|

|

|

|

|||||

|

|

AT&T Inc. T and Comcast Corporation CMCSA are prominent players in the telecommunications sector. There are multiple factors that are driving growth in the U.S. telecom market. 5G adoption, fiber expansion, and growing mobile data traffic are primary drivers for this growth.

Per a report by Research and Markets, the U.S. telecom market is expected to witness a 6.8% compound annual growth rate between 2024 and 2029. With deep industry acumen, both AT&T and Comcast hold a strong foothold in the highly competitive U.S. telecom sector. Let us analyze the competitive strengths and weaknesses of the companies in depth to understand which is better positioned to maximize gains from the emerging market trends.

AT&T is benefiting from solid momentum in the communications segment. In the third quarter, the company’s service revenues improved, backed by solid subscriber gains. Higher volumes of non-phone sales and higher-priced phone sales are driving equipment revenues. AT&T recorded net fiber additions of 288,000, while Internet Air added 270,000 subscribers during the quarter. The consistent gain in the fiber broadband business is driving growth in the Consumer Wireline.

AT&T is rapidly expanding its 5G infrastructure nationwide. The company has rapidly deployed mid-band spectrum from Echo Star around 23,000 cell sites. This will ensure a significant increase in speed and capacity for customers in 5,300 cities across 48 states. The integration of the spectrum from Echo Star has improved download speed for mobility by 80%, while it has improved 55% for AT&T Internet Air users.

The acquisition of Echo Star is a smart move from AT&T as it eliminates the requirement of capital-intensive construction of cell sites to boost network capacity. This network capacity enhancement will allow T to meet the requirements of advanced applications such as streaming, gaming, cloud services and various AI use cases. Along with this, the network boost will also support first responders, as the FirstNet customers will also get access to AT&T commercial spectrum.

The company is also actively working to integrate AI to enhance efficiency across its operations. Ask AT&T Workflows is a newly developed AI agent tool that takes customer service update requests, synchronizes data across systems, and auto-installs information in real time. The AI tools can significantly improve end users’ experience by reducing wait times and allowing employees to focus on high-priority work. Such growing emphasis on resource optimization can have a positive impact on the company’s profitability and cash flow.

However, the company faces stiff competition from other industry leaders such as Verizon Communications, Inc. VZ, T-Mobile, Comcast and others. Verizon is steadily expanding its fiber footprint, which affects AT&T’s fiber expansion initiatives. However, with a strong foundation, focus on customer service and margin improvement, AT&T is well equipped to gain a competitive edge.

Comcast is primarily focused on broadband Internet and in-home WiFi. The company offers residential broadband and wireless connectivity services, residential and business video services through the Residential Connectivity & Platforms segment. Revenues from this segment decreased 1.5% year over year in the third quarter. The decline was primarily induced by weakness in the video and advertising business. The declining trend is partially offset by strength in domestic broadband, domestic wireless and international connectivity business.

Comcast has established a differentiated market position through integrated connectivity and wireless convergence. The company boasts a robust broadband infrastructure to offer seamless bundled services combining Internet, wireless and entertainment under unified pricing structures. Comcast Xfinity is one of the widely accessible broadband services in the country. Its Hybrid Fiber-Coaxial (HFC) network provides the required flexibility and scalability to expand network coverage and capacity.

The company’s DOCSIS 3.1 technology facilitates gigabit-plus downstream broadband speeds to residential and business customers. It is also actively rolling out DOCSIS 4.0 technology, which is allowing the company to deliver multigigabit symmetrical broadband speeds over the existing HFC network. Focus on virtualization and automation of the core network to boost operational efficiency is a tailwind.

However, the company is witnessing a downtrend in the Residential Connectivity & Platforms due to growing competition from other broadband providers such as AT&T and Verizon. T recently added 10 million fiber Internet customers in the United States. The acquisition of Lumen’s Mass Markets fiber business, which is expected to close in early 2026, will add 1 million fiber customers and 4 million fiber locations across 11 U.S. states. The company is well-positioned to reach 60 million total fiber locations by the end of 2026. Verizon is also actively expanding its fiber infrastructure nationwide. These factors can further intensify competition and impede Comcast’s growth prospects.

The Zacks Consensus Estimate for AT&T’s 2025 sales indicates growth of 2.14% year over year, while EPS implies a decline of 8.85% year over year. The EPS estimates have been trending upward over the past 60 days.

The Zacks Consensus Estimate for Comcast’s 2025 sales indicates a decline of 0.07% year over year, while EPS is projected to decline 3.46% year over year. The EPS estimates have been trending southward over the past 60 days.

Image Source: Zacks Investment Research

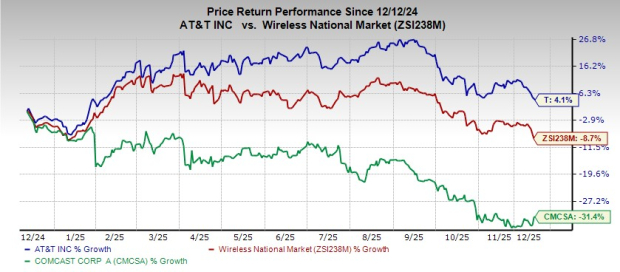

Over the past year, AT&T has gained 4.1%, while Comcast has declined 31.4%.

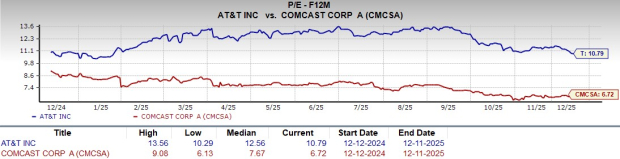

CMCSA looks more attractive than AT&T from a valuation standpoint. Going by the price/earnings ratio, CMCSA’s shares currently trade at 6.72 forward earnings, lower than 10.79 for AT&T.

AT&T and Comcast carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Both AT&T and Comcast are actively expanding their network infrastructure to drive subscriber growth. Comcast's DOCSIS 4.0 deployment is a positive factor. However, a downtrend in estimate revision underscores dwindling investors’ confidence in Comcast’s growth potential. AT&T is also rapidly expanding its fiber footprint with strategic acquisitions and infrastructure expansion. Moreover, AT&T’s initiative to boost 5G network capacity and AI integration to enhance customer service and optimize resources bodes well for long-term growth. With upward estimate revision and better stock price performance, solid wireless momentum, AT&T appears to be a better investment option right now.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite