|

|

|

|

|||||

|

|

Zacks Rank #3 (Hold) stock Alphabet (GOOGL) is one of the most innovative companies in the modern technological age. Over the last few years, the company has evolved from primarily a search engine provider to cloud computing, ad-based video and music streaming, autonomous vehicles, healthcare and others. In the online search arena, Google has a monopoly accounting for roughly 90% of the online search volume and market share. Over the years, the company has witnessed an increase in search queries, resulting from ongoing growth in user adoption and usage, primarily on mobile devices, continued growth in advertiser activity, and improvements in ad formats.

AI Cannibalization Fears Overblown

Alphabet’s dominant search market share and expanding cloud footprint are key growth drivers for the company. Initially, Google’s AI efforts got off to a shaky start. For instance, in Google’s first version AI model named “Bard,” searches often were completely inaccurate. Meanwhile, it appeared that ChatGPT and other models were running away with the AI race. However, several iterations later, and Google’s Gemini 2.5 AI delivers some of the most rapid responses in the industry and is viewed as an industry standard. Meanwhile, investor fears about cannibalization of the search business are unfounded. In fact, Google’s unique hybrid AI search model has driven popularity among younger users. Gemini models are being rapidly embedded across Search, YouTube, Android, and Workspace, enhancing user experience and driving internal productivity (e.g., coding, customer service).

Google has constructed its own chips to power AI bots. Google's Tensor Processing Units (TPUs) are custom-designed Application-Specific Integrated Circuits (ASICs) built to dramatically accelerate machine learning (ML) tasks, especially large-scale training and inference for models like Google's Gemini, powering Search, Photos, and more, available via Google Cloud and functioning as a core component of Google’s AI Hypercompute system. A TPU board fits into the same slot as a hard drive on the massive hardware racks inside the data centers that power Google's online services, the company says, adding that its own chips provide "an order of magnitude better-optimized performance per watt for machine learning" than other hardware options. TPU is tailored to machine learning applications, allowing the chip to be more tolerant of reduced computational precision, which means it requires fewer transistors per operation."

Alphabet has been growing rapidly in the booming cloud-computing market. In third-quarter 2025, Google Cloud revenues increased 33.5% year over year to $15.16 billion. Google’s growing investments in infrastructure, security, data management, analytics, and AI are positive. Its strategic partnerships and acquisitions, along with the growing number of data centers are helping Google expand its cloud footprint worldwide. Alphabet is benefiting from its partnership with NVIDIA (NVDA) in the cloud. Google Cloud was the first cloud provider to offer NVIDIA’s B200 and GB200 Blackwell GPUs and will be offering its next-generation Vera Rubin GPUs. Introduction of 2.5 flash, Imagen 3, and Veo 2 are noteworthy developments. Google Cloud is becoming a preferred choice for enterprises planning to deploy AI agents thanks to the Agent Development Kit and the low-code Agent Designer tool.

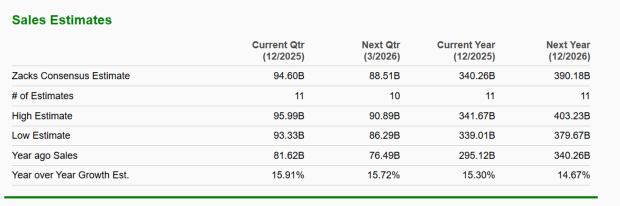

AI is improving ad targeting and effectiveness, making the core business more resilient and profitable even with AI challengers. Meanwhile, YouTube continues to perform exceptionally well, acting as another strong pillar for revenue growth (especially the short-form video side). Zacks’ Consensus estimate sees double-digit top-line growth for the full year 2026.

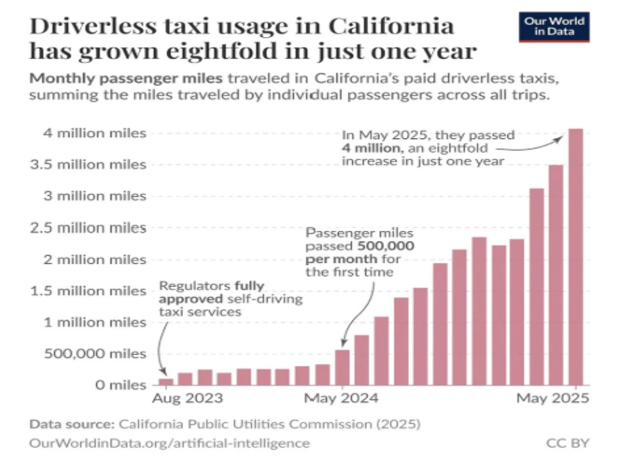

Waymo is completing over 450,000 paid robotaxi rides per week across its operating areas, including Phoenix, LA, SF, and Austin. Reports from late 2025 indicate significant volume, a substantial increase from earlier in the year, with goals to reach 1 million weekly rides by late 2026. While I believe Tesla (TSLA) is poised to win the robotaxi race due to its scale and costs, there will likely not be one winner-takes-all and Waymo will have a significant chunk.

Warren Buffett's Berkshire Hathaway recently made a significant surprise investment, buying a $4.3 billion stake in Google's parent company, Alphabet, during the third quarter of 2025, marking a major tech bet for the value investor, likely driven by Alphabet's strong market dominance in search, its lucrative ad network, and potential in AI, despite Buffett's usual tech hesitation.

Google consistently has among the lowest P/Es among the Mag 7 stocks. With a P/E of 30x EPS, it’s reasonably priced and unsurprising that Buffett wants a piece. Additionally, the company has about $100 billion in cash and only $20 billion in debt. The strong cash balance provides the flexibility required to pursue any growth strategy, whether through acquisitions or otherwise.

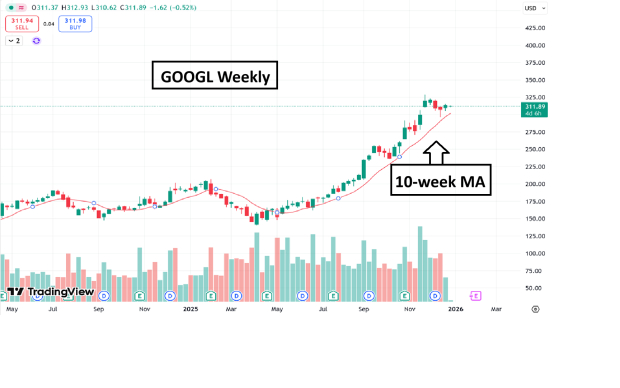

GOOGL shares have outperformed the general market indices and trended higher all year in a stair-stepping fashion. Investors can use the intermediate 10-week moving average as a trend guide.

Bottom Line

Alphabet remains one of the most strategically positioned companies in technology, combining dominant search economics, accelerating cloud momentum, and expanding AI-driven fundamentals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 min | |

| 7 min | |

| 31 min | |

| 35 min | |

| 39 min | |

| 40 min | |

| 47 min | |

| 50 min | |

| 51 min | |

| 56 min | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Stock Market Today: Dow Up 300 Points; Nvidia Jumps, Amer Sports Glows In New Breakout (Live Coverage)

NVDA

Investor's Business Daily

|

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite