|

|

|

|

|||||

|

|

Pan American Silver Corp. PAAS and SSR Mining Inc.SSRM are well-known names in the silver mining space, sharing several key similarities that define their strategic positioning and investor appeal. Both PAAS and SSRM are gaining from record-high gold and silver prices.

Silver prices have skyrocketed roughly 207% year over year, with gold prices increasing around 75%, supported by strong safe-haven demand, geopolitical tensions and escalating trade conflicts. Silver has benefited from resilient industrial demand and mounting supply deficits. Demand for solar energy, electronics and electrification now accounts for more than half of global silver demand. Currently, silver is trading at a near record-high at $94 per ounce, backed by escalating tensions over Greenland, which bodes well for prices. Gold prices also surged to fresh highs near $4,900 per ounce yesterday on concerns over a fierce U.S.-EU trade war.

For investors seeking to capitalize on this momentum, the key question is: Which stock stands out, Pan American Silver or SSR Mining? Let us explore the fundamentals, growth drivers and potential headwinds facing both companies to find out.

Pan American Silver is a leading producer of silver and gold in the Americas, operating mines in Canada, Mexico, Peru, Brazil, Bolivia, Chile and Argentina. The company has 11 operating mines. It also owns the Escobal mine in Guatemala, which is currently not operating, and it holds interests in exploration and development projects.

The MAG Silver acquisition has positioned PAAS as one of the leading silver producers globally and significantly strengthened the company’s industry-leading silver reserve base. As part of the MAG Silver Corp. deal, Pan American Silver gained a 44% stake in the Juanicipio project, which has produced 2.5 million ounces of silver since its acquisition. The transaction also adds full ownership of the Larder exploration project and a full earn-in interest in the Deer Trail exploration project to PAAS’s portfolio.

The company recently announced the production of 22.8 million ounces of silver in 2025, up 8% from 2024. The consolidated silver production came within PAAS's expected 22-25 million ounces for the year. Pan American Silver’s fourth-quarter silver output was a record 7.3 million ounces, driven by the addition of the Juanicipio mine.

The company produced 742.2 thousand ounces of gold in 2025, which came within its expectations. Gold production in 2025 decreased 17% year over year, reflecting the loss of contribution from the La Arena mine and Dolores. The fourth-quarter gold production was 197.8 thousand ounces.

As of Dec. 31, 2025, the company had cash and short-term investments of $1.32 billion. This marked a rise from $408 million held on Sept. 30, 2025. This amount excludes an additional $127 million of cash attributable to PAAS’ 44% investment in Juanicipio. At the end of 2025, Pan American Silver had a total available liquidity of $2.07 billion.

For 2026, the company expects silver production between 25 million and 27 million ounces, indicating an increase of 14% at the mid-point. However, gold production is guided between 700 thousand and 750 thousand ounces, indicating a year-over-year dip of 2% at the mid-point.

SSR Mining has its assets located in four jurisdictions — the United States, Turkey, Canada and Argentina. In March 2025, SSR Mining closed the acquisition of the Cripple Creek & Victor (CC&V) mine, which positions it as the third-largest gold producer in the United States.

This open-pit mine is expected to produce 170,000 ounces of gold annually. The deal is expected to be accretive across all key per-share metrics — net asset value, gold production, mineral reserves and free cash flow — strengthening the company’s overall investment appeal and strategic flexibility. The mine has a projected 12-year mine life, with 26 years of total production based on 2.8 million ounces of gold mineral reserves.

SSRM’s total gold production is expected to be in the lower half of 410,000-480,000 gold-equivalent ounces for 2025 (including output from Seabee, Marigold and CC&V). The company had produced 399,267 gold equivalent ounces in 2024.

Operations at the Çöpler mine in Turkey remain suspended following the heap leach failure on Feb. 13, 2024. The company is recording care and maintenance expense, which represents depreciation and direct costs not associated with the environmental reclamation and remediation costs.

SSRM is working with authorities to restart the mine, but no timeline or conditions for resumption have yet been determined. The company expects reclamation and remediation costs of $250-$300 million for 2025.

As of Sept. 30, 2025, SSR Mining had a cash and cash equivalent balance of $409 million, and available liquidity of $909.3 million. Its debt-to-capital ratio stood at 0.08 at the end of the third quarter. The company continues to advance exploration and development activities across its portfolio in the quarter as it targets potential high-return, low capital intensity mine life extension opportunities at Marigold, Seabee and Puna.

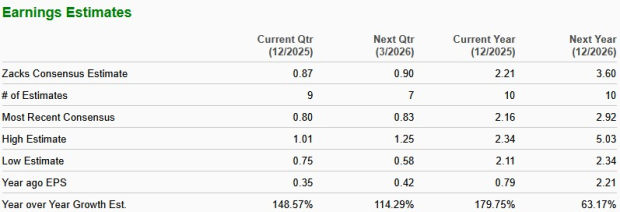

The Zacks Consensus Estimate for Pan American Silver’s 2025 earnings is pegged at 2.21 per share, indicating a year-over-year upsurge of 179.7%. Earnings estimates of $3.60 for 2026 imply a 63.2% rise. The estimates have been trending north over the past 60 days.

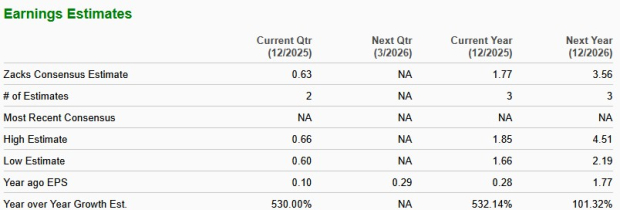

The Zacks Consensus Estimate for SSRM’s earnings for 2025 is pegged at $1.77 per share, indicating a year-over-year jump of a whopping 532.1%. The 2026 estimate of $3.56 implies growth of 101.3%. The 2026 estimates have been trending north over the past 60 days.

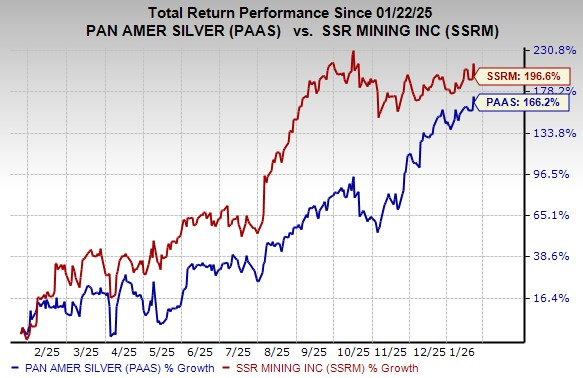

In the past year, the PAAS stock has soared 166.2% and SSRM has climbed 196.6%.

PAAS is currently trading at a forward 12-month earnings multiple of 15.76X, lower than its five-year median. SSRM is currently trading at a forward 12-month earnings multiple of 6.53X, lower than its five-year median.

Pan American Silver and SSR Mining are poised to benefit from the current surge in silver and gold prices, as well as higher production expectations and their expansion efforts, both organic and through acquisitions. SSR Mining has delivered a stronger price performance compared with PAAS. SSR Mining also has a more attractive valuation, which gives it the edge over Pan American Silver.

Both companies have a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 14 hours | |

| 21 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Mining Stocks Face Big Expectations Ahead Of Earnings, As Gold And Silver Sink

SSRM -7.83% PAAS

Investor's Business Daily

|

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite