|

|

|

|

|||||

|

|

Despite a decline in package volumes, FedEx Corporation’s FDX shares have outperformed the Zacks Transportation—Air Freight and Cargo industry. To offset the resulting pressure on revenues, the company implemented cost-cutting measures. Supported by these initiatives, FDX’s shares rose 2.7% in 2025, compared with declines of 11.3% for the industry and 21.3% for rival United Parcel Service UPS.

Given the stock’s better-than-expected performance on the back of the company’s ongoing cost-cutting initiatives aimed at boosting bottom-line growth, investors may be questioning whether FDX is a buy as we enter 2026. Let’s take a closer look to address this question.

Last month, FedEx reported better-than-expected revenues for the second quarter of fiscal 2026 (ended Nov. 30, 2025). Share repurchases boosted fiscal second-quarter earnings by 5 cents per share. Revenues improved on a year-over-year basis, mainly driven by the impressive performance of the Federal Express segment.

Apart from the better-than-expected results, FDX has raised its full-year fiscal 2026 guidance for revenues and earnings. For the full-year fiscal 2026, FedEx now expects revenue growth in the range of 5-6% on a year-over-year basis (prior view: up 4-6%).

Earnings per share are now anticipated between $14.80 and $16.00 before the MTM retirement plans accounting adjustments, compared with the prior guidance of $14.20-$16.00. EPS, after excluding costs related to business optimization initiatives, the planned spin-off of FedEx Freight, and the planned change in its fiscal year end, is now expected between $17.80 and $19.00 compared with the prior guided range of $17.20 to $19.00.

The better-than-expected bottom-line results in the second quarter of fiscal 2026 meant that FDX’s impressive earnings track record continued. The transportation company’s earnings beat the Zacks Consensus Estimate thrice in the last four quarters and missed the same on the other occasion. The average beat is 5.7%.

FedEx Corporation price-eps-surprise | FedEx Corporation Quote

In view of the top-line struggles as highlighted above, FDX is aggressively slashing expenses. FedEx is realigning its costs under a companywide initiative called DRIVE. Driven by the initiatives (that include reducing flight frequencies, parking aircraft and cutting staff), FDX reported a double-digit year-over-year increase in its fiscal second-quarter earnings.

The DRIVE program resulted in $1.8 billion in permanent savings in fiscal 2024. The program resulted in $2.2 billion in cost savings in fiscal 2025. For fiscal 2026, management expects to achieve $1 billion of transformation-related savings, which includes DRIVE and Network2.0.

FDX’s Freight division has been under pressure for an extended period and has weighed on its overall revenue performance. In the first half of fiscal 2026, segment revenues fell 2% year over year, as continued weakness in U.S. industrial production dampened demand across the less-than-truckload industry.

Amid this top-line softness, FDX recently announced plans to spin off its freight trucking unit into a standalone company. This move is intended to sharpen the company’s focus on its core delivery operations while supporting ongoing restructuring efforts. The transaction will result in two independently operated, publicly listed entities.

Following the separation, both companies will pursue their respective growth strategies while preserving the benefits of collaboration across key commercial, operational and technology initiatives. Customers of both businesses are expected to continue receiving the same high levels of service, speed and network coverage.

The spinoff is slated for completion on June 1, 2026. Upon completion, FedEx Freight will operate as an independently traded public company on the New York Stock Exchange under the ticker symbol FDXF. The separation is expected to enable FDX to unlock a premium valuation for its Freight business, comparable to the leading players in the less-than-truckload space.

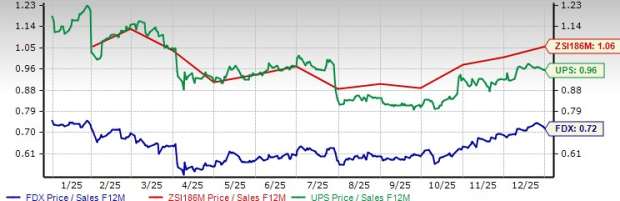

Going by the forward 12-month price/sales ratio, the company’s shares are currently trading at levels lower than its industry and rival United Parcel Service. FDX currently has a Value Score of A and United Parcel Service has a Value Score of B.

FDX's P/S F12M vs. the Industry & UPS

The company’s shareholder-friendly initiatives are noteworthy. In 2025, FDX increased its quarterly dividend by 5.1% to $1.45 per share, or $5.80 annually. The company has also been active on the share-repurchase front, buying back $3 billion worth of shares in fiscal 2025. In total, FDX returned $4.3 billion to shareholders through dividends and buybacks during fiscal 2025, surpassing its target of $3.8 billion.

While near-term challenges stemming from tariffs persist, it is important to recognize that FDX’s strong brand and extensive network position it to generate steady cash flows over the long term. Dividend-paying stocks like FDX are generally considered relatively safe wealth-creation vehicles, as regular payouts can help cushion investors against economic uncertainty. FDX’s multi-year deal with Amazon AMZN was signed in 2025. Per the agreement, FDX is responsible for delivering select large packages for Amazon. The deal comes soon after FDX’s rival, United Parcel Service, decided to lower its volumes with Amazon.

That said, the planned spin-off of FDX’s freight division is still about six months away, making any immediate impact on the stock unlikely. Moreover, visibility into the standalone financial profile of the new entity remains limited. Additional headwinds, including subdued shipping demand, further reinforce our view that buying this Zacks Rank #3 (Hold) stock at present is not advisable.

Investors should closely track the company’s developments to identify a more favorable entry point. Those who already hold the stock would be better served by remaining invested, a stance supported by the stock’s current Zacks Rank.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 33 min | |

| 1 hour | |

| 1 hour |

MercadoLibre Stock Climbs After Posting Mixed Q4 Results, Strong E-Commerce Growth

AMZN

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours |

Anthropic Shows Olive Branch At Enterprise Event. Software Stocks Gain.

AMZN

Investor's Business Daily

|

| 5 hours | |

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite