|

|

|

|

|||||

|

|

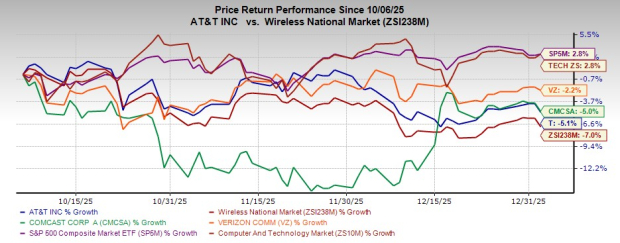

AT&T, Inc. T has declined 5.1% over the past three months compared to the Wireless National industry’s decrease of 7%. The stock has underperformed compared to the Zacks Computer & Technology sector and the S&P 500’s growth during this period.

The company has underperformed its peers like Verizon Communications Inc. VZ and Comcast Corporation CMCSA. Verizon has declined 2.2%, while Comcast has decreased 5% during this period.

The U.S. wireless market is highly saturated and intensely competitive. Intensifying competition with a relatively fixed pool of customers is making the market highly price sensitive. Telecom companies are opting for aggressive promotions to grab market share. Amid this backdrop, T has to constantly adjust its strategies to retain and expand its user base. The nature of the industry exposes the company to the risk associated with a high churn rate and high customer retention costs. Moreover, companies like Verizon and T-Mobile are rapidly expanding their 5G network. With a robust broadband infrastructure and continuous rollout of DOCSIS 4.0, Comcast is also emerging as a major competitor in the broadband domain.

Moreover, AT&T is aiming to focus on onboarding converged customers, i.e., users who will buy multiple AT&T services. The company may opt for an aggressive approach in terms of pricing, discounts and incentives for this strategy. Although these converged customers are expected to be stickier and offer better margins in the long term, in the short term, AT&T is set to see moderation in ARPU growth.

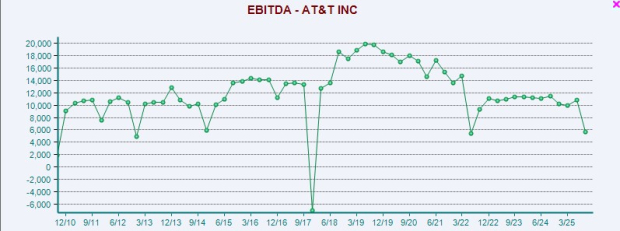

As of Sept. 30, 2025, AT&T had $20.27 billion of cash and cash equivalents with long-term debt of $128.09 billion compared with respective tallies of $10.5 billion and $123.06 billion in the previous quarter. This indicates that although its short-term liquidity has improved, its long-term debt burden has increased significantly.

The telecom industry is highly capital-intensive. It takes years for the company to realize any gains from the capex spending. AT&T has to constantly upgrade its network infrastructure to deliver consistent connectivity. Capex tied up with the company’s rapid fiber buildout, combined with a high debt burden, can impact its operating results.

AT&T expects to continue investing in key areas and adjust its business according to the evolving market scenario to fuel long-term growth. It anticipates gaining a competitive edge over rivals through edge computing services that allow businesses to route application-specific traffic. Through its Multi-access Edge Compute (MEC) solution, the company offers the flexibility to better manage the data traffic. The MEC leverages an indigenous software-defined network to enable low-latency, high-bandwidth applications for faster access to data processing. AT&T expects edge computing solutions to be widely available in autonomous vehicles, drones, robotic production lines and autonomous forklifts in the near future. This presents a solid growth opportunity for the company.

It boasts one of the largest 5G network infrastructures, connecting more than 310 million people across 26,100 cities and towns nationwide. The company’s 5G policy framework is based on three fundamental pillars: mobile 5G, fixed wireless and edge computing. Its 5G services utilize millimeter wave spectrum for deployment in dense urban pockets to match the high-capacity requirements. In suburban and rural areas, it deploys 5G on mid and low-band spectrum holdings.

Per a report from Grand View Research, the U.S. 5G services market is expected to witness a staggering 51.1% compound annual growth rate from 2025 to 2030. It is steadily expanding its 5G network infrastructure to capitalize on this trend. Recently, the company has installed mid-band spectrum from EchoStar around 23,000 cell sites. This has resulted in a substantial improvement in speed and capacity for customers in 5,300 cities across 48 states. The incorporation of the spectrum from Echo Star has improved download speed for mobility by 80%, while it has improved 55% for AT&T Internet Air users. The acquisition of EchoStar is a smart approach from AT&T, as it eliminates the requirement for capital-intensive construction of cell sites to boost network capacity.

It is also collaborating with AST SpaceMobile to expand into the emerging satellite connectivity space. T is activating its satellite gateways, which will act as a bridge between ASTS’ satellite and AT&T’s ground network infrastructure. By leveraging ASTS Satcom capabilities, T aims to address issues with dead spots and poor connectivity in rural and remote areas. Such initiatives are expected to bring long-term benefits.

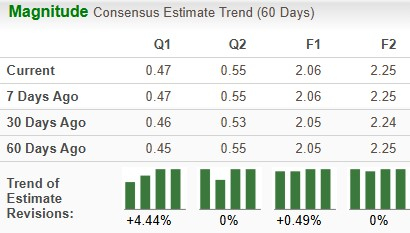

Earnings estimates for AT&T for 2025 have increased over the past 60 days. However, it has remained unchanged for 2026.

From a valuation standpoint, AT&T appears to be trading relatively cheaper compared to the industry and trading below its mean. Going by the price/earnings ratio, the company shares currently trade at 10.88 forward earnings, lower than 11.73 for the industry and the stock’s mean of 12.56.

AT&T’s strategy of constantly improving network infrastructure and enhancing 5G speed and capacity to support high-bandwidth intensive AI and cloud native applications will likely drive subscriber gains. Utilization of space-based connectivity infrastructure to improve services in rural areas is a positive factor. Focus on acquiring converged customers, expected to drive ARPU in the long run.

However, growing customer acquisition costs induced by a price-sensitive market and intense competition are impacting profitability. High debt burden makes it vulnerable to economic downturns. With a Zacks Rank #3 (Hold), AT&T appears to be treading in the middle of the road, and new investors could be better off if they trade with caution. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 15 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite