|

|

|

|

|||||

|

|

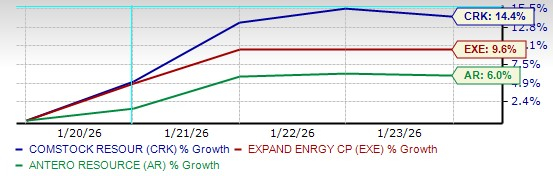

U.S. natural gas prices posted one of the most dramatic weekly surges in decades as winter risks abruptly returned to the forefront. A sudden shift in weather forecasts forced traders to reprice heating demand, sending Henry Hub futures sharply higher and reigniting investor interest across the natural gas complex. At this time, investors may want to keep an eye on gas-focused names such as Expand Energy EXE, Comstock Resources CRK and Antero Resources AR, which have already started to reflect the renewed momentum in prices.

Natural gas futures surged throughout the week, climbing from near $3 per million British thermal units (MMBtu) to settle around $5.27 per MMBtu by Friday. The rally represented a weekly gain of roughly 70%, marking the strongest advance in more than three decades. Prices pushed to multi-year highs as forecasts turned sharply colder across most of the United States, driving expectations for a spike in heating demand. Any extension of cold conditions could keep pressure on supply-demand balances, while even small forecast changes may trigger sharp price reactions.

The powerful move was driven by a classic winter squeeze. Winter Storm Fern and a broader Arctic blast raised heating and power demand while simultaneously increasing the risk of production freeze-offs. Wells, pipelines and processing equipment across key producing regions faced disruption, tightening supply just as consumption was set to surge.

U.S. storage levels provided only limited reassurance. The latest Energy Information Administration report showed a 120 billion cubic feet withdrawal, leaving inventories modestly above the five-year average. While this buffer helps, it does not fully protect the market from prolonged or severe cold.

Despite the volatility, recent price action has reset expectations for natural gas. Strong winter demand, rising awareness of supply risks and tighter near-term balances have improved the outlook for producers with direct exposure to gas prices. Gas-focused equities reflected this shift last week, with several names posting solid gains as sentiment turned more constructive.

For investors, the rally highlights how quickly fundamentals can change in the natural gas market. While price swings are likely to remain intense, the mix of weather-driven demand and supply sensitivity creates renewed opportunity. In that context, Expand Energy, Comstock Resources and Antero Resources each gained between the mid-single digits and low teens last week and remain worth watching if prices stay elevated.

Expand Energy: Expand Energy has solidified itself as the largest natural gas producer in the United States, following the Chesapeake-Southwestern merger. With key assets in the Haynesville and Marcellus basins, Zacks Rank #3 (Hold) EXE is well-positioned to capitalize on the increasing demand for natural gas, driven by LNG exports, AI/data centers, EV expansion and broader electrification trends. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Expand Energy’s 2026 earnings per share indicates a 31% year-over-year surge. The firm has a trailing four-quarter earnings surprise of roughly 4.9%, on average.

Comstock Resources: It is an independent natural gas producer based in Frisco, TX, with operations concentrated in north Louisiana and East Texas. Comstock Resources — currently carrying a Zacks Rank of 3 — is fully focused on developing the Haynesville and Bossier shales, two of the largest gas plays in the United States.

CRK holds a large acreage position across the Haynesville, giving it direct exposure to Gulf Coast LNG demand growth. Its production is 100% natural gas, making it one of the most gas-levered E&Ps in the sector. The Zacks Consensus Estimate for Comstock Resources’ 2026 earnings per share indicates a 32.6% year-over-year surge. The firm has a trailing four-quarter earnings surprise of roughly 220.5%, on average.

Antero Resources: It is an independent energy producer focused on natural gas and liquids in the Appalachian Basin. Headquartered in Denver, this Zacks #3 Ranked company develops low-cost assets in the Marcellus and Utica shales, holding about 515,000 net acres. Antero Resources’ production mix is weighted toward natural gas and NGLs, with minimal oil exposure. AR is also one of the largest U.S. suppliers of natural gas and LPG to export markets.

Antero Resources is supported by its midstream affiliate, Antero Midstream, in which it owns roughly 29%. This integrated setup secures transportation and market access from Appalachia to the Gulf Coast. A low debt profile and steady drilling results provide flexibility and support long-term growth. The Zacks Consensus Estimate for Antero Resources’ 2026 earnings per share indicates an 87% year-over-year surge.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-04 | |

| Mar-04 | |

| Mar-03 | |

| Mar-03 | |

| Mar-02 | |

| Feb-28 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite