|

|

|

|

|||||

|

|

The Campbell's Company (CPB) reported first-quarter fiscal 2026 results, with the top line missing the Zacks Consensus Estimate but the bottom line exceeding the same. However, both metrics declined year over year.

Adjusted earnings per share (EPS) were 77 cents, down 13% year over year, due to lower adjusted earnings before interest and taxes (“EBIT”). However, the bottom line beat the Zacks Consensus Estimate of 73 cents.

The Campbell's Company price-consensus-eps-surprise-chart | The Campbell's Company Quote

Net sales of $2,677 million decreased 3% year over year, and missed the Zacks Consensus Estimate of $2,659 million. Organic net sales, which exclude divestitures, decreased 1% to $2.7 billion, due to lower volume/mix, partially offset by favorable pricing.

The company’s adjusted gross profit fell to $801 million from $871 million, which missed our estimate of $823.1 million. We note that the adjusted gross profit margin declined 150 basis points (bps) to 29.9%. The margin decrease was primarily due to cost inflation and supply-chain expenses with moderate tariff impacts and unfavorable volume/mix, partly offset by supply-chain productivity benefits, favorable net price realization and cost savings.

Adjusted marketing and selling expenses decreased 2% to $237 million, primarily caused by lower selling expenses, cost savings initiatives and reduced incentive compensation, partially offset by elevated marketing spend.

Adjusted administrative expenses dipped 9% to $150 million, mainly reflecting benefits from cost savings and lower incentive compensation.

The adjusted EBIT dropped 11% to $383 million, mainly owing to reduced adjusted gross profit, somewhat offset by lower adjusted administrative expenses and adjusted marketing and selling expenses. We expected an adjusted EBIT to drop 14.4% for the quarter.

Meals & Beverages: Net sales decreased 4% to $1,665 million for the quarter. Excluding the noosa divestiture, organic net sales declined 2%, caused by lower sales in U.S. soup, Canada, SpaghettiOs, Pace Mexican sauces and V8 beverages, partially offset by growth in Rao’s. Overall sales reflected a 3% decline in volume/mix, partially offset by 1% favorable price realization. U.S. soup sales decreased 2%, primarily due to declines in ready-to-serve and condensed soups, partially offset by growth in broth. We anticipated the segment to decline 3.8% in the fiscal first quarter.

Snacks: Net sales decreased 2% to $1,012 million in the quarter. Excluding the Pop Secret divestiture, organic net sales declined 1%, due to decreases in third-party partner and contract brands, Snyder’s of Hanover pretzels, fresh bakery, Goldfish crackers and Cape Cod potato chips, partially offset by gains in Pepperidge Farm cookies. Performance reflected a 3% decline in volume/mix, partially offset by 2% favorable price realization. We expected the segment to decrease 2.7% in the fiscal first quarter.

As of the end of the reported quarter, Campbell's had cash and cash equivalents of $168 million and a total debt of $6,972 million. Cash flow from operations for the quarter ended Nov. 2, 2025, was $224 million. Capital expenditures were $127 million in the said period.

CPB paid $120 million in cash dividends and repurchased nearly $24 million in shares during the fiscal first quarter.

As of Nov. 2, 2025, the company had $174 million available under its anti-dilutive share repurchase program and $301 million under the September 2021 strategic share repurchase program.

In the fiscal first quarter, Campbell’s delivered $15 million in cost savings, bringing total savings to $160 million toward its fiscal 2028 target of $375 million.

Campbell’s will acquire a 49% stake in La Regina, the longtime producer of Rao’s tomato sauces, for $286 million in two payments. The deal strengthens their partnership and supports future innovation. It is expected to close in the second half of fiscal 2026.

Campbell’s is reaffirming its full-year fiscal 2026 guidance. Organic net sales are still expected to range from a 1% decline to 1% rise year over year. Adjusted EBIT is estimated to decrease 9-13%. Adjusted EPS is expected to decline 12-18%, in the range of $2.40-$2.55.

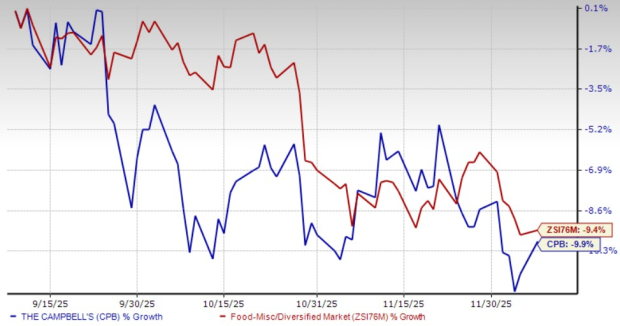

Shares of this Zacks Rank #3 (Hold) company have lost 9.9% in the past three months compared with the industry's decline of 9.4%.

United Natural Foods, Inc. (UNFI) distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. At present, United Natural flaunts a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for United Natural’s current fiscal-year sales and earnings implies growth of 1% and 187.3%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 52.1%, on average.

Lamb Weston Holdings, Inc. (LW) engages in the production, distribution and marketing of frozen potato products in the United States, Canada, Mexico and internationally. It carries a Zacks Rank #2 (Buy) at present. Lamb Weston delivered a trailing four-quarter earnings surprise of 16%, on average.

The Zacks Consensus Estimate for Lamb Weston's current fiscal-year sales indicates growth of 2.4% from the prior-year levels.

Village Farms International, Inc. (VFF) produces, markets and distributes greenhouse-grown tomatoes, bell peppers, cucumbers and mini-cukes in North America. It holds a Zacks Rank #2. VFF delivered a trailing four-quarter earnings surprise of 155.6%, on average.

The Zacks Consensus Estimate for Village Farms’ current fiscal-year earnings indicates growth of 165.6% from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-11 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-08 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite