|

|

|

|

|||||

|

|

The Clorox Company, Inc. CLX is navigating a tougher consumer environment where pricing power is increasingly tested by heightened value-seeking behavior. Management acknowledged that category growth has stabilized but remains below historical levels, while competitive intensity is elevated as brands fight for wallet share. The company acknowledged that consumers across income segments are under pressure, prompting shifts toward smaller pack sizes, usage stretching and trade-down options within portfolios.

Rather than relying solely on price increases, Clorox is leveraging price pack architecture and targeted promotions to protect brand equity while maintaining affordability. The company is expanding smaller-size offerings in businesses like Brita, Food and Kingsford, while dilutable cleaners in its Cleaning segment are resonating with cost-conscious shoppers by delivering versatility at a lower effective price point.

At the same time, Clorox is seeing strong demand for larger, value-oriented formats in Club and eCommerce channels, highlighting a polarized consumer response rather than outright resistance to pricing.

Clorox continues to find areas where consumers are willing to pay a premium, particularly for convenience and time savings. Growth in wipes, convenience toilet cleaners and ready-to-eat innovations like Hidden Valley Ranch Dippers & Toppers suggests pricing power can still hold where value is clearly differentiated.

However, margin pressure remains a clear overhang. In the first quarter of fiscal 2026, Clorox’s gross margin declined 410 basis points (bps), driven by lower fixed-cost absorption tied to volume declines from the ERP-related shipment disruption, alongside higher manufacturing and logistics costs. While cost savings provided some offset, elevated expenses, including storm-related manufacturing impacts and stepped-up digital investments, weighed meaningfully on profitability.

Management also expects fiscal 2026 gross margin to trend toward the lower end of its guidance range of 50 to 100 bps, reflecting lingering ERP-related headwinds and an uncertain tariff environment. As pricing flexibility narrows and promotional intensity rises, Clorox’s ability to fully rebuild margins could remain constrained in the near term, even as demand stabilizes.

While consumer elasticity in the near term is tightening, Clorox’s diversified approach, balancing affordability, value sizing and premium convenience, appears better positioned than blunt pricing actions alone. With brand health metrics such as household penetration and loyalty remaining stable, the company’s pricing power may not be absolute, but it remains selectively resilient in a constrained consumer landscape.

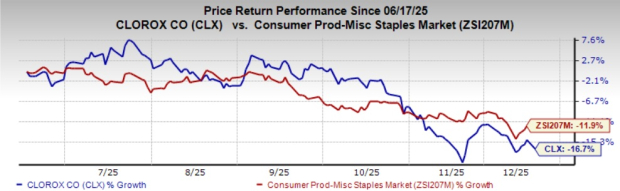

In the past six months, CLX’s shares have plunged 16.7% compared with the industry’s decline of 11.9%. CLX carries a Zacks Rank #3 (Hold).

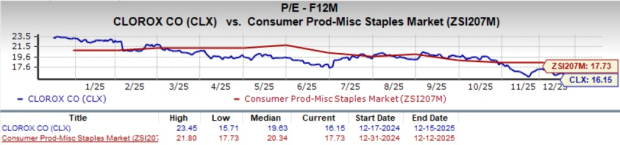

From a valuation standpoint, CLX trades at a forward price-to-earnings ratio of 16.15X, lower than the industry average of 17.73X.

The Zacks Consensus Estimate for CLX’s fiscal 2026 earnings implies a year-over-year decline of 24%, while fiscal 2027 earnings suggest a year-over-year rise of 15.8%.

Some better-ranked stocks have been discussed below:

United Natural Foods, Inc. UNFI distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. At present, United Natural sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for United Natural’s current fiscal-year sales and earnings implies growth of 1% and 187.3%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 52.1%, on average.

The Vita Coco Company, Inc. COCO develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific. COCO currently flaunts a Zacks Rank #1.

The Zacks Consensus Estimate for Vita Coco's current fiscal-year sales and earnings implies growth of 18% and 15%, respectively, from the year-ago figures. Vita Coco delivered a trailing four-quarter earnings surprise of 30.4%, on average.

Monster Beverage Corporation MNST engages in the development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally. MNST currently sports a Zacks Rank #1.

The Zacks Consensus Estimate for Monster Beverage's current fiscal-year sales and earnings implies growth of 9.6% and 22.2%, respectively, from the year-ago figures. MNST delivered a trailing four-quarter earnings surprise of 5.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 11 hours | |

| 11 hours | |

| 13 hours | |

| 21 hours | |

| Mar-08 | |

| Mar-08 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite