of the segment information (revenues, operating income (loss), and adjusted operating income (loss)) that impacts Ben’s Equity Holders. “Ben’s Equity Holders” refers to the holders of Beneficient Class A and Class B common stock and Series B Preferred Stock as well as holders of interests in BCH, which represent noncontrolling interests. For a description of noncontrolling interests, see Item 2 of our Quarterly Report on Form 10-Q for the three months ended June 30, 2025, and Reconciliation of Business Segment Information Attributable to Ben’s Equity Holders to Net Income Attributable to Ben Common Holders. Such information is computed as the sum of the Ben Liquidity, Ben Custody and Corp/Other segments since it is the operating results of those segments that determine the net income (loss) attributable to Ben’s Equity Holders. See further information in table 5 and Non-GAAP Reconciliations. | ||||||||||||

Table 2 below presents a summary of selected unaudited consolidated balance sheet information.

| Consolidated FiscalFirstQuarter Results ($ in thousands) | Fiscal1Q26 As of June 30, 2025 | Fiscal4Q25 As of March 31, 2025 | Change % | |||||

| Investments, at Fair Value | $ | 263,769 | $ | 291,371 | (9.5)% | |||

| All Other Assets | 57,723 | 50,490 | 14.3% | |||||

| Goodwill and Intangible Assets, Net | 13,014 | 13,014 | —% | |||||

| Total Assets | $ | 334,506 | $ | 354,875 | (5.7)% | |||

Business Segment Information Attributable to Ben's Equity Holders(1)

Table 3 below presents unaudited segment revenues and segment operating income (loss) for business segments attributable to Ben's equity holders.

| Segment Revenues Attributable to Ben's Equity Holders(1) ($ in thousands) | Fiscal1Q26 June 30, 2025 | Fiscal4Q25 March 31, 2025 | Fiscal1Q25 June 30, 2024 | Change % vs. Prior Quarter | ||||

| Ben Liquidity | $ | 8,837 | $ | 8,459 | $ | 10,849 | 4.5% | |

| Ben Custody | 4,183 | 5,396 | 5,382 | (22.5)% | ||||

| Corporate & Other | 38 | 398 | 4 | (90.5)% | ||||

| Total Segment Revenues Attributable to Ben's Equity Holders(1) | $ | 13,058 | $ | 14,253 | $ | 16,235 | (8.4)% | |

| Segment Operating Income (Loss) Attributable to Ben's Equity Holders(1) ($ in thousands) | Fiscal1Q26 June 30, 2025 | Fiscal4Q25 March 31, 2025 | Fiscal1Q25 June 30, 2024 | Change % vs. Prior Quarter | ||||

| Ben Liquidity | $ | (6,015) | $ | (12,340) | $ | (514) | 51.3% | |

| Ben Custody | 3,128 | 4,165 | 1,287 | (24.9)% | ||||

| Total Segment Operating Income (Loss) Attributable to Ben's Equity Holders(1) | (73,549) | (8,487) | 44,091 | NM | ||||

| $ | (76,436) | $ | (16,662) | $ | 44,864 | NM | ||

| NM - Not meaningful. | ||||||||

| (1) Segment financial information attributable to Ben’s equity holders is presented to provide users of our financial information an understanding and visual aide of the segment information (revenues, operating income (loss), and adjusted operating income (loss)) that impacts Ben’s Equity Holders. “Ben’s Equity Holders” refers to the holders of Beneficient Class A and Class B common stock and Series B Preferred Stock as well as holders of interests in BCH, which represent noncontrolling interests. For a description of noncontrolling interests, see Item 2 of our Quarterly Report on Form 10-Q for the three months ended June 30, 2025, and Reconciliation of Business Segment Information Attributable to Ben’s Equity Holders to Net Income Attributable to Ben Common Holders. Such information is computed as the sum of the Ben Liquidity, Ben Custody and Corp/Other segments since it is the operating results of those segments that determine the net income (loss) attributable to Ben’s Equity Holders. See further information in table 5 and Non-GAAP Reconciliations. | ||||||||

Adjusted Business Segment Information Attributable to Ben's Equity Holders(2)

Table 4 below presents unaudited adjusted segment revenue and adjusted segment operating income (loss) for business segments attributable to Ben's equity holders.

| Adjusted Segment Revenues Attributable to Ben's Equity Holders(1)(2) ($ in thousands) | Fiscal1Q26 June 30, 2025 | Fiscal4Q25 March 31, 2025 | Fiscal1Q25 June 30, 2024 | Change % vs. Prior Quarter | |||||||

| Ben Liquidity | $ | 8,837 | $ | 8,459 | $ | 10,849 | 4.5% | ||||

| Ben Custody | 4,183 | 5,396 | 5,382 | (22.5)% | |||||||

| Corporate & Other | 38 | 398 | 11 | (90.5)% | |||||||

| Total Adjusted Segment Revenues Attributable to Ben's Equity Holders(1)(2) | $ | 13,058 | $ | 14,253 | $ | 16,242 | (8.4)% | ||||

| Adjusted Segment Operating Income (Loss) Attributable to Ben's Equity Holders(1)(2) ($ in thousands) | Fiscal1Q26 June 30, 2025 | Fiscal4Q25 March 31, 2025 | Fiscal1Q25 June 30, 2024 | Change % vs. Prior Quarter | |||||||

| Ben Liquidity | $ | (6,015) | $ | (12,340) | $ | (509) | 51.3% | ||||

| Ben Custody | 3,128 | 4,632 | 4,416 | (32.5)% | |||||||

| Corporate & Other | (6,340) | (6,143) | (8,459) | (3.2)% | |||||||

| Total Adjusted Segment Operating Income (Loss) Attributable to Ben's Equity Holders(1)(2) | $ | (9,227) | $ | (13,851) | $ | (4,552) | 33.4% | ||||

| NM - Not meaningful. | |||||||||||

| (1) Adjusted Revenues, Adjusted Operating Income (Loss), Adjusted Segment Revenues attributable to Ben's Equity Holders and Adjusted Segment Operating Income (Loss) attributable to Ben's Equity Holders are non-GAAP financial measures. For reconciliations of our non-GAAP measures to the most directly comparable GAAP financial measures and for the reasons we believe the non-GAAP measures provide useful information, see Non-GAAP Reconciliations. (2) Segment financial information attributable to Ben’s equity holders is presented to provide users of our financial information an understanding and visual aide of the segment information (revenues, operating income (loss), and adjusted operating income (loss)) that impacts Ben’s Equity Holders. “Ben’s Equity Holders” refers to the holders of Beneficient Class A and Class B common stock and Series B Preferred Stock as well as holders of interests in BCH, which represent noncontrolling interests. For a description of noncontrolling interests, see Item 2 of our Quarterly Report on Form 10-Q for the three months ended June 30, 2025, and Reconciliation of Business Segment Information Attributable to Ben’s Equity Holders to Net Income Attributable to Ben Common Holders. Such information is computed as the sum of the Ben Liquidity, Ben Custody and Corp/Other segments since it is the operating results of those segments that determine the net income (loss) attributable to Ben’s Equity Holders. See further information in table 5 and Non-GAAP Reconciliations. | |||||||||||

Reconciliation of Business Segment Information Attributable to Ben's Equity Holders to Net Income (Loss) Attributable to Ben Common Shareholders

Table 5 below presents reconciliation of operating income (loss) by business segment attributable to Ben's Equity Holders to net income (loss) attributable to Ben common shareholders.

| Reconciliation of Business Segments to Net Income (Loss) to Ben Common Shareholders ($ in thousands) | Fiscal1Q26 June 30, 2025 | Fiscal4Q25 March 31, 2025 | Fiscal1Q25 June 30, 2024 | ||||||

| Ben Liquidity | $ | (6,015) | $ | (12,340) | $ | (514) | |||

| Ben Custody | 3,128 | 4,165 | 1,287 | ||||||

| Corporate & Other | (73,549) | (8,487) | 44,091 | ||||||

| Income tax expense (allocable to Ben and BCH equity holders) | — | 661 | (28) | ||||||

| Net loss attributable to noncontrolling interests - Ben | 15,984 | 19,777 | 7,187 | ||||||

| Noncontrolling interest guaranteed payment | (4,624) | (4,556) | (4,356) | ||||||

| Net income (loss) attributable to Ben's common shareholders | $ | (65,076) | $ | (780) | $ | 47,667 | |||

Investor Webcast

Beneficient expects to host a webcast and conference call to provide investors with an update on the Company’s performance, strategy and transactions in the coming weeks. A press release and 8-K will provide details when available.

About Beneficent

Beneficient (Nasdaq: BENF) – Ben, for short – is on a mission to democratize the global alternative asset investment market by providing traditionally underserved investors − mid-to-high net worth individuals, small-to-midsized institutions and General Partners seeking exit options, anchor commitments and valued-added services for their funds− with solutions that could help them unlock the value in their alternative assets. Ben’s AltQuote™ tool provides customers with a range of potential exit options within minutes, while customers can log on to the AltAccess® portal to explore opportunities and receive proposals in a secure online environment.

Its subsidiary, Beneficient Fiduciary Financial, L.L.C., received its charter under the State of Kansas’ Technology-Enabled Fiduciary Financial Institution (TEFFI) Act and is subject to regulatory oversight by the Office of the State Bank Commissioner.

For more information, visit www.trustben.com or follow us on LinkedIn.

Contacts

Investors:

Matt Kreps/214-597-8200/[email protected]

Michael Wetherington/214-284-1199/[email protected]

[email protected]

Not an Offer of Securities

The information in this communication is for informational purposes only and shall not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. The securities that are the subject of the Transactions have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

Disclaimer and Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to, among other things, demand for our solutions in the alternative asset industry, opportunities for market growth, our ability to identify and negotiate transactions, diversification and size of our loan portfolio and our ability to scale operations and provide shareholder value. These forward-looking statements are generally identified by the use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” and, in each case, their negative or other various or comparable terminology. These forward-looking statements reflect our views with respect to future events as of the date of this document and are based on our management’s current expectations, estimates, forecasts, projections, assumptions, beliefs and information. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. All such forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, and could cause future events or results to be materially different from those stated or implied in this document. It is not possible to predict or identify all such risks. These risks include, but are not limited to, our ability to consummate liquidity transactions on terms desirable for the Company, or at all, our ability to timely demonstrate compliance with the Nasdaq bid price requirements within the extension period granted by the Nasdaq Hearings Panel, our ability to regain compliance with the Nasdaq stockholders’ equity requirement, our ability to cure any deficiencies in compliance with any other Nasdaq Listing Rules, our ability to obtain stockholder approval for a reverse stock split of the common stock, risks related to the substantial costs and diversion of management’s attention and resources due to these matters, and the risk factors that are described under the section titled “Risk Factors” in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the SEC. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this document and in our SEC filings. We expressly disclaim any obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

Table 6: CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

| Three Months Ended June 30, | |||||||

| (Dollars in thousands, except per share amounts) | 2025 | 2024 | |||||

| Revenues | |||||||

| Investment income (loss), net | $ | (12,776 | ) | $ | 11,028 | ||

| Gain (loss) on financial instruments, net (related party of $(1) and $(365)) | (45 | ) | (1,183 | ) | |||

| Interest and dividend income | 10 | 12 | |||||

| Trust services and administration revenues (related party of $8 and $8) | 188 | 189 | |||||

| Total revenues | (12,623 | ) | 10,046 | ||||

| Operating expenses | |||||||

| Employee compensation and benefits | 3,331 | 3,850 | |||||

| Interest expense (related party of $3,317 and $3,054) | 3,415 | 4,288 | |||||

| Professional services | 7,957 | 5,544 | |||||

| Provision for credit losses | — | 524 | |||||

| Loss on impairment of goodwill | — | 3,394 | |||||

| Accrual (release) of loss contingency related to arbitration award | 62,831 | (54,973 | ) | ||||

| Other expenses (related party of $628 and $694) | 2,491 | 3,081 | |||||

| Total operating expenses | 80,025 | (34,292 | ) | ||||

| Net income (loss) before income taxes | (92,648 | ) | 44,338 | ||||

| Income tax expense | — | 28 | |||||

| Net income (loss) | (92,648 | ) | 44,310 | ||||

| Plus: Net loss attributable to noncontrolling interests - Customer ExAlt Trusts | 16,212 | 526 | |||||

| Plus: Net loss attributable to noncontrolling interests - Ben | 15,984 | 7,187 | |||||

| Less: Noncontrolling interest guaranteed payment | (4,624 | ) | (4,356 | ) | |||

| Net income (loss) attributable to Beneficient common shareholders | $ | (65,076 | ) | $ | 47,667 | ||

| Other comprehensive income (loss): | |||||||

| Unrealized (loss) gain on investments in available-for-sale debt securities | — | (21 | ) | ||||

| Total comprehensive income (loss) | (65,076 | ) | 47,646 | ||||

| Less: comprehensive (loss) gain attributable to noncontrolling interests | — | (21 | ) | ||||

| Total comprehensive income (loss) attributable to Beneficient | $ | (65,076 | ) | $ | 47,667 | ||

| Net income (loss) per common share | |||||||

| Class A - basic | $ | (7.19 | ) | $ | 12.11 | ||

| Class B - basic | $ | (7.19 | ) | $ | 12.11 | ||

| Net income (loss) per common share | |||||||

| Class A - diluted | $ | (7.19 | ) | $ | 0.17 | ||

| Class B - diluted | $ | (7.19 | ) | $ | 0.17 | ||

Table 7: CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

| June 30, 2025 | March 31, 2025 | ||||||

| (Dollars and shares in thousands) | (unaudited) | ||||||

| ASSETS | |||||||

| Cash and cash equivalents | $ | 7,612 | $ | 1,346 | |||

| Investments, at fair value: | |||||||

| Investments held by Customer ExAlt Trusts (related party of $4 and $5) | 263,769 | 291,371 | |||||

| Other assets, net | 50,111 | 49,144 | |||||

| Intangible assets | 3,100 | 3,100 | |||||

| Goodwill | 9,914 | 9,914 | |||||

| Total assets | $ | 334,506 | $ | 354,875 | |||

| LIABILITIES, TEMPORARY EQUITY, AND EQUITY (DEFICIT) | |||||||

| Accounts payable and accrued expenses (related party of $15,343 and $14,733) | $ | 228,884 | $ | 156,770 | |||

| Other liabilities (related party of $22,028 and $19,360) | 26,903 | 24,381 | |||||

| Warrants liability | 197 | 227 | |||||

| Debt due to related parties | 108,393 | 117,896 | |||||

| Total liabilities | 364,377 | 299,274 | |||||

| Redeemable noncontrolling interests | |||||||

| Preferred Series A Subclass 0 Redeemable Unit Accounts, nonunitized | 90,526 | 90,526 | |||||

| Total temporary equity | 90,526 | 90,526 | |||||

| Shareholder’s equity (deficit): | |||||||

| Preferred stock, par value $0.001 per share, 250,000 shares authorized | |||||||

| Series A preferred stock, 0 and 0 shares issued and outstanding as of June 30, 2025 and March 31, 2025, respectively | — | — | |||||

| Series B preferred stock, 1,543 and 363 shares issued and outstanding as of June 30, 2025 and March 31, 2025, respectively | 2 | — | |||||

| Class A common stock, par value $0.001 per share, 5,000,000 and 5,000,000 shares authorized as of June 30, 2025 and March 31, 2025, respectively, 9,425 and 8,483 shares issued as of June 30, 2025 and March 31, 2025, respectively, and 9,416 and 8,474 shares outstanding as of June 30, 2025 and March 31, 2025, respectively | 9 | 8 | |||||

| Class B convertible common stock, par value $0.001 per share, 250 shares authorized, 239 and 239 shares issued and outstanding as of June 30, 2025 and March 31, 2025 | — | — | |||||

| Additional paid-in capital | 1,856,723 | 1,844,489 | |||||

| Accumulated deficit | (2,073,128 | ) | (2,008,052 | ) | |||

| Treasury stock, at cost (9 shares as of June 30, 2025 and March 31, 2025) | (3,444 | ) | (3,444 | ) | |||

| Accumulated other comprehensive income | (2 | ) | (2 | ) | |||

| Noncontrolling interests | 99,443 | 132,076 | |||||

| Total equity (deficit) | (120,397 | ) | (34,925 | ) | |||

| Total liabilities, temporary equity, and equity (deficit) | $ | 334,506 | $ | 354,875 | |||

Table 8: Non-GAAP Reconciliations

| (in thousands) | Three Months Ended June 30, 2025 | |||||||||||||||||

| Ben Liquidity | Ben Custody | Customer ExAlt Trusts | Corporate/Other | Consolidating Eliminations | Consolidated | |||||||||||||

| Total revenues | $ | 8,837 | $ | 4,183 | $ | (12,851 | ) | $ | 38 | $ | (12,830 | ) | $ | (12,623 | ) | |||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 1 | — | — | 1 | ||||||||||||

| Adjusted revenues | $ | 8,837 | $ | 4,183 | $ | (12,850 | ) | $ | 38 | $ | (12,830 | ) | $ | (12,622 | ) | |||

| Operating income (loss) | $ | (6,015 | ) | $ | 3,128 | $ | (53,976 | ) | $ | (73,549 | ) | $ | 37,764 | $ | (92,648 | ) | ||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 1 | — | — | 1 | ||||||||||||

| Intersegment provision for credit losses on collateral comprised of interests in the GWG Wind Down Trust | — | — | — | — | — | — | ||||||||||||

| Goodwill impairment | — | — | — | — | — | — | ||||||||||||

| Accrual (release) of loss contingency related to arbitration award | — | — | — | 62,831 | — | 62,831 | ||||||||||||

| Share-based compensation expense | — | — | — | 461 | — | 461 | ||||||||||||

| Legal and professional fees(1) | — | — | — | 3,917 | — | 3,917 | ||||||||||||

| Adjusted operating income (loss) | $ | (6,015 | ) | $ | 3,128 | $ | (53,975 | ) | $ | (6,340 | ) | $ | 37,764 | $ | (25,438 | ) | ||

| (1) Includes legal and professional fees related lawsuits. | ||||||||||||||||||

| (in thousands) | Three Months Ended March 31, 2025 | ||||||||||||||||

| Ben Liquidity | Ben Custody | Customer ExAlt Trusts | Corporate/Other | Consolidating Eliminations | Consolidated | ||||||||||||

| Total revenues | $ | 8,459 | $ | 5,396 | $ | (31,556 | ) | $ | 398 | $ | (13,666 | ) | $ | (30,969 | ) | ||

| Mark to market adjustment on interests in GWG Wind Down Trust | — | — | 6 | — | — | 6 | |||||||||||

| Adjusted revenues | $ | 8,459 | $ | 5,396 | $ | (31,550 | ) | $ | 398 | $ | (13,666 | ) | $ | (30,963 | ) | ||

| Operating income (loss) | $ | (12,340 | ) | $ | 4,165 | $ | (71,705 | ) | $ | (8,487 | ) | $ | 43,072 | $ | (45,295 | ) | |

| Mark to market adjustment on interests in GWG Wind Down Trust | — | — | 6 | — | — | 6 | |||||||||||

| Intersegment provision for credit losses on collateral comprised of interests in the GWG Wind Down Trust | — | 467 | — | — | (467 | ) | — | ||||||||||

| Goodwill impairment | — | — | — | — | — | — | |||||||||||

| Accrual (release) of loss contingency related to arbitration award | — | — | — | — | — | — | |||||||||||

| Share-based compensation expense | — | — | — | 487 | — | 487 | |||||||||||

| Legal and professional fees(1) | — | — | — | 1,857 | — | 1,857 | |||||||||||

| Adjusted operating income (loss) | $ | (12,340 | ) | $ | 4,632 | $ | (71,699 | ) | $ | (6,143 | ) | $ | 42,605 | $ | (42,945 | ) | |

| (1) Includes legal and professional fees related to lawsuits. | |||||||||||||||||

| (in thousands) | Three Months Ended June 30, 2024 | |||||||||||||||||

| Ben Liquidity | Ben Custody | Customer ExAlt Trusts | Corporate/Other | Consolidating Eliminations | Consolidated | |||||||||||||

| Total revenues | $ | 10,849 | $ | 5,382 | $ | 9,853 | $ | 4 | $ | (16,042 | ) | $ | 10,046 | |||||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 358 | 7 | — | 365 | ||||||||||||

| Adjusted revenues | $ | 10,849 | $ | 5,382 | $ | 10,211 | $ | 11 | $ | (16,042 | ) | $ | 10,411 | |||||

| Operating income (loss) | $ | (514 | ) | $ | 1,287 | $ | (29,629 | ) | $ | 44,091 | $ | 29,103 | $ | 44,338 | ||||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 358 | 7 | — | 365 | ||||||||||||

| Intersegment provision for credit losses on collateral comprised of interests in the GWG Wind Down Trust | 5 | — | — | — | (5 | ) | — | |||||||||||

| Goodwill impairment | — | 3,129 | — | 265 | — | 3,394 | ||||||||||||

| Accrual (release) of loss contingency related to arbitration award | — | — | — | (54,973 | ) | — | (54,973 | ) | ||||||||||

| Share-based compensation expense | — | — | — | 994 | — | 994 | ||||||||||||

| Legal and professional fees(1) | — | — | — | 1,157 | — | 1,157 | ||||||||||||

| Adjusted operating income (loss) | $ | (509 | ) | $ | 4,416 | $ | (29,271 | ) | $ | (8,459 | ) | $ | 29,098 | $ | (4,725 | ) | ||

| (1) Includes legal and professional fees related to GWG Holdings bankruptcy, lawsuits, public relations, and employee matters. | ||||||||||||||||||

| Three Months Ended June 30, | |||||||

| 2025 | 2024 | ||||||

| Operating Expenses Non GAAP Reconciliation | |||||||

| Operating expenses | $ | 80,025 | $ | (34,292 | ) | ||

| Plus (less): Accrual (release) of loss contingency related to arbitration award | (62,831 | ) | 54,973 | ||||

| Less: Goodwill impairment | — | (3,394 | ) | ||||

| Operating expenses, excluding goodwill impairment and release of loss contingency related to arbitration award | $ | 17,194 | $ | 17,287 | |||

Adjusted Revenues, Adjusted Operating Income (Loss), Adjusted Segment Revenues attributable to Ben's Equity Holders and Adjusted Segment Operating Income (Loss) attributable to Ben's Equity Holders are non-GAAP financial measures. We present these non-GAAP financial measures because we believe it helps investors understand underlying trends in our business and facilitates an understanding of our operating performance from period to period because it facilitates a comparison of our recurring core business operating results. The non-GAAP financial measures are intended as a supplemental measure of our performance that is neither required by, nor presented in accordance with, U.S. GAAP. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Our computation of these non-GAAP financial measures may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate such items in the same way.

We define adjusted revenue as revenue adjusted to exclude the effect of mark-to-market adjustments on related party equity securities that were acquired both prior to and during the Collateral Swap, which on August 1, 2023, became interests in the GWG Wind Down Trust. Adjusted Segment Revenues attributable to Ben's Equity Holders is the same as "adjusted revenues" related to the aggregate of the Ben Liquidity, Ben Custody, and Corporate/Other Business Segments, which are the segments that impact the net income (loss) attributable to all equity holders of Beneficient, including equity holders of Beneficient's subsidiary, BCH.

Adjusted operating income (loss) represents GAAP operating income (loss), adjusted to exclude the effect of the adjustments to revenue as described above, credit losses on related party available-for-sale debt securities that were acquired in the Collateral Swap which on August 1, 2023, became interests in the GWG Wind Down Trust, and receivables from a related party that filed for bankruptcy and certain notes receivables originated during our formative transactions, non-cash asset impairment, share-based compensation expense, and legal, professional services, and public relations costs related to the GWG Holdings bankruptcy, lawsuits, and certain employee matters, including fees & loss contingency accruals (releases) incurred in arbitration with a former director. Adjusted Segment Operating Income (Loss) attributable to Ben's Equity Holders is the same as "adjusted operating income (loss)" related to the aggregate of the Ben Liquidity, Ben Custody, and Corporate/Other Business Segments, which are the segments that impact the net income (loss) attributable to all equity holders of Beneficient, including equity holders of Beneficient's subsidiary, BCH.

These non-GAAP financial measures are not a measure of performance or liquidity calculated in accordance with U.S. GAAP. They are unaudited and should not be considered an alternative to, or more meaningful than, GAAP revenues or GAAP operating income (loss) as an indicator of our operating performance. Uses of cash flows that are not reflected in adjusted operating income (loss) or adjusted segment operating income (loss) attributable to Ben's Equity Holders include capital expenditures, interest payments, debt principal repayments, and other expenses, which can be significant. As a result, adjusted operating income (loss) and/or adjusted segment operating income (loss) attributable to Ben's Equity Holders should not be considered as a measure of our liquidity.

Because of these limitations, Adjusted Revenues, Adjusted Operating Income (Loss), Adjusted Segment Revenues attributable to Ben's Equity Holders, and Adjusted Segment Operating Income (Loss) attributable to Ben's Equity Holders should not be considered in isolation or as a substitute for performance measures calculated in accordance with U.S. GAAP. We compensate for these limitations by relying primarily on our U.S. GAAP results and using Adjusted Revenues, Adjusted Operating Income (Loss), Adjusted Segment Revenues attributable to Ben's Equity Holders, and Adjusted Segment Operating Income (Loss) attributable to Ben's Equity Holders on a supplemental basis. You should review the reconciliation of these non-GAAP financial measures set forth above and not rely on any single financial measure to evaluate our business.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/49a323c6-9246-4465-a3fc-7632bb7d178b

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-12 | |

| Jan-21 | |

| Jan-20 | |

| Jan-13 | |

| Jan-08 | |

| Jan-05 | |

| Dec-17 | |

| Dec-11 | |

| Dec-10 | |

| Nov-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite