|

|

|

|

|||||

|

|

U.S. consumers are under financial pressure as restrictive monetary policy, persistent inflation in essential services and uneven real wage growth collide with record-high debt levels. Total U.S. consumer debt surpassed $18 trillion by the end of third-quarter 2025, rising from $17.7 trillion in January 2025, driven primarily by growth in credit card balances, auto loans and personal lending, according to the latest Quarterly Report on Household Debt and Credit. Credit card debt is hovering near all-time highs, signaling increasing reliance on revolving credit to maintain consumption.

Rising consumer credit stress can weigh on banks through higher loan defaults and delinquencies, forcing them to increase provisions and hurting profits. At the same time, weaker demand for new loans and tighter lending standards can limit interest income, a key revenue source. Banks with strong capitalization, diversified revenue streams and solid liquidity are better-positioned to withstand these pressures. Hence, Bank of America BAC, Wells Fargo WFC and U.S. Bancorp USB stand out as relatively safer options for investors seeking stability in the banking sector amid rising consumer credit challenges.

Signs of strain are becoming increasingly visible in U.S. credit performance. Aggregate consumer delinquency rates rose to 4.5% by the end of the third quarter 2025, the highest level since early 2020. Structural factors are compounding cyclical pressure as persistent inflation in non-discretionary categories, the resumption of student loan repayments and higher borrowing costs are weighing on household balance sheets and sentiment.

Reflecting this stress, U.S. consumer confidence has weakened throughout 2025. According to the Conference Board’s data, the Consumer Confidence Index declined for the fifth consecutive month in December and remained below the early-year levels. Further, the Expectations Index fell sharply from 104.1 in January to 70.7 in December, indicating growing pessimism about economic prospects.

Amid such pressure, investors looking for stability in the banking sector can consider the above-mentioned banks. These banks offer solid fundamentals, diversified operations and strong growth projections, positioning them well for healthy returns in 2026.

To choose these banks, we ran the Zacks Stocks Screener to identify stocks with a market capitalization of more than $30 billion, a past-year price performance above 15% and a 2026 earnings growth projection of above 5%. Also, these three stocks currently carry a Zacks Rank 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

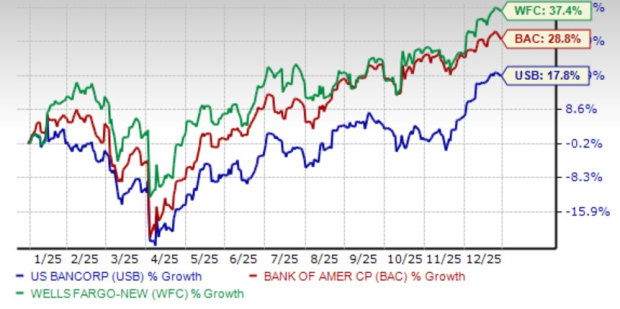

Price Performance

Bank of America is one of the largest financial holding companies in the United States. With total assets worth $3.40 trillion as of Sept. 30, 2025, it provides a diverse range of banking and non-banking financial services and products through 3,649 financial centers.

From an asset quality perspective, Bank of America continues to exhibit resilient credit fundamentals despite prior macroeconomic headwinds. In the first nine months of the year, provisions declined marginally, while net charge-offs (NCO) fell 4.8% year over year, reflecting improving portfolio performance. Management emphasized that the sustained strength in asset quality stems from years of disciplined risk management, a well-diversified credit portfolio and stronger loan growth relative to peers with comparable credit performance.

The bank is prioritizing organic, domestic expansion through a combination of physical footprint growth and digital scale. The company plans to open more than 150 financial centers by 2027, complementing its 3,649 existing centers and the growing adoption of digital banking tools. This strategy is designed to support sustainable revenue growth while maintaining cost discipline and capital efficiency.

The bank’s asset quality profile is further supported by a solid liquidity position. As of Sept. 30, 2025, BAC reported short-term debt of $54.2 billion, alongside $246.5 billion in cash and cash equivalents.

Management targets earnings growth of more than 12% over the next three to five years, with a return on tangible common equity (ROTCE) of 16-18% while maintaining a common equity tier 1 ratio of 10.5%.

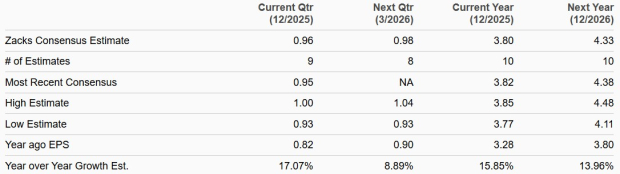

The Zacks Consensus Estimate for Bank of America’s 2026 earnings stands at $4.33 per share, indicating a 13.9% increase from the prior year. It has a market capitalization of $410.2 billion.

Earnings Estimates

Wells Fargo is one of the largest financial services companies in the United States, with $2.06 trillion in assets as of Sept. 30, 2025.

From an asset quality standpoint, Wells Fargo is showing clear signs of strengthening credit fundamentals. In the first nine months of 2025, NCO declined 17.2% year over year, while provisions for credit losses fell 19%, reflecting improving conditions across both consumer and commercial portfolios. This stabilization underscores better underwriting discipline and a healthier loan book, providing a solid foundation for balance sheet expansion.

Along with improving asset quality, the removal of the longstanding asset cap marks a pivotal shift in the bank’s operating trajectory. With this constraint lifted, WFC is transitioning from a defensive recovery phase to a renewed growth cycle. The bank can now expand deposits, grow its loan portfolio and increase securities holdings, all of which are expected to support stronger earnings generation and long-term strategic flexibility.

Complementing this, the bank continues to streamline operations and sharpen its focus on core banking franchises, while investing heavily in its physical footprint. By the end of 2025, the bank expects to have refreshed slightly more than half of its branch network, supporting customer engagement and deposit stability.

Encouraged by these developments, management raised its medium-term ROTCE target to 17-18%, up from the prior goal of 15%, signaling confidence in sustained balance sheet quality and earnings resilience.

The company’s asset quality and growth outlook are further reinforced by its strong liquidity profile. As of the third quarter of 2025, Wells Fargo reported a liquidity coverage ratio of 121%, well above the regulatory minimum of 100%, providing ample protection against potential market stress.

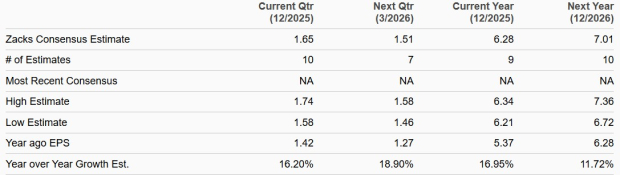

The Zacks Consensus Estimate projects 2026 earnings of $7.01 per share, suggesting an 11.7% increase from the prior year’s actual. WFC has a market capitalization of $299 billion.

Earnings Estimates

U.S. Bancorp, headquartered in Minneapolis, MN, provides banking and investment services mainly operating in the Midwest and West regions of the United States.

From an asset quality perspective, USB continues to demonstrate gradual but steady improvement, supported by stabilizing credit trends and disciplined risk management. In the first nine months of 2025, provisions for credit losses declined 4.1% year over year, while NCO decreased 8.3%, signaling improving performance across the loan portfolio. Although pockets of stress persist in select consumer and commercial segments, the company’s conservative underwriting standards, diversified balance sheet and strong capital position have helped contain credit risks and preserve overall asset quality.

Improving credit fundamentals is complemented by initiatives aimed at strengthening the bank’s growth profile and revenue mix. U.S. Bancorp has expanded its market presence and fee-based income through targeted acquisitions and partnerships, supporting fee income stability and customer engagement. These strategic moves, along with ongoing investments in digital capabilities, such as upgrades to the Avvance point-of-sale lending platform and the expansion of the Coinstar partnership, are expected to support loan growth, attract low-cost deposits and improve earnings durability.

The company’s asset quality and earnings outlook are further reinforced by a sound balance sheet position. As of Sept. 30, 2025, U.S. Bancorp carried $62.5 billion in long-term debt, while short-term borrowings remained modest at $15.4 billion. Cash and due from banks totaled $66.6 billion, providing ample liquidity and balance sheet flexibility. Together with portfolio repositioning efforts and reduced deposit migration, support stronger net interest income generation and enhance financial resilience.

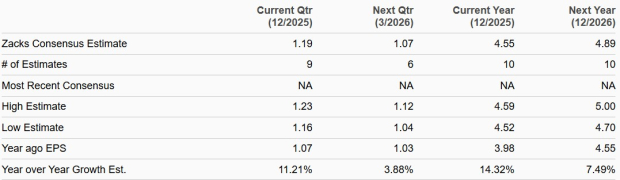

The Zacks Consensus Estimate for USB’s 2026 earnings stands at $4.89 per share, indicating a 7.5% increase from the prior year’s actual. It has a market capitalization of $85.5 billion.

Earnings Estimates

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 12 hours | |

| 13 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite