|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Merck MRK and AbbVie ABBV are leading pharmaceutical players with entrenched franchises in oncology and immunology. Beyond these core areas, AbbVie has built a presence in aesthetics, neuroscience and eye care, while Merck maintains a more diversified portfolio spanning vaccines, neuroscience, diabetes, virology and animal health.

Oncology accounts for more than 60% of Merck’s overall revenues, with its flagship cancer therapy Keytruda generating roughly half of its pharmaceutical sales. At AbbVie, immunology remains the largest revenue driver, anchored by blockbuster treatments such as Humira, Skyrizi and Rinvoq, which collectively contribute about half of total sales.

Both companies are delivering steady revenue and earnings growth and boast robust late-stage pipelines. The key question for investors, however, is which stock presents the more attractive opportunity—an answer that requires a closer look at their fundamentals, growth prospects and risk profiles.

AbbVie has successfully navigated the loss of exclusivity (“LOE”) of its blockbuster drug, Humira, which once generated more than 50% of its total revenues. It has accomplished this by launching two other successful new immunology medicines, Skyrizi and Rinvoq, which are performing extremely well, bolstered by approvals in new indications, and should support top-line growth in the next few years.

Skyrizi and Rinvoq generated combined sales of $18.5 billion in the first nine months of 2025. Skyrizi sales are now annualizing at almost $18 billion and Rinvoq at more than $8 billion. AbbVie expects to outperform its target of combined sales of Skyrizi and Rinvoq of more than $25 billion in 2025 and more than $31 billion by 2027. AbbVie recently settled patent litigation with all generic manufacturers for Rinvoq, which extended the drug’s patent exclusivity by four years to 2037.

AbbVie’s oncology and neuroscience drugs are also contributing to top-line growth. AbbVie’s oncology segment generated combined revenues of $5.0 billion in the first nine months of 2025, up 2.7% year over year as higher sales of Venclexta and contributions from new drugs, Elahere and Epkinly, more than offset the decline in Imbruvica sales. Sales of its neuroscience drugs increased 20.3% to almost $7.8 billion in the first nine months of 2025, driven by higher sales of Botox Therapeutic, depression drug Vraylar and newer migraine drugs, Ubrelvy and Qulipta.

AbbVie has been on an inorganic growth track over the past couple of years to bolster its early-stage pipeline, which should drive long-term growth. Particularly, it is signing several M&A deals in the immunology space, its core area, while also entering into some early-stage alliances in oncology and neuroscience. AbbVie has executed more than 30 M&A transactions since the beginning of 2024.

However, the company faces some near-term headwinds like Humira’s biosimilar erosion, increasing competitive pressure on cancer drug Imbruvica and decreasing sales of the Aesthetics unit. AbbVie’s global sales of its aesthetics portfolio declined 7.4% in the first nine months of 2025.

Continued macro challenges and low consumer sentiment, especially in the United States, with concerns about the economy and inflation weighing on discretionary spending, are hurting aesthetics sales.

Merck boasts more than six blockbuster drugs in its portfolio, with Keytruda being the key top-line driver. Keytruda has played an instrumental role in driving Merck’s steady revenue growth in the past few years. The drug recorded sales of $23.3 billion in the first nine months of 2025, up 8% year over year. Keytruda’s sales have been gaining from rapid uptake across earlier-stage indications, mainly early-stage non-small cell lung cancer. Though Keytruda will lose patent exclusivity in 2028, its sales are expected to remain strong until then.

Merck’s subcutaneous formulation of Keytruda, known as Keytruda Qlex, was approved by the FDA in September 2025. Keytruda Qlex can offer substantially quicker administration time than the intravenous infusion of Keytruda.

Merck’s other oncology drugs, Welireg, AstraZeneca-partnered Lynparza and Eisai-partnered Lenvima, are also contributing to top-line growth.

MRK’s phase III pipeline has almost tripled since 2021, supported by in-house pipeline progress as well as the addition of candidates through M&A deals. This has positioned Merck to launch around 20 new vaccines and drugs over the next few years, with many having blockbuster potential. These include Merck’s new 21-valent pneumococcal conjugate vaccine, Capvaxive and pulmonary arterial hypertension drug, Winrevair, which are already launched and have the potential to generate significant revenues over the long term. Both products have witnessed a strong launch.

Merck has been on an acquisition spree in the past year, as it faces the looming patent expiration of Keytruda in 2028. Earlier this month, it closed the previously announced acquisition of Cidara Therapeutics for $9.2 billion. The acquisition added CDTX’s lead pipeline candidate, CD388, a first-in-class long-acting, strain-agnostic antiviral agent, currently being evaluated in late-stage studies for the prevention of seasonal influenza in individuals at higher risk of complications.

Last year, it also acquired Verona Pharma for around $10 billion, which added the latter’s lead drug Ohtuvayre, a novel, first-in-class maintenance treatment for chronic obstructive pulmonary disease, with multibillion-dollar commercial potential. Ohtuvayre's commercial launch is off to a solid start.

Merck’s Animal Health business is also a key contributor to its top-line growth, as the company is recording above-market growth.

However, sales of Gardasil, Merck’s second-largest product, are declining due to weak performance in China, resulting from sluggish demand trends amid an economic slowdown. Sales of some other Merck vaccines, like Proquad, M-M-R II, Varivax, Rotateq and Pneumovax 23, also declined in 2025. Merck is also seeing weakness in the diabetes franchise and the generic erosion of some drugs.

Merck is heavily reliant on Keytruda. There are rising concerns about the firm’s ability to grow its non-oncology business ahead of the upcoming loss of exclusivity of Keytruda in 2028.

Also, competitive pressure might increase for Keytruda in the near future from dual PD-1/VEGF inhibitors like Summit Therapeutics’ ivonescimab that inhibit both the PD-1 pathway and the VEGF pathway at once. They are designed to overcome the limitations of single-target therapies like Keytruda.

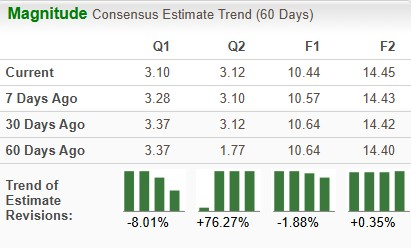

The Zacks Consensus Estimate for ABBV’s 2026 sales and EPS implies a year-over-year increase of 10.2% and 38.4%, respectively. EPS estimates for 2026 have risen over the past 60 days.

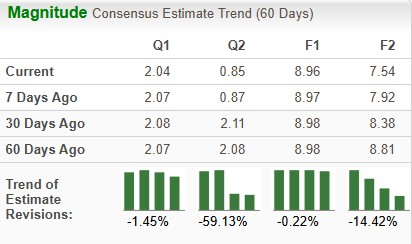

The Zacks Consensus Estimate for Merck’s 2026 sales and EPS implies a year-over-year increase of 3.7% and a decrease of 15.9%, respectively. Estimates for MRK’s 2026 earnings have declined from $8.81 per share to $7.54 per share over the past 60 days. This was probably due to costs related to Merck’s various M&A deals, like the Verona acquisition, which was closed in October, and the Cidara Therapeutics acquisition, which was closed this month.

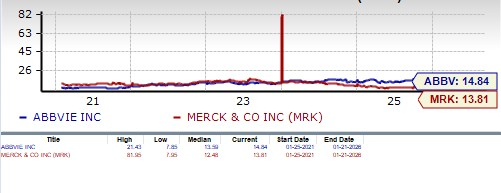

In the past year, AbbVie’s stock has risen 26.6%, and Merck’s stock has risen 15% compared with the industry’s increase of 21.1%.

ABBV is more expensive than MRK, going by the price/earnings ratio. AbbVie’s shares currently trade at 14.84 forward earnings, higher than 13.81 for Merck. AbbVie and Merck are both priced lower than 17.75 for the industry.

Both Merck and AbbVie are cheaper than other large drugmakers like Eli Lilly LLY, AstraZeneca and J&J JNJ.

AbbVie’s dividend yield of 3.06% is lower than MRK’s 3.2%.

AbbVie has a Zacks Rank #3 (Hold), while Merck has a Zacks Rank #4 (Sell), which clearly makes AbbVie the winner.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Merck faces several near-term challenges, including persistent challenges for Gardasil in China, potential competition for Keytruda and rising competitive and generic pressure on some of its drugs. All these factors have raised doubts about Merck’s ability to navigate the Keytruda LOE period successfully. Also, estimates have declined recently due to costs related to its various M&A deals.

On the other hand, AbbVie has faced its biggest challenge — Humira’s patent cliff — quite well and looks well-positioned for continued strong growth in the years ahead. AbbVie returned to robust revenue growth in 2025, which is just the second year following the U.S. Humira LOE, driven by its ex-Humira platform.

Sales of AbbVie’s ex-Humira drugs rose more than 20% (on a reported basis) in the third quarter, which was above its expectations, driven by Skyrizi, Rinvoq and neuroscience.

Boosted by its new product launches, AbbVie had expected to return to mid-single-digit revenue growth in 2025 with a high single-digit CAGR through 2029, as it has no significant LOE events for the rest of this decade. As a result, AbbVie enjoys the flexibility to invest more in R&D to continue to acquire external innovation.

Despite its steeper valuation, AbbVie is a clear-cut winner due to rising estimates, stock price appreciation, a solid pipeline and expectations for continued strong earnings growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite