|

|

|

|

|||||

|

|

Flex Ltd. FLEX is rapidly scaling its presence in the high-growth data center market, leveraging a combination of proprietary technology, partnerships and global manufacturing capacity to meet rising AI-driven infrastructure demand. In the second quarter of fiscal 2026, the company delivered exceptional performance across both cloud and power segments, reinforcing its leadership in the space.

Flex’s integrated data center portfolio, spanning power systems, cooling solutions and compute, has become a core growth engine, supported by deep systems expertise and global scale. On the last earnings call, management stated that the company’s fully integrated power and IT solutions help hyperscale, colocation and silicon customers deploy infrastructure faster and operate more efficiently, while strengthening Flex’s overall margin profile.

A major catalyst in this acceleration is Flex’s introduction of a new AI infrastructure platform. Designed as a pre-engineered, scalable approach that brings together power, cooling and compute, the platform helps data center operators deploy up to 30% faster and reduce execution risk. Flex announced a collaboration with NVIDIA to build modular, energy-efficient AI data centers at scale, leveraging next-generation 800-volt DC architectures that improve energy efficiency, lower cooling requirements and eliminate points of failure as data centers grow in density and complexity. Additionally, Flex recently announced a new partnership with LG Electronics to co-develop integrated modular cooling systems designed to tackle the growing thermal challenges of AI-driven data centers.

These factors are driving Flex’s data center momentum. The company is on track to generate roughly $6.5 billion in data center revenue this year, representing at least 35% year-over-year growth and accounting for 25% of its total revenues. In the Reliability Solutions segment, the company expects robust demand for data center power solutions within its industrial unit. Within the Agility Solutions segment, the company expects continued strong cloud and AI demand in the CEC unit in fiscal 2026. All these factors are favorably positioning Flex for the AI-powered technology shift, prevalent in the industry, from grid to chip and from the cloud to the edge.

For fiscal 2026, Flex has revised its revenue guidance to $26.7–$27.3 billion, up $500 million from the prior midpoint. It expects an adjusted operating margin of 6.2% to 6.3%, indicating consistent performance above 6%. The company anticipates adjusted EPS of $3.09 to $3.17, raising the midpoint by 17 cents. It is targeting to achieve the fiscal 2027 goal of a positive 6% adjusted operating margin a year ahead of schedule.

However, Flex’s highly leveraged balance sheet, macro uncertainty and evolving trade policy remain concerns. Moreover, the company faces intense competition from other companies, such as Jabil Inc. JBL and Sanmina Corporation SANM.

Jabil’s diversifying business and expanding opportunities in the healthcare, cloud, data center, power and energy infrastructure businesses bode well. Jabil’s top line is expected to benefit from strength in AI data center infrastructure, capital equipment and warehouse automation markets. The company is likely to gain from the rapid adoption of 5G wireless and cloud computing in the long haul. The company is benefiting from solid demand in key end markets, together with excellent operational execution and skillful management of supply chain dynamics. The Johnson & Johnson deal is a major growth driver for Jabil. For fiscal 2026, revenues are now projected at $31.3 billion. Non-GAAP earnings per share are expected to be $11.00. The company is expected to generate more than $1.3 billion in adjusted free cash flow.

Sanmina offers end-to-end solutions that include product designing, manufacturing, assembling, testing and aftermarket support. Strengthening technology leadership combined with a customer-focused approach is the cornerstone of Sanmina’s long-term growth strategy. The company unveiled 42Q connected manufacturing that effectively integrates data from customers’ global factories and suppliers’ fleets and creates an up-to-date information base. It offers a unified data ecosystem with real-time data analytics capabilities that significantly improve visibility across the enterprise’s distributed manufacturing and accelerate the decision-making process. Sanmina prioritizes expanding into high-growth industries backed by its strong global network, deep expertise and unique value proposition in advanced electronics manufacturing. For the first quarter of fiscal 2026, revenues are expected to be in the range of $2.05-$2.15 billion. Management estimates non-GAAP earnings per share in the band of $1.95-$2.25.

Shares of FLEX have gained 48.5% in the past year compared with the Electronics - Miscellaneous Products industry’s growth of 20.7%.

FLEX trades at a forward 12-month price-to-earnings (P/E) ratio of 18.77, below the industry’s average of 24.02.

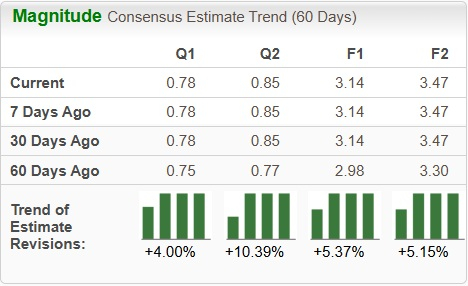

The Zacks Consensus Estimate for FLEX earnings for fiscal 2026 has been revised upward over the past 60 days.

FLEX currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 |

Jabil set to move manufacturing out of downtown Clinton; NyproMold to stay

JBL

Worcester Telegram & Gazette

|

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite