|

|

|

|

|||||

|

|

Norwegian Cruise Line Holdings Ltd. NCLH continues to make measurable progress in strengthening its balance sheet, an area that has remained central to investor scrutiny since the pandemic-era leverage build. During the third quarter of 2025, the company executed a series of capital market transactions designed to reduce structural risk, extend its maturity profile and enhance capital efficiency — while remaining essentially leverage neutral.

A key component of this effort was the refinancing of approximately $2 billion of debt, including the replacement of roughly $1.8 billion of secured borrowings with unsecured notes. As a result, NCLH has now eliminated secured notes from its capital structure, materially improving collateral flexibility and long-term financial optionality.

The refinancing also alleviated near-term maturity concentration. By addressing the majority of its 2027 exchangeable notes, the company extended maturities and smoothed its debt ladder, reducing refinancing risk over the medium term. Notably, these balance sheet actions were accompanied by a reduction of more than 38 million shares on a fully diluted basis — representing over 7% of outstanding shares — which provided an immediate lift to adjusted EPS. Management emphasized that these transactions were executed without increasing net leverage, reinforcing a disciplined approach focused on balance sheet optimization rather than incremental risk.

This progress comes as NCLH continues to integrate new capacity into the fleet. Net leverage rose modestly to 5.4x in the third quarter, primarily reflecting the delivery of Oceania Allura before its EBITDA contribution is fully annualized. Even so, the company expects to exit 2025 with leverage around 5.3x, or closer to 5.2x when excluding non-cash foreign exchange impacts. Maintaining broadly stable leverage in a year that includes multiple vessel deliveries underscores the growing cash flow durability generated by margin expansion and cost discipline.

Looking ahead, management reiterated that deleveraging remains its top financial priority, with a clear path toward the mid-4x leverage range in 2026. With an extended maturity profile, the elimination of secured debt and improving free cash flow visibility, NCLH’s refinancing momentum suggests balance sheet risk is gradually receding.

Carnival Corporation & plc CCL is making rapid progress in its post-pandemic financial reset, executing one of the cruise industry’s most aggressive deleveraging efforts. In the third quarter of fiscal 2025, the company reduced secured debt by nearly $2.5 billion, refinanced more than $11 billion at improved terms and prepaid an additional $1 billion, driving net debt-to-EBITDA down to 3.6x from 4.3x a year ago, with a sub-3x target by 2026.

The strengthened balance sheet has already led to a positive outlook, while plans to fully redeem outstanding convertible notes by year-end are expected to further lower leverage entering fiscal 2026. With minimal new ship deliveries ahead, management anticipates a sharp increase in free cash flow, positioning Carnival to eventually reinstate dividends once leverage stabilizes below 3.5x.

Royal Caribbean Cruises Ltd. RCL is entering its next phase of balance-sheet strength and shareholder-focused execution. In the second quarter of fiscal 2025, the company secured investment-grade ratings from all three major credit agencies and reported liquidity of $7.1 billion, underscoring the strength of its cash generation and disciplined capital structure.

RCL expects to reduce net leverage to the mid-2x range by 2025-end. Management emphasized that deleveraging is largely complete, paving the way for competitive dividends and opportunistic buybacks. With limited near-term maturities and expanding credit facilities, Royal Caribbean now operates from a position of financial leadership in the sector — shifting its focus from recovery to capital returns and long-term growth.

Shares of Norwegian Cruise have gained 19.4% in the past six months compared with the industry’s growth of 5.5%.

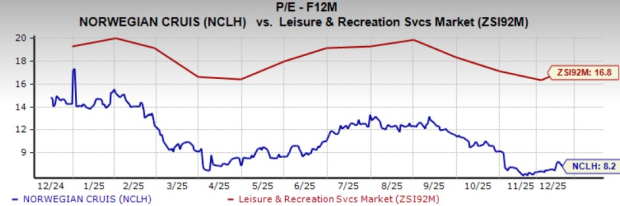

From a valuation standpoint, NCLH trades at a forward price-to-earnings ratio of 8.2, significantly below the industry’s average of 16.8.

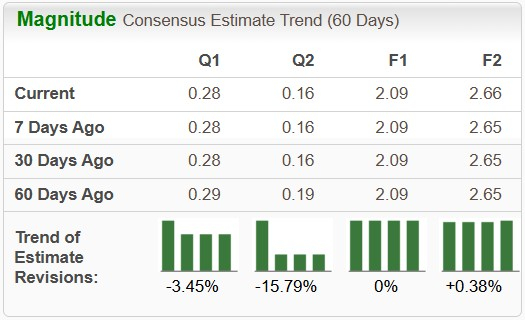

The Zacks Consensus Estimate for NCLH’s 2026 earnings implies a year-over-year uptick of 27.7%. The EPS estimates for 2026 have increased in the past 30 days.

NCLH stock currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 36 min | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite