|

|

|

|

|||||

|

|

Ralph Lauren Corporation RL is set to report third-quarter fiscal 2026 results on Feb. 5, before market open. The Zacks Consensus Estimate for revenues is pegged at $2.3 billion, which indicates growth of 7.9% from the year-ago quarter’s reported figure.

The consensus estimate for earnings is pegged at $5.78 per share, which suggests growth of 19.9% from the year-earlier actual. The consensus mark for earnings has increased 0.3% in the past seven days.

In the last reported quarter, the company’s bottom line surpassed the Zacks Consensus Estimate by 9.9%. Ralph Lauren has a trailing four-quarter earnings surprise of 9.8%, on average.

Ralph Lauren’s quarterly performance is likely to have benefited from a strong brand presence, a diverse product portfolio and expanding e-commerce capabilities, which have been strengthening its market position. The company's growing store footprint, coupled with its focus on innovation and integration of AI technology, reflects its commitment to staying ahead in the evolving fashion industry and achieving sustained growth.

RL has been experiencing growth in its digital and omnichannel business through investments in mobile, omnichannel and fulfillment. Digital transformation drives growth, with investments in personalization, mobile, omnichannel and fulfillment enhancing consumer engagement. The company has been adding consumers to its direct-to-consumer business, highlighting the effectiveness of its strategies and the strong appeal of its products, which is expected to have aided the fiscal third-quarter performance. Such positives are anticipated to be reflected in its top and bottom-line results.

Retail and wholesale have been the key pillars, with flagship stores, premium distribution and partnerships expected to have boosted comparable sales across North America, Europe and Asia in third-quarter fiscal 2026.

On the last reported quarter’s earnings call, management was optimistic about its continued brand momentum and outperformance across all regions and channels in the first half of the year.

For the fiscal third quarter, management anticipated revenue growth in the mid-single digits on a constant-currency basis, with foreign currency expected to contribute an additional 150-200 basis points (bps). The operating margin for the quarter is forecast to expand 60-80 bps in constant currency, primarily driven by operating expense leverage. Foreign currency is also expected to benefit the gross and operating margins by 10 and 20 bps, respectively.

Ralph Lauren Corporation price-eps-surprise | Ralph Lauren Corporation Quote

However, Ralph Lauren has been facing rising selling costs, with supply-chain disruptions, inflation, tariffs and market volatility, which have created near-term headwinds, exposing Ralph Lauren to potential inefficiencies and limiting flexibility for growth initiatives.

Ralph Lauren is grappling with elevated operating expenses, which are compressing margins and limiting profitability despite steady revenue growth. Investments in brand activations, technology, digital acceleration and store expansion have been resulting in elevated operating expenses. While these investments support brand engagement, the higher cost structure could pressure profitability in the to-be-reported quarter.

Additionally, tariffs, inflationary pressures, supply-chain challenges and currency fluctuations remain key variables that could affect RL’s results in the to-be-reported quarter. The company had earlier predicted the performance to be first-half weighted, supported by strong early execution and planned wholesale timing shifts. However, the company remains cautious about the second half, highlighting rising tariff headwinds, most severe in the fiscal fourth quarter, and potential U.S. consumer pressure, which together may hurt demand and create margin challenges.

Our proven model conclusively predicts an earnings beat for Ralph Lauren this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is exactly the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Ralph Lauren currently has an Earnings ESP of +0.53% and a Zacks Rank of 2.

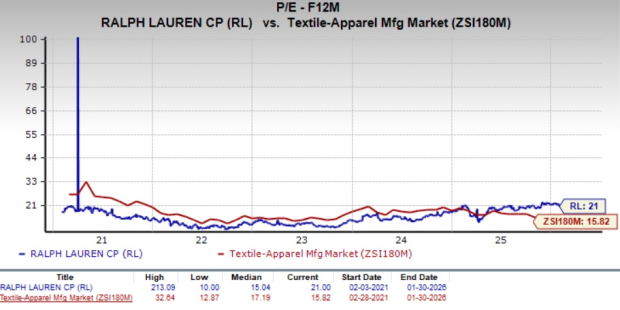

Ralph Lauren's stock is trading at a premium valuation relative to the industry. Going by the price-to-earnings ratio, the stock is currently trading at 21X on a forward 12-month basis, higher than its five-year median of 15.04X and the Textile - Apparel industry’s 15.82X.

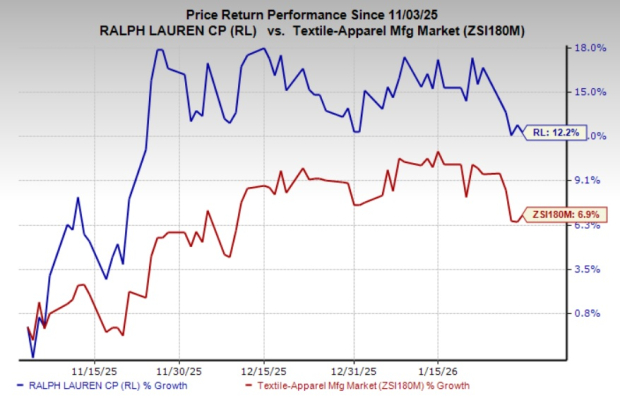

The recent market movements show that RL shares have risen 12.2% in the past three months compared with the industry's 6.9% growth.

Here are some other companies that, according to our model, also have the right combination of elements to beat on earnings this reporting cycle.

Under Armour UAA has an Earnings ESP of +68.75% and flaunts a Zacks Rank of 1 at present. UAA is likely to register top and bottom-line declines when it releases third-quarter fiscal 2026 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $1.3 billion, which implies a decline of 5.9% from the figure reported in the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for UAA’s bottom-line has been unchanged in the past 30 days at a loss of 2 cents per share, suggesting a decline from earnings of 8 cents reported in the year-ago quarter. Under Armour delivered an earnings surprise of 44.5%, on average, in the trailing four quarters.

Savers Value Village, Inc. SVV currently has an Earnings ESP of +1.08% and a Zacks Rank of 3. SVV is likely to register top and bottom-line growth when it reports fourth-quarter 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $464.7 million, indicating 15.6% growth from the figure reported in the prior-year quarter.

The consensus estimate for SVV’s earnings is pegged at 16 cents per share, implying a 60% surge from the year-ago quarter’s actual. The consensus mark for earnings has been unchanged in the past 30 days. Savers Value delivered an earnings surprise of 25%, on average, in the trailing four quarters.

Cintas CTAS has an Earnings ESP of +0.07% and a Zacks Rank of 3 at present. CTAS is likely to register top and bottom-line growth when it releases third-quarter fiscal 2026 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $2.8 billion, which implies a rise of 7.7% from the figure reported in the year-ago quarter.

The consensus estimate for Cintas’ quarterly earnings has been unchanged in the past 30 days at $1.23 per share, implying growth of 8.9% from the year-ago quarter’s reported number. CTAS delivered an earnings surprise of 3%, on average, in the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| 11 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite