|

|

|

|

|||||

|

|

Investors are increasingly focused on the quantum computing market, which is projected to grow from $3.52 billion in 2025 to $20.20 billion by 2030, representing a robust CAGR of 41.8% over the forecast period (per MarketsandMarkets). The growth pattern of the market is marked by rapid advancements in hardware, increasing cloud-based accessibility, and rising investments from both private and public sectors.

Government agencies and regulatory bodies are playing a pivotal role, with initiatives such as the US National Quantum Initiative Act and the EU Quantum Flagship Program, as well as similar strategies in Asia, driving R&D funding, workforce development and industry collaboration. These efforts are accelerating commercialization and shaping the market's trajectory.

Quantum Computing Inc. QUBT or “QCi” and Rigetti Computing RGTI are two of the key players in the quantum computing market.

According to a report by Plain Concepts, despite remarkable advances, the quantum computing market still faces many technological hurdles that limit its applications, scalability, and reliability for the time being. Due to their fragility, qubit interconnection, decoherence, and external noise, quantum systems are prone to errors. Therefore, there is a need to improve fault-tolerant quantum structures, qubit coherence times and error correction methods.

In the past month, shares of QCi have surged 29.2% while those of Rigetti have skyrocketed 160.6%.

Image Source: Zacks Investment Research

Quantum Computing is an innovative quantum optics and integrated photonics company executing a phased manufacturing strategy through Fab 1 and Fab 2 to scale from early production to full commercialization. This approach positions QCi to improve margins and strengthen its competitive standing. Fab 1 is an operational thin-film lithium niobate (TFLN) photonics foundry in Tempe, AZ, which supports small-batch production for early customers across datacom, telecom, advanced sensing and quantum computing markets, while also supplying components for QCi’s proprietary systems. Meanwhile, Fab 2 is designed as a high-volume facility, planned over the next three years. These developments anchor QCi’s long-term manufacturing scale.

QCi reported third-quarter revenues of $384,000, driven by R&D and custom hardware contracts and initial DIRAC-3 cloud access revenues. The company is deploying its DIRAC-3 quantum optimization system to address solar noise in space-based LiDAR data, reinforcing its role as a trusted government partner. It also secured its first commercial sale of quantum cybersecurity solutions with a top-five U.S. bank, validating real-world adoption.

Financially, QCi significantly strengthened its balance sheet, raising $500 million in gross proceeds during the third quarter and an additional $750 million post-third quarter. At the end of the quarter, QCi reported cash and cash equivalents of $352 million, along with $461 million in investments, reflecting ample liquidity to support ongoing operations and expansion plans.

Rigetti Computing is a pioneer in full-stack quantum computing, integrating hardware and software to advance commercial quantum advantage. A core differentiator is its Fab-1 facility in Fremont, CA, the industry’s first dedicated superconducting-qubit manufacturing plant. This gives the company end-to-end control over design, fabrication and testing. Fab-1 is a strategic asset that shortens development cycles and supports faster deployment of systems, such as Ankaa and the Cepheus-1-36Q chiplet architecture. This in-house manufacturing capability positions Rigetti to innovate faster and capture more revenue opportunities as the market matures.

Rigetti reported total revenues of $1.9 million in the third quarter, driven by government contracts, cloud-based quantum services, research collaborations and component sales. Notable wins include a $5.48 million Air Force Office of Scientific Research award and a contract to deliver a 24-qubit Ankaa-class system to the UK’s National Quantum Computing Centre.

Financially, Rigetti exited third-quarter 2025 with cash, cash equivalents, and short-term available-for-sale investments of $446.9 million. Importantly, the company ended the quarter with no debt on its balance sheet, underscoring a solid solvency position. This balance sheet strength was further reinforced by a $350 million equity raise in 2025, which expanded cash reserves and signaled investor confidence in Rigetti’s long-term vision.

For 2025, the loss per share for QUBT is projected to be 15 cents compared with the year-ago loss of 73 cents per share. The loss per share estimates have narrowed 3 cents over the past 30 days.

Image Source: Zacks Investment Research

For 2025, RGTI’s loss per share is projected to be 68 cents compared with the prior-year loss of 36 cents. The loss per share estimates have remained stable over the past 30 days.

Image Source: Zacks Investment Research

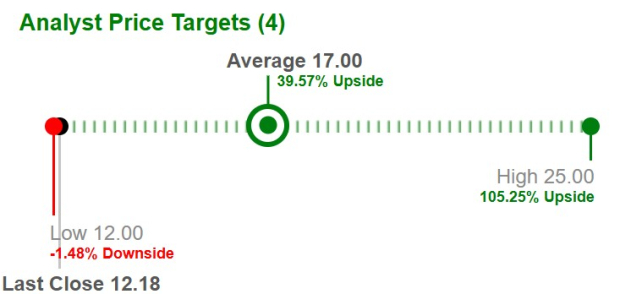

Based on short-term price targets from four analysts, the average price target for QCi is $17.00, representing a potential 39.6% upside from the last closing price.

Image Source: Zacks Investment Research

Based on short-term price targets by nine analysts, Rigetti’s average price target of $37.56 implies a 52.1% upside from the last close.

Image Source: Zacks Investment Research

Overall, QCi’s vertically integrated photonics manufacturing strategy, early commercial traction, and strong government and enterprise validation position it to scale effectively as quantum adoption advances. At the same time, Rigetti’s full-stack approach, differentiated in-house superconducting qubit fabrication, and expanding government and commercial engagements underscore its ability to innovate rapidly and capture long-term value.

Additionally, both companies’ robust balance sheets serve as key catalysts supporting their long-term growth outlook in the evolving quantum computing market.

From an investor’s perspective, both QCi, carrying a Zacks Rank #2 (Buy), and Rigetti, carrying a Zacks Rank #3 (Hold), may appeal to those willing to wait for longer-term execution. However, while Rigetti remains a high-potential quantum computing player with strong manufacturing capabilities and notable contract wins, its recent share price outperformance appears to have already priced in much of this optimism. Hence, we advise investors to wait for a more attractive entry point in RGTI, while recommending buying QCi at current levels, given its improving fundamentals and favorable Zacks Rank. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-07 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite