|

|

|

|

|||||

|

|

Iridium Communications (IRDM) reported earnings per share (EPS) of 35 cents for the third quarter of 2025, beating the Zacks Consensus Estimate by 35%. The bottom line compared favorably with the prior-year quarter's figure of 21 cents.

Iridium reported quarterly revenues of $226.9 million, a 7% increase year over year, driven by continued strength in Service revenue and Equipment and Engineering/Support sales. The consensus estimate was $224.05 million. The communications market is changing, with new industries now exploring satellite solutions that provide real customer value. This creates a favorable environment, expanding Iridium’s opportunities. By investing in new technologies and refining its market focus, the company stays competitive with specialized, highly reliable and customized products and services.

Total Service revenues increased 3% year over year to $165.2 million. Recurring service revenue remains the core of Iridium’s business, supported by a growing subscriber base and diversified applications across aviation, maritime, government, mining and IoT. Service revenues accounted for 73% of total revenues in the third quarter, close to our estimate of $164.3 million.

Iridium’s commercial service segment continues to be the backbone of the company, representing 61% of total revenues in the quarter. Commercial revenue reached $138.3 million, a 4% increase driven by momentum in commercial IoT, PNT and voice and data. Government service revenue was $26.9 million, up 1%, supported by contractual rate increases under the EMSS deal with the U.S. Space Force. Hosted Payload & Data Services revenue grew 14% to $18.7 million, mainly from Iridium’s PNT service.

Iridium Communications Inc price-consensus-eps-surprise-chart | Iridium Communications Inc Quote

Our estimate for total commercial service and government service revenues was pegged at $137.1 million and $27.2 million, respectively.

Subscriber Equipment sales declined 3% to $21.5 million. We projected the figure to be $22.5 million.

Engineering and support revenues surged 31% to $40.2 million, due to increased U.S. government-related projects, including Space Development Agency contracts. For full-year 2025, Iridium expects equipment sales to be slightly down, while engineering revenue should be significantly higher than in 2024.

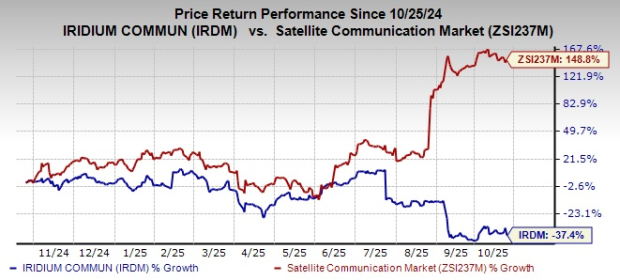

However, management decided to pause share buybacks to prioritize strategic investments and debt reduction. Following the announcements, IRDM’s shares tumbled 7.48% in trading and closed the session at $18.19 on Oct. 23. In the past year, shares have declined 37.4% against the Zacks Satellite and Communication industry's growth of 148.8%.

Total operating expenses were $156.9 million compared with $157.9 million in the prior-year quarter.

Operational EBITDA (OEBITDA) rose 10% in the third quarter to $136.6 million, fueled by recurring service revenue and engineering and support activities.

Operating income came in at $70.1 million compared with $54.9 million reported in the year-ago quarter.

As of Sept. 30, the company had 2,542,000 billable subscribers, up 2% from 2,482,000 at the end of the prior-year quarter. The year-over-year rise was backed by strength in commercial IoT. Commercial IoT now represents 82% of Iridium’s commercial user base, underscoring the company’s strength in industrial and enterprise IoT connectivity.

As of Sept. 30, total cash and cash equivalents were $88.5 million, with $1.8 billion of net debt. Capital expenditures were $21.5 million in the quarter under review.

In the third quarter, Iridium repurchased 1.9 million shares for $50 million. Since the program’s inception in 2021, it has retired 36.7 million shares for $1.3 billion. As of Sept. 30, 2025, $245.3 million remained available under the current authorization, which runs through 2027.

For 2025, IRDM has lowered its full-year service revenue growth forecast to around 3% from 3-5% guided earlier. The outlook is impacted by the delayed timing of PNT revenue. A major customer’s significant PNT deployment, while promising, depends on factors beyond its control. As a result, hosted payload and data service growth will be below trend in the fourth quarter, with full-year service revenue likely at the lower end of its prior guidance.

It is also narrowing its OEBITDA guidance to $495–$500 million, at the upper end of its prior range ($490-$500 million).

Iridium currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here

America Movil, S.A.B. de C.V. (AMX) reported net income per ADR of 40 cents for third-quarter 2025 compared with 11 cents reported in the prior-year quarter. The earnings figure surpassed the Zacks Consensus Estimate of 36 cents. Net income in the quarter was Mex$22,700 million or Mex$0.38 per share against a net loss of Mex$6,427 million or Mex$0.10 per share in the year-ago quarter.

Badger Meter, Inc. (BMI) reported earnings per share (EPS) of $1.19 for third-quarter 2025, which surpassed the Zacks Consensus Estimate by 7.2%. Also, the bottom line compared favorably with the year-ago quarter’s EPS of $1.08. Quarterly net sales were $235.7 million, up 13.1% from $208.4 million in the year-ago quarter, driven by higher utility water sales. The Zacks Consensus Estimate was pegged at $229.4 million.

SAP SE (SAP) reported third-quarter 2025 non-IFRS earnings of €1.59 ($1.86) per share, climbing 29% from the year-ago quarter’s levels. The Zacks Consensus Estimate was pegged at $1.69. Driven by robust cloud growth, disciplined cost control and expanding AI capabilities, SAP reported total revenues on a non-IFRS basis of €9.08 billion ($10.6 billion), representing a 7% year-over-year increase (up 11% at constant currency or cc). The Zacks Consensus Estimate was pegged at $10.56 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 8 hours | |

| 9 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite