|

|

|

|

|||||

|

|

Flowers Foods, Inc. FLO reported third-quarter fiscal 2025 results. The top line increased year over year but missed the Zacks Consensus Estimate. The bottom line declined year over year but met the consensus mark.

Flowers Foods delivered modest sales growth in the third quarter of 2025, supported by the contribution from its Simple Mills acquisition, which helped offset softer pricing and volume trends. Profitability declined, reflecting a challenging consumer environment and higher interest costs, though the company continued to show resilience in its leading brands. Management emphasized progress in strategically aligning the portfolio toward better-for-you and value-oriented offerings, driving relative strength in pressured bakery categories. With continued focus on innovation and disciplined execution, Flowers Foods remains positioned to optimize near-term performance and support long-term growth.

Flowers Foods posted adjusted quarterly earnings per share (EPS) of 23 cents, which fell 30.3% year over year. It reported break-even earnings with the Zacks Consensus Estimate.

Flowers Foods, Inc. price-consensus-eps-surprise-chart | Flowers Foods, Inc. Quote

Sales of $1,226.6 million missed the Zacks Consensus Estimate of $1,233 million and rose 3% year over year. Price/mix declined 2.3%, volumes dropped 0.6% and the Simple Mills acquisition added 5.9%. We estimated the price/mix to be down 0.5% and volumes to decline 1.4% in the third quarter.

Branded retail sales inched up 6.9% to $812.8 million, driven by contributions from the acquisition, partially offset by an unfavorable price/mix and lower volumes. Price/mix inched down 1.1%, sales volume decreased 1.3% and the Simple Mills acquisition contributed 9.3%. We anticipated the price/mix to be down 0.5% and volumes to decline 1% in the fiscal third quarter.

Other sales decrease 3.8% to $413.8 million, impacted by unfavorable price/mix, partially offset by increased volume for non-retail items. Price/mix declined 4.1% and volume increased 0.3%. We estimated price/mix to be down 0.5% and volume to decline 2% in the fiscal third quarter.

Materials, supplies, labor and other production costs (exclusive of depreciation and amortization) increase 190 basis points (bps) to 52.1% of net sales. This improvement was driven by increased outside product purchases, lower sales price/mix and lower production volumes, partly offset by lower ingredient and workforce-related costs.

Selling, distribution and administrative (SD&A) expenses were 38.8% of sales, up 10 bps. The slight increase reflected higher workforce-related costs tied to the California conversion and restructuring implementation, partially offset by lower distributor distribution fees. Adjusted SD&A expenses were 38.3% of sales, down 30 bps from the year-ago quarter.

Adjusted EBITDA decreased 11.4% to $118.1 million. The adjusted EBITDA margin was 9.6%, down 160 bps. We anticipated an adjusted EBITDA margin decrease of 150 bps to 9.7% for the quarter under review.

FLO ended its fiscal third quarter with cash and cash equivalents of nearly $16.7 million and long-term debt of $1,779.6 million. Stockholders’ equity at the quarter’s end was $1,420.5 million.

In the fiscal third quarter, cash flow from operating activities totaled $54.3 million and capital expenditures were $23.9 million. The company paid out dividends worth $52.3 million during this time.

For fiscal 2025, management now expects net sales in the range of $5.254-$5.306 billion, indicating a 2.9% to 4% increase year over year. This forecast is revised from the previous guidance of $5.239-$5.308 billion, indicating a 2.7% to 4% increase year over year.

Adjusted EBITDA is likely to be in the range of $515-$532 million compared with $512-$538 million projected earlier and $538.5 million recorded in fiscal 2024.

For fiscal 2025, adjusted EPS is envisioned in the range of $1.02-$1.08 compared with the earlier view of $1.00-$1.10 and $1.28 delivered in fiscal 2024.

Management expects depreciation and amortization in the range of $168-$172 million, while net interest expenses are likely to be $58-$62 million. For fiscal 2025, capital expenditures are expected in the range of $120-$130 million.

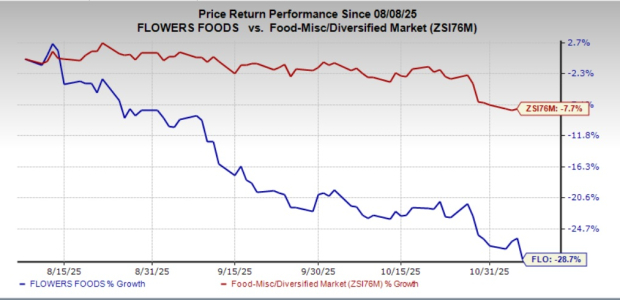

This Zacks Rank #4 (Sell) stock has lost 28.7% in the past three months compared with the industry’s decline of 7.7%.

The Chefs' Warehouse, Inc. CHEF, a premier distributor of specialty food products in the United States, currently sports a Zacks Rank #1 (Strong Buy). CHEF has a trailing four-quarter earnings surprise of 14.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CHEF’s current financial-year sales and EPS calls for growth of 8.1% and 29.3%, respectively, from the year-ago reported numbers.

United Natural Foods, Inc. UNFI distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. United Natural sports a Zacks Rank of 1 at present.

The consensus estimate for United Natural’s current fiscal-year sales and earnings implies growth of 1% and 167.6%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 416.2%, on average.

Ollie's Bargain Outlet Holdings, Inc. OLLI, a leading off-price retailer of brand-name household products, currently carries a Zacks Rank #2 (Buy). OLLI has a trailing four-quarter earnings surprise of 4.2%, on average.

The Zacks Consensus Estimate for Ollie's Bargain’s current financial-year sales and EPS suggests growth of 17.4% and 16.5%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| 11 hours | |

| 15 hours | |

| 18 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite