|

|

|

|

|||||

|

|

Both MARA Holdings, Inc. MARA and Bitfarms Ltd. BITF operate as bitcoin mining companies, focusing on running large-scale, high-performance mining facilities.

Their business models revolve around deploying massive computational power, mainly through specialized mining rigs, to solve complex cryptographic puzzles and earn newly minted bitcoin as rewards. These companies continuously expand their infrastructure, optimize energy efficiency and scale operations to maintain competitiveness as mining difficulty increases.

MARA and BITF also benefit from rising bitcoin prices, as higher market values directly improve the profitability of their mined coins while supporting long-term growth strategies within the rapidly evolving digital asset ecosystem.

MARA has carved out a differentiated position in the crypto ecosystem by following a dual-built strategy that supports both near-term performance and long-term value creation.

The company employs a hybrid model: its large-scale, energy-efficient mining fleet produces Bitcoin at comparatively lower costs, while management intentionally retains a meaningful share of mined assets. This blend allows MARA to sustain operating income from ongoing production while steadily increasing its Bitcoin reserves, creating a portfolio that can benefit from future appreciation.

The strength of this approach lies in its equilibrium. Consistent mining output helps buffer short-term market fluctuations, providing the company with stable cash generation even during periods of crypto volatility. At the same time, the decision to accumulate Bitcoin rather than sell aggressively positions the company to amplify shareholder value if prices move higher. Together, these elements provide both operational durability and strategic upside.

This balanced strategy has parallels in the broader digital asset landscape. Riot Platforms RIOT, another major Bitcoin miner, has also prioritized scaling energy-efficient operations to lower production costs. However, unlike MARA, RIOT has historically leaned toward a higher sell-through rate of its mined Bitcoin, focusing more on near-term liquidity. While it remains a significant player in U.S. mining, its approach highlights the distinctiveness of MARA’s asset accumulation philosophy.

Bitfarms’ shift from a pure Bitcoin mining model to High-Performance Computing and AI is likely to face several obstacles. Rapid growth in power demand is outstripping available capacity, pushing capital and operating costs higher for new data center developments. This squeezes margins and requires heavier upfront spending, which can delay the path to profitability.

Management also acknowledged that chip supply is expected to grow faster than data center infrastructure. This imbalance limits Bitfarms’ ability to deploy GPUs at scale quickly, slowing potential revenue expansion.

There is an added risk that current data center designs may become incompatible with the next generation of high-density hardware. Energy requirements are rising sharply per rack, and any technological mismatch can lead to additional capital expenditures and execution challenges.

Even with Bitfarms’ solid balance sheet, the pivot toward HPC and AI remains highly capital-intensive, supported by significant external financing. This increases financial vulnerability if market conditions tighten or if deployed assets underperform, potentially straining liquidity.

Competitive pressure adds further difficulty. Both Marathon Digital and Riot Platforms diversified into AI/HPC immediately after the Bitcoin Halving, eliminating any first-mover advantage for Bitfarms. Their larger scale allows them to expand more efficiently and compete aggressively for lucrative, long-duration contracts with major technology clients, potentially diverting demand away from Bitfarms.

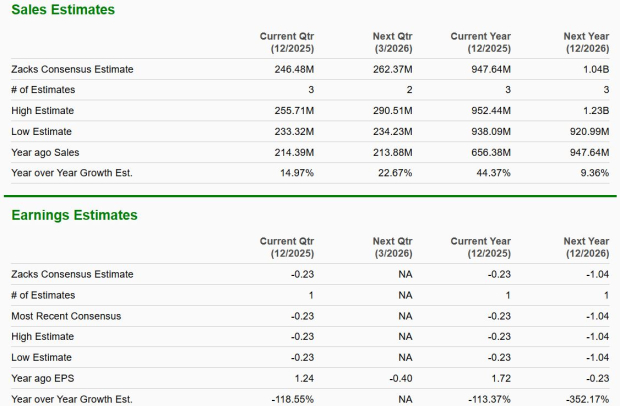

The Zacks Consensus Estimate for MARA’s 2025 sales indicates year-over-year growth of 47.4%, and that for the bottom-line indicates a loss of 23 cents against year-ago earnings of $1.72. EPS estimates have been trending upward over the past 60 days.

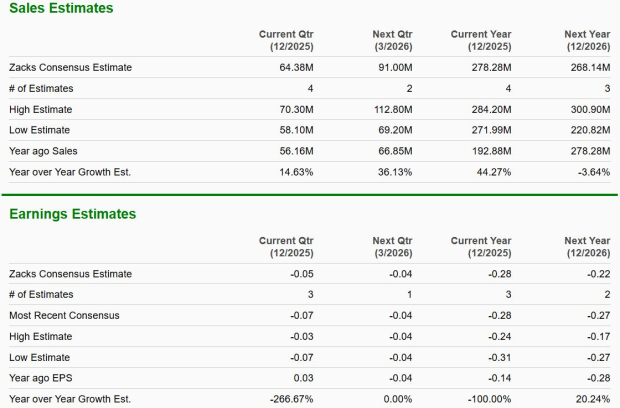

The Zacks Consensus Estimate for BITF’s current year sales suggests 44.3% year-over-year growth, while the loss is expected to increase 100%. EPS estimates have been trending downward over the past 60 days.

MARA is trading at a forward sales multiple of 3.83X, below its 12-month median of 5.75X. BITF’s forward sales multiple stands at 6.49X, above its median of 1.83X.

Between the two miners, MARA demonstrates a more well-rounded and strategically sound position at the moment. Its mix of efficient Bitcoin production and measured accumulation practices provides a steadier framework in a sector defined by volatility. This balanced approach supports durability and keeps the company better aligned for potential long-term upside, even if the stock remains a hold at its current Rank 3 standing.

BITF, on the other hand, is navigating a far more uncertain path. Its shift toward HPC and AI lacks a clear competitive edge, while rising operating costs, infrastructure bottlenecks and tightening industry competition continue to pressure its ability to scale profitably. These challenges reinforce its current sell stance.

Overall, MARA appears better positioned for investors who prefer stability and strategic clarity, whereas BITF’s execution risks make it less compelling in the current environment.

While MARA currently has a Zacks Rank #3 (Hold), BITF carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours |

Riot Surges On Activist Data Center Proposal, ARK Resumes Coinbase Buys

RIOT +5.80%

Investor's Business Daily

|

| 5 hours |

Riot Rises On Activist Data Center Proposal, ARK Resumes Coinbase Buys

RIOT +5.80%

Investor's Business Daily

|

| 6 hours | |

| 8 hours | |

| 8 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite