|

|

|

|

|||||

|

|

The Trade Desk, Inc. TTD is positioning OpenPath as a transformative force in the digital advertising supply chain, reinforcing its long-standing commitment to transparency, efficiency and advertiser-centric innovation across the open Internet. As the digital ad market continues to grapple with inefficiencies, opaque intermediaries and duplicated inventory, OpenPath is designed to create a cleaner, more direct connection between advertisers and premium publishers, fundamentally reshaping how media is bought and sold.

OpenPath functions as a direct integration between The Trade Desk’s demand-side platform and trusted sources of publisher inventory. By connecting directly into auctions that meet strict transparency and quality standards, OpenPath establishes what the company describes as “clean pipes” into supply. This approach allows advertisers to clearly understand what they are buying, while publishers gain better insight into how their inventory is valued by the market when it is described accurately and transparently. As a result, both sides benefit from improved price discovery and reduced friction in transactions.

The rapid adoption of OpenPath underscores its impact. In the last earnings call, management highlighted that OpenPath has grown by many multiples over the past year. Publishers such as Hearst are experiencing significant benefits from integrating OpenPath, including a fourfold improvement in ad fill rates and a 23% increase in revenues. At the same time, interest in OpenAds has been strong since its launch, with 20 publishers already committed to adopting the solution.

OpenPath also addresses a longstanding challenge in digital advertising: the weakening of auction integrity caused by inventory duplication and obfuscation. By plugging directly into premium publisher auctions, including those operated by large media owners, OpenPath helps ensure that inventory is evaluated and priced fairly. The Trade Desk emphasizes that a healthy auction is neither buy-side nor sell-side biased, but instead serves as a trusted referee that enables efficient, competitive markets.

OpenPath aligns with The Trade Desk’s broader strategy of strengthening the open Internet in contrast to walled gardens. While major technology platforms focus on monetizing their owned and operated inventory, OpenPath reinforces an ecosystem built on objectivity, competition and transparency. OpenPath is more than a product feature; it represents a structural upgrade to the digital advertising supply chain.

PubMatic PUBM is leveraging CTV, AI-driven automation and sell-side data intelligence to drive its growth amid the macro pressures and reduced spend from legacy DSP customers. The company is aggressively expanding and diversifying its DSP mix, reducing dependence on legacy buyers and concentrating on mid-tier DSP partners. Additionally, the company launched Programmatic Guaranteed with a top-three DSP, enabling more efficient execution around CTV and premium video deal Supply Path Optimization (SPO), driving Higher Platform Engagement. PubMatic has heavily invested in AI, building a three-layered AI system across infrastructure, application and transactions, creating a defensible moat.

Amazon.com, Inc. AMZN reported continued strong momentum, generating $17.6 billion in quarterly revenues, up 22% year over year, in the third quarter of 2025. Growth was driven by solid demand across its full-funnel advertising portfolio, which reaches an average ad-supported audience of more than 300 million people in the US alone. The company remains encouraged by the expansion of Amazon DSP, enabling advertisers to plan, execute and measure campaigns across the entire funnel. Also, Amazon expanded partnerships with Netflix, giving Amazon DSP advertisers direct access to Netflix’s premium ad inventory. Additional integrations with Spotify and SiriusXM further broaden reach, offering programmatic access to more than 400 million global ad-supported Spotify listeners and 160 million monthly digital listeners across SiriusXM services such as Pandora and SoundCloud.

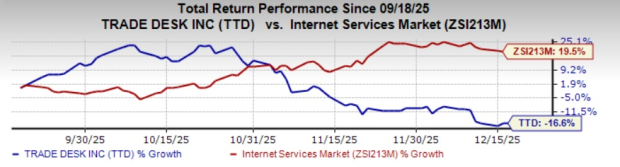

Shares of TTD have lost 16.6% in the past three months against the Internet – Services industry’s growth of 19.5%.

In terms of forward price/earnings, TTD’s shares are trading at 29.52X compared with the Internet Services industry’s ratio of 28.22X.

The Zacks Consensus Estimate for TTD’s earnings for 2025 has been marginally revised upward over the past 60 days.

TTD currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Marketplaces Are the Next Frontier in Publisher Deals With AI Companies

AMZN

The Wall Street Journal

|

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite