|

|

|

|

|||||

|

|

The digital transformation of retail continues to reshape consumer behaviour as online commerce remains a dominant force heading into 2026. Per Mordor Intelligence, the global e-commerce market is projected to expand to around $37 trillion in 2026, reflecting continued growth across both consumer and business digital transactions. This sustained expansion reflects multiple tailwinds, including rising smartphone penetration in emerging markets, the proliferation of buy-now-pay-later payment options that increase purchasing accessibility, growing consumer trust in digital payment security and the continued shift of advertising budgets toward e-commerce platforms. Three companies positioned to capitalise on these trends are Amazon AMZN, Expedia EXPE and Fiverr International FVRR, each offering distinct exposure to different facets of the expanding digital economy.

The sector's momentum has been reinforced by improving macroeconomic conditions, particularly the Federal Reserve's three interest rate cuts in 2025 that lowered the benchmark federal funds rate by 175 basis points since September 2024 to a range of 3.50%-3.75%. These rate reductions have eased borrowing costs for both consumers and businesses, potentially unlocking discretionary spending power that favors online purchasing channels.

Artificial intelligence is expected to play a more visible role in shaping online retail outcomes in 2026, building on investments made across the sector in 2025. Retailers increasingly deployed AI-driven recommendation engines, search optimization tools and personalized marketing algorithms to improve conversion rates and customer engagement. AI has also been applied to demand forecasting, inventory management and dynamic pricing, helping platforms reduce stockouts while improving fulfilment efficiency. In parallel, generative AI tools have been integrated into customer service and content creation workflows, lowering operating costs and enhancing responsiveness. These capabilities are expected to strengthen operating leverage while reinforcing convenience for digital shoppers globally.

Beyond AI, several structural trends are expected to support continued online retail expansion in 2026. Faster fulfilment remains a key driver, with wider adoption of same-day and next-day delivery reducing friction in purchase decisions. Social commerce is gaining momentum as platforms enable in-app shopping, live commerce and creator-led discovery, shortening the path from engagement to transaction. Cross-border e-commerce is expected to benefit from improved international logistics, localized fulfilment networks and multi-currency payment processing, expanding addressable markets for leading platforms. In addition, the growing use of digital wallets, loyalty ecosystems and subscription-based models is likely to enhance customer retention, purchase frequency and revenue visibility, reinforcing long-term growth prospects for digital-first retailers.

Over the past three months, shares of digital commerce leaders have shown divergent performance. Shares of Expedia Group led with an increase of 32.8%, significantly outperforming the broader market as investors rewarded B2B momentum and margin expansion. Amazon advanced 3.7%, supported by its diversified revenue streams across retail, cloud and advertising. Shares of Fiverr International declined 20.4% as the market digested concerns around AI competition in the freelance services sector. These varying performances create different entry points for investors seeking exposure to online retail trends heading into 2026.

The chart below shows the price performance of our three picks in the past three-month period.

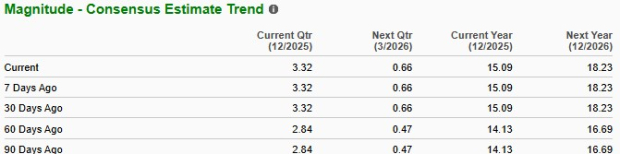

Expedia is positioned to benefit as increased travel booking migrates to digital channels in 2026. The platform's AI-powered search and mobile commerce capabilities enhance conversion rates as consumers book trips via smartphone. Lower interest rates expand discretionary budgets for leisure spending, while buy-now-pay-later options increase accessibility. Expedia's B2B segment captures corporate travel shifting to digital procurement, providing differentiation. Geographic diversification and social commerce integration through set-jetting trends strengthen market positioning. Expedia currently sports a Zacks Rank #1 (Strong Buy), and the Zacks Consensus Estimate for EXPE's 2026 EPS has remained unchanged over the past 30 days at $18.23. You can see the complete list of today’s Zacks #1 Rank stocks here.

Fiverr is expected to benefit from the digitization of services procurement in 2026. The platform's network effects strengthen as more freelancers attract buyers, creating switching costs. Fiverr's predefined gig structure simplifies transactions compared to bidding platforms, reducing friction. The marketplace spans over 500 service categories, providing breadth that competitors struggle to match. Mobile commerce enables seamless transactions while AI integration improves delivery quality. Lower interest rates support small business outsourcing budgets. Fiverr's commission-based model scales efficiently as volumes increase. Fiverr currently sports a Zacks Rank #1, and the Zacks Consensus Estimate for FVRR's 2026 EPS has inched upward by a penny over the past 30 days to $3.05.

Amazon is expected to capture significant online retail growth in 2026, benefiting from rising smartphone penetration and AI-powered personalisation that enhances conversion rates. AMZN's logistics network and Prime ecosystem create switching costs, reinforcing customer loyalty. Amazon's fulfillment infrastructure enables faster delivery, while lower interest rates expand discretionary budgets. Advertising within product search generates high-margin revenue as brands compete for visibility. Its marketplace model allows third-party sellers to reach Prime members efficiently. Amazon currently carries a Zacks Rank #2 (Buy), and the Zacks Consensus Estimate for AMZN's 2026 EPS has inched upward by 2 cents over the past 30 days to $7.85.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 min | |

| 56 min | |

| 1 hour | |

| 4 hours | |

| 4 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite