|

|

|

|

|||||

|

|

By one estimate, quantum computing can create up to $1 trillion in global economic value over the next decade.

However, one surefire valuation tool demonstrates how early in the commercialization cycle quantum computers currently are.

Perspective is important when analyzing companies at the forefront of game-changing trends.

If you think artificial intelligence (AI) is Wall Street's hottest trend, you haven't been paying close enough attention to the rise of quantum computing in 2025.

Over the trailing year, as of the closing bell on Dec. 12, shares of quantum computing pure-play stocks IonQ (NYSE: IONQ), Rigetti Computing (NASDAQ: RGTI), D-Wave Quantum (NYSE: QBTS), and Quantum Computing Inc. (NASDAQ: QUBT) soared by 68%, 333%, 568%, and 89%, respectively.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Investors have clearly been enamored with the real-world applications of quantum computers, as well as the high-ceiling addressable markets associated with this technology. Online publication The Quantum Insider believes it can create up to $1 trillion in global economic value by 2035, while analysts at Boston Consulting Group anticipate between $450 billion and $850 billion in worldwide economic value creation come 2040.

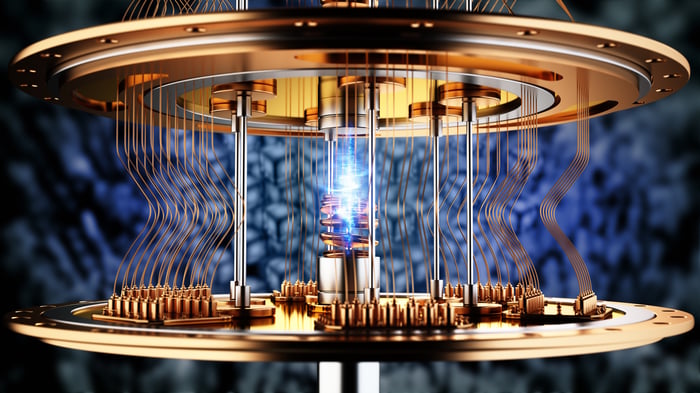

Image source: Getty Images.

With all four of these pure-play stocks possessing a first-mover advantage, it's not a surprise that we've witnessed a parabolic move in quantum computing stocks. However, one time-tested figure strongly suggests the rug is going to be pulled out from under IonQ, Rigetti, D-Wave, and Quantum Computing Inc. in the new year.

One of the most difficult things for investors is assigning a proper valuation to an early stage business.

When most investors attempt to value a business, they typically turn to the traditional price-to-earnings (P/E) ratio or the price-to-earnings-growth ratio, which is also known as the PEG ratio. The P/E ratio, which is arrived at by dividing a company's share price by its trailing 12-month earnings per share (EPS), works particularly well for evaluating mature businesses. Meanwhile, the PEG ratio addresses one of the P/E ratio's biggest flaws by taking into account a company's growth rate.

But neither of these valuation tools works well for early stage businesses that are expected to grow rapidly but are currently operating at a loss. Without positive EPS, both metrics lack utility. Thus enters the price-to-sales (P/S) ratio, stage left.

As its name implies, the P/S ratio divides a company's market cap by its trailing 12-month sales. Although a lower P/S ratio typically aligns with a stock being more fundamentally attractive, other factors, such as growth rate, can move the pendulum.

Before the bursting of the dot-com bubble in March 2000, many companies heralding the charge, such as Microsoft, Amazon, and Cisco Systems, peaked at P/S ratios above 30 (and occasionally exceeded 40). What historical precedent has shown, with the bursting of the dot-com bubble and with each subsequent "next-big-thing" technology that's been hyped on Wall Street, is that P/S ratios of 30 or above aren't sustainable over an extended period.

As of the closing bell on Dec. 12, the trailing 12-month P/S ratios for Wall Street's quantum computing darlings were as follows:

I assure you, I haven't forgotten any periods. These figures are a direct reflection of how early in the commercialization process these pure-play stocks currently are.

For those of you who believe this data is being cherry-picked, let's look two years out, using Wall Street's consensus revenue forecasts for all four pure-play stocks, and rerun the P/S ratios. Based on 2027 estimated sales, here's how the numbers shake out:

In one respect, it's easy to see why IonQ sports a market cap that's more than double that of Rigetti and nearly twice as much as D-Wave Quantum. At the same time, it becomes clear that high double-digit or even sustained triple-digit annual sales growth rates wouldn't be enough to lower their respective P/S ratios below the historical threshold that indicates a bubble for a hyped trend.

Although the P/S ratio can't predict when bubbles will pop, there's a good likelihood that 2026 will be a challenging year for quantum computing stocks, to say the least.

Image source: Getty Images.

However, the time-tested P/S ratio isn't the only piece of history that points to trouble for quantum computing pure-play stocks in the new year.

Correlated events over the last 30 years indicate that every game-changing technology or hyped trend has required considerable time to mature and evolve.

For example, businesses began utilizing the internet as a marketing tool for their products and services more than half a decade before the dot-com bubble burst. Although there was reasonably strong demand for this technology, businesses didn't immediately understand how to optimize it to boost their sales and profits. In short, investors overestimated the adoption and/or optimization rate of the internet.

Following the proliferation of the internet, we've observed the same dynamic play out with genome decoding, nanotechnology, 3D printing, blockchain technology, and the metaverse, among other prominent technological trends. These bubbles burst because investors didn't give these technologies ample time to mature.

A strong argument can be made that quantum computers are nowhere close to having practical problem-solving utility. Likewise, there's no indication that sizable investments in quantum computing hardware or services have led to profits for the businesses making these investments. We're witnessing the same series of errors play out, yet again.

The potential silver lining for quantum computing stock investors is that time has led to instances of success. Although the internet bubble popped in a big way -- the S&P 500 and Nasdaq Composite shed 49% and 78% of their respective value on a peak-to-trough basis -- quite a few internet-driven businesses have gone on to deliver jaw-dropping returns over the last quarter of a century.

With the proper perspective (i.e., one that looks five to 10 years down the road), some of these quantum computing pure-play stocks may prove to be winners. However, expecting quantum computing stocks to maintain their parabolic ascents without any mainstream commercialization of their products and services is unwise.

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,695!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,080,694!*

Now, it’s worth noting Stock Advisor’s total average return is 962% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of December 17, 2025.

Sean Williams has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Cisco Systems, IonQ, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 9 hours | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite