|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Kymera Therapeutics, Inc. KYMR has put up a stupendous performance over the past year. Shares of this clinical-stage biotechnology company have surged 82.4% over the said time frame compared with the industry’s gain of 17.3%. The stock has also outperformed the sector and the S&P 500 Index during this period.

The rally can be attributed to positive pipeline and regulatory updates for lead pipeline candidate KT-621.

Let’s examine KYMR’s fundamentals, growth potential, key challenges, and valuation to make an informed decision in this context.

Kymera is deploying targeted protein degradation (TPD) to develop drugs for critical health problems and it has advanced the first degrader into the clinic for immunological diseases.

KT-621 is an investigational, first-in-class, once daily, oral degrader of STAT6, the specific transcription factor responsible for IL-4/IL-13 signaling and the central driver of type 2 inflammation.

Last month, KYMR stock surged after the company announced positive data from the phase Ib BroADen study, which evaluated KT-621 for treating atopic dermatitis (AD), also known as eczema.

Data from the study showed that treatment with KT-621 led to deep STAT6 degradation in both the 100 mg and 200 mg doses, with median reductions of 94% in the skin and 98% in the blood, showing that the candidate’s effects in healthy volunteers translated well to AD patients.

Treatment with KT-621 also led to strong reductions in disease-relevant type 2 biomarkers in blood, including Thymus and Activation-Regulated Chemokine (TARC) – median reduction of 74% in patients with baseline TARC levels comparable to Sanofi’s SNY and Regeneron’s REGN Dupixent (dupilumab) studies on AD, Eotaxin-3, IL-31, IgE, and in core type 2 inflammation and AD disease-relevant gene sets in skin lesions.

KT-621 demonstrated strong clinical activity across all measured endpoints in the phase Ib BroADen study, including a mean 63% reduction in Eczema Area and Severity Index (EASI) and a mean 40% reduction in peak pruritus Numerical Rating Scale (“NRS”).

Treatment with KT-621 was generally safe and well-tolerated, with no serious adverse side effects observed.

The positive phase Ib BroADen results highlight KT-621’s potential as a first-in-class, once-daily oral therapy for type 2 inflammatory diseases. Its week-4 outcomes were comparable to—and in some cases exceeded—published data for SNY/REGN’s blockbuster drug, Dupixent, which is approved for several types of inflammatory diseases, including moderate-to-severe AD.

The FDA also granted Fast Track designation to pipeline candidate KT-621 for the treatment of moderate to severe AD.

A phase IIb study, BROADEN2, in moderate to severe AD patients on KT-621 is ongoing, with data expected to be released by mid-2027. Kymera also plans to initiate a phase IIb study, BREADTH, of KT-621 in asthma in the first quarter of 2026. These studies aim to speed KT-621’s development and determine optimal dosing for upcoming subsequent parallel phase III registration studies in several type 2 dermatology, gastroenterology and respiratory diseases.

In June 2025, Kymera entered into an exclusive option and license agreement with Gilead Sciences, Inc. GILD to accelerate the development and commercialization of a novel molecular glue degrader program targeting cyclin-dependent kinase 2 (CDK2) with broad oncology treatment potential in breast cancer and other solid tumors.

Kymera is advancing preclinical activities for its CDK2 molecular glue program aimed at treating breast cancer and solid tumors. If Gilead exercises its option, which includes an option payment to Kymera, it would assume all development, manufacturing and commercialization responsibilities for any products resulting from the collaboration.

Kymera also has a collaboration with Sanofi to advance its pipeline. However, in June 2025, Sanofi informed Kymera that it has selected KT-485/SAR447971, an oral, highly potent and selective development candidate targeting IRAK4 for immuno-inflammatory diseases, to advance into clinical studies.

The candidate was discovered by Kymera. KT-485 is being prioritized for development under the companies’ existing IRAK4 collaboration following extensive preclinical work supporting its robust development potential. The candidate is expected to advance into early-stage testing next year.

Consequently, Sanofi discontinued the development of KT-474, which was being evaluated for the treatment of hidradenitis suppurativa and AD in two phase IIb dose-ranging studies.

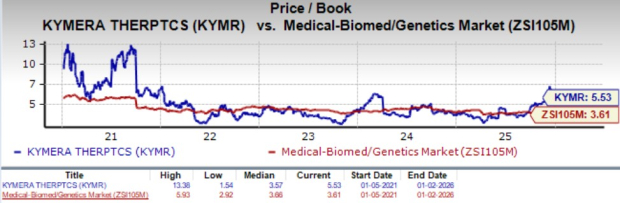

From a valuation perspective, KYMR is overvalued. Going by the price/book ratio, KYMR’s shares currently trade at 5.53X, higher than 3.61X for the biotech industry and the company’s mean of 3.57X.

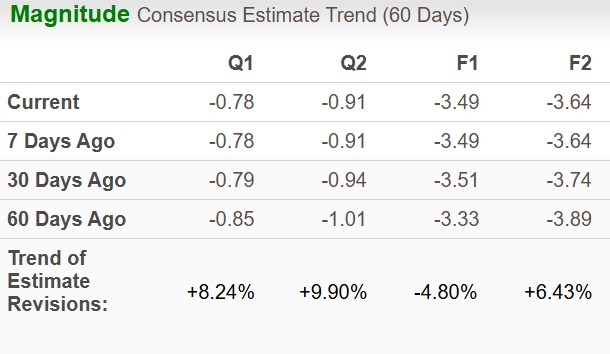

The Zacks Consensus Estimate for 2025 loss per share has widened over the past 60 days while that for 2026 loss has narrowed to $3.64 in the same time frame.

Kymera’s novel TPD approach is promising, and the pipeline progress is encouraging.

Additional positive pipeline updates on KT-621 will be a significant boost for the stock. Hence, we recommend existing investors to hold the stock for now.

However, prospective investors should wait for a better entry point. Although the oncology deal with GILD appears promising and the resulting influx of cash is encouraging, there is still a long way to go.

Sanofi's decision to advance preclinical IRAK4 degrader KT-485 rather than advancing KT-474 delayed milestone payments for Kymera that could have been achieved on the approval of KT-474, which had moved to phase IIb studies in late 2023.

KYMR currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 38 min | |

| 39 min | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite