|

|

|

|

|||||

|

|

Fidelity National Information Services, Inc. FIS recently announced a significant advancement to its FIS Asset Finance solution through a robust SaaS-based cloud offering. This latest enhancement introduces critical functionality tailored to the U.S. consumer auto finance market, enabling comprehensive lifecycle support for loans and leases across consumer auto, wholesale, and equipment finance. Its shares dipped 0.8% on Nov. 19.

The solution significantly boosts operational efficiency by automating formerly manual workflows through a highly configurable system, leading to reduced operational burdens and quicker value realization. It supports complete lifecycle management—from origination and credit decisioning to servicing, asset management and remarketing—within one integrated ecosystem.

Thanks to its API-driven flexibility and digital-first approach, lenders can deliver consistent and personalized borrower experiences across all channels. Borrowers benefit from seamless self-service access and more customized interactions around the clock.

As a result of the recent upgradation, the FIS Asset Finance solution empowers consumers by simplifying vehicle financing and equipping lenders with the tools needed to modernize operations.

Moreover, the latest move seems to be a time-opportune one since enhanced lending and servicing capabilities can enable FIS to alleviate the mounting pressures in asset finance and auto lending sectors, such as rising customer expectations, regulatory shifts, increasing operational costs and the burdens of legacy infrastructure.

Upgradation of the FIS Asset Finance solution is likely to be followed by its increased utilization, which in turn, may drive the revenues of FIS in the days ahead. Total revenues of the company improved 4.5% year over year in the first nine months of 2025.

FIS remains committed to innovation by investing in advanced technologies and introducing solutions that enhance the payment ecosystem. The company continuously broadens its offerings through ongoing software improvements, strategic acquisitions and targeted equity investments.

This October, FIS rolled out Smart Basket, a new checkout solution set to boost savings and loyalty rewards for consumers as well as higher conversion rates for retailers.

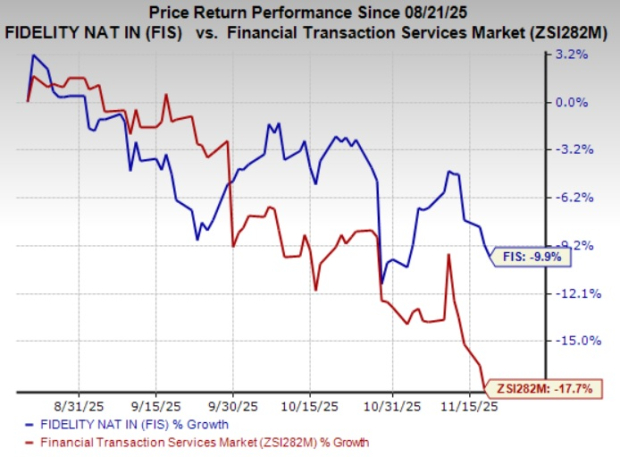

Shares of Fidelity National have lost 9.9% in the past three months compared with the industry’s 17.7% fall. FIS currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Business Services space are FirstCash Holdings, Inc. FCFS, EVERTEC, Inc. EVTC and FTI Consulting, Inc. FCN. While FirstCash currently sports a Zacks Rank #1 (Buy), EVERTEC and FTI Consulting carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of FirstCash outpaced estimates in each of the last four quarters, the average surprise being 12.35%. The Zacks Consensus Estimate for FCFS’ 2025 earnings indicates an improvement of 29.3% from the year-ago figure. The same for revenues implies growth of 5.3% from the year-ago number. The consensus mark for FCFS’ earnings has moved 5.5% north in the past 30 days.

EVERTEC's earnings outpaced estimates in each of the trailing four quarters, the average surprise being 8.78%. The Zacks Consensus Estimate for EVTC’s 2025 earnings indicates an improvement of 8.5% from the year-ago figure. The same for revenues implies growth of 9.3% from the prior-year reading. The consensus mark for EVTC's earnings has moved 2% north in the past 30 days.

The bottom line of FTI Consulting outpaced estimates in three of the last four quarters and missed the mark once, the average surprise being 17.49%. The Zacks Consensus Estimate for FCN’s 2025 earnings indicates an improvement of 5.5% from the year-ago figure. The same for revenues implies growth of 0.3% from the year-ago actual. The consensus mark for FCN’s earnings has moved 4.3% north in the past 30 days.

FirstCash stock has gained 9.9% in the past three months. However, shares of EVERTEC and FTI Consulting have declined 18.6% and 4.8%, respectively, in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-12 | |

| Feb-12 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-08 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite