|

|

|

|

|||||

|

|

Quantum Computing, Inc. QUBT, also known as QCi, delivered strong quarterly results in 2025, underscoring growing real-world adoption of its photonic and quantum computing systems.

According to Spinq, the quantum computing industry reached a critical inflection point in 2025, shifting from theoretical potential to tangible commercial progress. This transition has been driven by fundamental advances across hardware, software, and error correction, alongside the emergence of practical use cases that demonstrate measurable quantum advantage.

A convergence of increased investment capital, sustained government support, workforce development initiatives, and proven technical breakthroughs has fostered a robust ecosystem for commercial quantum computing. While significant challenges remain, the industry’s trajectory suggests that meaningful commercial applications could begin to materialize over the next five to 10 years in targeted areas, such as drug discovery, materials science, optimization and cryptography.

At the same time, QCi faces intensifying competition, with peers such as D-Wave Quantum QBTS and Rigetti Computing RGTI also reporting notable progress and accelerating growth initiatives.

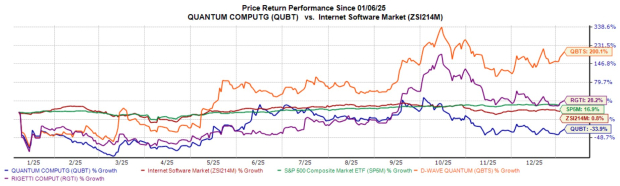

In the past year, QUBT stock has declined 33.9%, underperforming the broader industry’s 0.8% gain. The S&P 500 benchmark index has gained 16.9% during this period. The company has also underperformed other players, including QBTS, which rose 200.1%, and RGTI, which gained 28.2% during the same period.

Image Source: Zacks Investment Research

Growing Adoption Across Quantum Platforms

In 2025, QCi was awarded a subcontract by the National Aeronautics and Space Administration's ("NASA") Langley Research Center through to remove solar noise from space LIDAR data — a persistent challenge in achieving accurate daytime atmospheric sensing.

The company is deploying its DIRAC-3 quantum optimization machine to develop quantum-based methods for mitigating this problem. This collaboration reinforces QCi’s emergence as a trusted government partner and demonstrates the practical relevance of its quantum computing solutions in scientific and environmental research.

In addition, the company announced a purchase order from a top-five U.S. bank for its quantum security solutions — the first U.S. commercial sale of its quantum cybersecurity offerings — marking a key milestone in validating its platform for real-world use cases.

Leveraging M&A to Accelerate Quantum Commercialization

In 2025, QCi signed an agreement to acquire Luminar Semiconductor, Inc. or “LSI”, a wholly owned subsidiary of Luminar Technologies, in an all-cash transaction valued at $110 million, subject to customary adjustments. The acquisition adds a strong portfolio of core photonic technologies, patents and an experienced team of engineers and scientists, accelerating QCi’s product roadmap while supporting and expanding LSI’s existing customer base.

Earlier, in 2022, QCi completed its previously announced merger agreement to acquire QPhoton, Inc., a quantum photonics innovator that developed a quantum photonic system (QPS). This deal enabled QCi to deliver a ready-to-run, full-stack QPS designed for real-world business applications and accessible to non-quantum experts.

By combining QPhoton’s room-temperature, stable QPS with QCi’s Qatalyst software, which eliminates the need for complex quantum programming, QCi is broadening its addressable market and advancing its goal of democratizing quantum computing.

A Strong Cash Position Drives Momentum Ahead

In the third quarter, the balance sheet strengthened significantly, with total assets reaching $898.2 million, and cash and investments totaling $352 million and $461 million, respectively, supported by $1.25 billion in private placements. Liabilities declined to $20.3 million, boosting shareholder equity to $877.9 million.

For full-year 2026, QCi is expected to generate revenue growth of 284.3%. On the profitability front, earnings per share are expected to remain negative. Over the past 30 days, QCi’s loss per share estimate for 2026 has narrowed 1 cent to 18 cents.

Image Source: Zacks Investment Research

QCi is prioritizing long-term platform leadership over near-term revenues and investing in manufacturing infrastructure to support future scale. Fab 1 qualifies thin-film lithium niobate processes and enables early customer programs, while Fab 2 (planned over the next three year) targets high-volume chip production and large-scale commercialization by decade-end. This strategy positions QUBT as a unique U.S.-based integrated photonics foundry with broad cross-industry potential.

However, near-term revenue growth remains constrained, as Fab 1 lacks scale and Fab 2’s financial impact is back-end loaded. In the next three years, QCi plans to focus on small, customized deployments for a limited set of customers, including government agencies, financial institutions and early enterprise adopters.

While successful execution supports real-world validation and credibility, these deployments generally lack scale. Low unit volumes, lengthy sales cycles, and customization requirements limit repeatability and near-term revenue expansion.

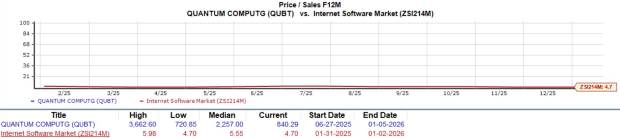

QCi stock is not so cheap, as suggested by the Value Score of F.

QUBT is currently trading at a 12-month forward price-to-sales (P/S) of 840.29X, which is higher than the industry average of 5.55X.

Image Source: Zacks Investment Research

QCi is entering a pivotal phase marked by rising real-world adoption, strategic acquisitions and a fortified balance sheet that supports long-term execution. Government and commercial wins validate the practicality of its quantum and photonic platforms. Yet, near-term revenue growth is constrained by a deliberate focus on infrastructure buildout and customized deployments.

QUBT, carrying a Zacks Rank #2 (Buy) at present, already trades at elevated levels. We advise those who have this stock in their portfolios to maintain their position, while others may wait for a more favorable entry point. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 |

Quantum Computing Stocks: IonQ Earnings, Revenue Beat Amid Acquisitions

QBTS +5.31%

Investor's Business Daily

|

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Quantum Computing Stocks: Will Earnings, 2026 Outlooks Reignite Momentum?

RGTI QBTS

Investor's Business Daily

|

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite