|

|

|

|

|||||

|

|

Intuitive Surgical ISRG reported fourth-quarter 2025 adjusted earnings per share (EPS) of $2.53, which beat the Zacks Consensus Estimate of $2.25 by 12.4%. The bottom line improved 14.5% year over year.

GAAP EPS in the quarter was $2.21, up 17.6% from the year-ago quarter’s level.

This Zacks Rank #3 (Hold) company reported revenues of $2.87 billion, up 19.1% year over year, as well as at constant currency (cc). A higher number of installed systems and growth in the da Vinci procedure volume contributed to the improvement. The top line beat the Zacks Consensus Estimate by 4.7%.

Instruments & Accessories

Revenues from this segment totaled $1.66 billion, indicating a year-over-year improvement of 17.5%. This can be attributed to the da Vinci procedure’s 17% volume growth. The sales growth also reflects approximately 44% growth in Ion procedures and 78% for the SP platform. The top-line improvement was also aided by higher system utilization, partially offset by a lower mix of bariatric procedures and a higher mix of cholecystectomy procedures.

Systems

This segment’s revenues totaled $785.9 million, up 20.1% year over year. The robust growth was driven by a higher system placement and a rise in average selling price. Intuitive Surgical shipped 532 da Vinci Surgical Systems compared with 493 in the prior-year quarter. The company placed 304 systems in the United States and 228 in international markets. During the fourth quarter, ISRG placed 303 of its latest da Vinci 5 (dV5) systems compared with 174 during the fourth quarter of 2024.

Services

Revenues from this segment amounted to $422 million, up 21.5% from the year-ago quarter’s level.

Intuitive Surgical, Inc. price-consensus-eps-surprise-chart | Intuitive Surgical, Inc. Quote

Adjusted gross profit was $1.94 billion, up 15.7% year over year. As a percentage of revenues, the gross margin was 67.6%, down approximately 210 bps from the prior-year quarter’s figure.

Selling, general and administrative expenses totaled $687.1 million, up 12.2% year over year.

Research and development expenses totaled $352.9 million, up 19.7% on a year-over-year basis.

Adjusted operating income totaled $1.1 billion, up 15.4% year over year. As a percentage of revenues, the operating margin was 38.3%, down approximately 10 bps from the prior-year quarter’s figure.

Intuitive Surgical exited the fourth quarter with cash, cash equivalents and investments of $9.03 billion compared with $8.43 billion in the previous quarter.

ISRG ended the fourth quarter on a strong note, with earnings and revenues beating the Zacks Consensus Estimate. Following this robust quarterly performance, the stock was up 2.4% during after-hours trading on Jan. 22.

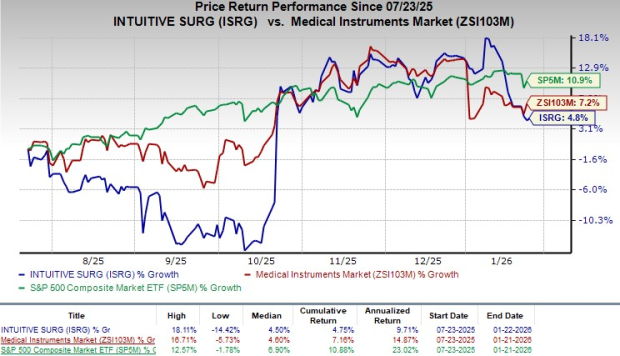

Shares of Intuitive Surgical have gained 4.8% in the last six-month period compared with the industry’s 7.2% growth. The S&P 500 Index has increased 10.9% during the same time frame.

The dV5 platform saw accelerating adoption through 2025 as Intuitive Surgical scaled manufacturing, expanded feature releases, and broadened regulatory clearances. For the full year, the company placed 870 da Vinci 5 systems, including 303 placements in the fourth quarter, with 43 systems placed outside the United States, including launches in Europe and Japan. Customer feedback highlighted higher utilization versus Xi, driven by improved efficiency, enhanced visualization and early adoption of digital capabilities such as Telepresence and Case Insights. Trade-in activity rose meaningfully, with 146 trade-in transactions in the fourth quarter, reflecting a growing upgrade cycle as U.S. customers transitioned to dV5 and redeployed Xi systems across sites of care.

Global da Vinci procedure volume increased approximately 18% in 2025, with U.S. procedures up 15% and international procedures rising 23%. In the fourth quarter, total procedures grew 18%, supported by strong U.S. general surgery demand and broad-based growth across international markets. Outside the United States, procedure growth was driven by strength in Europe, Asia, and distributor markets, with notable momentum in countries including India, Korea, Taiwan, and Canada. Benign general surgery procedures, particularly cholecystectomy and hernia repair, were key contributors internationally, while U.S. growth benefited from increased after-hours utilization, a proxy for acute care adoption.

Utilization trends strengthened across the portfolio. In the fourth quarter, average da Vinci utilization increased 4% globally, reflecting higher efficiency from dV5 adoption. The single-port (SP) platform continued to scale rapidly, with SP procedures up 78% in the fourth quarter and 87% for the full year, supported by strong growth in Korea. The Ion procedures increased 51% globally in 2025 and 44% in the fourth quarter, as Intuitive Surgical prioritized utilization expansion across its nearly 1,000-system installed base. These trends underscore sustained demand across multiple platforms and clinical applications.

Looking ahead, Intuitive Surgical guided to 2026 da Vinci procedure growth of 13%–15%, reflecting continued U.S. general surgery expansion, international adoption outside urology and incremental contributions from SP and Ion. Pro forma gross margin is expected to remain stable in the 67%–68% range, while operating expenses are projected to grow 11%–15% as the company invests in early-stage R&D, digital capabilities, and distributor transitions. Management emphasized continued focus on scaling dV5 globally, expanding utilization across care settings, including ASCs, and advancing its digital and AI-enabled ecosystem to drive long-term clinical and economic value.

Some better-ranked stocks in the broader medical space are IDEXX Laboratories IDXX, Boston Scientific BSX and STERIS STE. Each stock presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for IDEXX’s 2025 earnings per share (EPS) have remained constant at $12.93 in the past 30 days. Shares of the company have risen 12.6% in the past year compared with the industry’s 11.1% growth. IDXX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.1%. In the last reported quarter, it delivered an earnings surprise of 8.3%.

Boston Scientific shares have gained 2.9% in the past year. Estimates for the company’s 2025 EPS have remained constant at $3.04 in the past 30 days. BSX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.4%. In the last reported quarter, it posted an earnings surprise of 5.6%.

STERIS shares have risen 9.1% in the past year. Estimates for the company’s 2025 EPS have increased by 2 cents to $10.23 in the past 30 days. STE’s earnings topped estimates in three of the trailing four quarters and matched on one occasion, delivering an average surprise of 2.6%. In the last reported quarter, it posted an earnings surprise of 2.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite