|

|

|

|

|||||

|

|

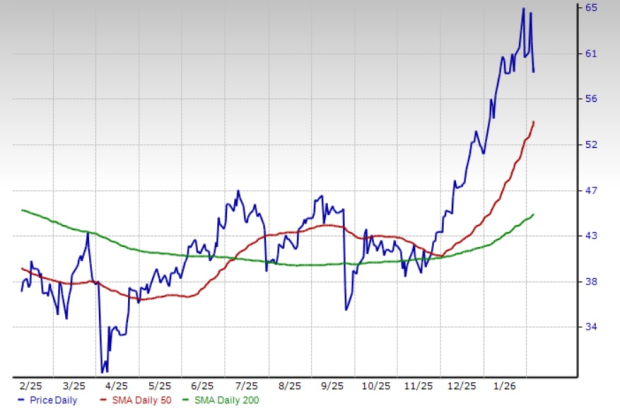

Freeport-McMoRan Inc.’s FCX shares have surged 47.4% in the past six months, largely a function of a rally in copper prices, driven by concerns over tighter global supply, tariff-related uncertainties and solid demand.

Freeport has underperformed the Zacks Mining - Non Ferrous industry’s rise of 86.7% while topping the S&P 500’s increase of 11.2% over the same period. Its peers, Southern Copper Corporation SCCO and BHP Group Limited BHP, have rallied 97.5% and 34.1%, respectively, in the same time.

FCX has been trading above the 50-day simple moving average (SMA) and 200-day SMA since late November 2025. Following a golden crossover on July 8, 2025, the 50-day SMA is reading higher than the 200-day SMA, indicating a bullish trend.

Let’s take a look at FCX’s fundamentals to analyze the stock better.

Freeport is well-placed with high-quality copper assets and remains focused on strong execution and advancing its organic growth opportunities. At its Cerro Verde operation in Peru, a large-scale concentrator expansion provided incremental annual production of around 600 million pounds of copper and 15 million pounds of molybdenum. It has completed the evaluation of a large-scale expansion at El Abra in Chile to define a large sulfide resource that could potentially support a major mill project similar to the large-scale concentrator at Cerro Verde, with an estimated resource of approximately 20 billion recoverable pounds of copper.

FCX is also advancing pre-feasibility studies (expected to be completed in 2026) in the Safford/Lone Star operations in Arizona to define a significant sulfide expansion opportunity. It has expansion opportunities at Bagdad in Arizona to more than double the concentrator capacity of the operation. Technical and economic studies have revealed the potential to build concentrating facilities to boost copper production by 200-250 million pounds annually.

PT Freeport Indonesia (PT-FI) substantially completed the construction of the new greenfield smelter in Eastern Java during 2024, with the start-up of operations having commenced in the second quarter of 2025. The first production of copper anode was achieved in July 2025. PT-FI is also developing the Kucing Liar ore body within the Grasberg district with a targeted ramp-up to commence in 2030. FCX completed studies in 2025 that showed an opportunity to increase Kucing Liar’s design capacity to 130,000 metric tons of ore per day and reserves by roughly 20% at low costs. Gold production also started at the new precious metals refinery in late 2024.

FCX has a strong liquidity position and generates substantial cash flows, which allow it to finance its growth projects, pay down debt and drive shareholder value. It generated solid operating cash flows of around $5.6 billion in 2025, including $693 million in the fourth quarter. Freeport ended 2025 with strong liquidity, including roughly $3.8 billion in cash and cash equivalents, $3 billion in availability under the FCX revolving credit facility, and $1.5 billion in availability under the PT-FI credit facility.

At the end of 2025, Freeport had a net debt of $2.3 billion, excluding PTFI’s new downstream processing facilities. Its net debt is below its targeted range of $3-$4 billion. Freeport has a policy of distributing 50% of the available cash to shareholders and the balance to either reduce debt or invest in growth projects. FCX has no significant debt maturities until 2027. Its long-term debt-to-capitalization is around 22.5% compared with 39.1% for Southern Copper and 29.3% for BHP Group.

FCX offers a dividend yield of roughly 0.5% at the current stock price. Its payout ratio is 17% (a ratio below 60% is a good indicator that the dividend will be sustainable). Backed by strong financial health, the company's dividend is perceived to be safe and reliable.

Prices of copper, the backbone of electrification, were volatile yet mostly favorable last year due to global economic and trade uncertainties. Prices, for the most part, remained above $5 per pound in the fourth quarter of 2025.

Copper prices gained momentum last month, underpinned by robust demand from China and the United States. Structural tailwinds, including electric vehicles (EVs), renewable energy projects, data-center growth and grid modernization, boosted copper consumption. Meanwhile, worries about a tighter supply amid rising EV and infrastructure demand lifted the red metal.

The threat of U.S. tariffs on refined metals pushed traders to redirect shipments into the country, tightening supply. Supply risks also increased amid worries over lower output and potential disruptions at major global mining operations. Copper hit an all-time high of around $6.58 per pound in late January, fueled by tariff threats and supply concerns amid solid demand, further supported by a weaker greenback. While prices have pulled back lately to below $6 per pound due to a concoction of factors, including aggressive profit-booking, a rebound in the U.S. dollar, prospects of higher supplies in China amid reduced demand and rising inventories, they remain supportive.

Freeport’s average realized copper price climbed around 28% year over year to $5.33 per pound in the fourth quarter. Favorable prices are expected to continue to support its performance.

FCX saw a sharp increase in its average unit net cash cost per pound of copper in the fourth quarter of 2025 to $2.22 from $1.40 in the prior quarter, marking a roughly 59% spike. It also climbed 34% year over year. The increase was fueled by a decline in copper sales volumes.

Freeport's outlook for the first quarter of 2026 suggests higher costs on a sequential basis. It expects unit net cash costs to rise to $2.60 per pound, while projecting a full-year average of roughly $1.75. Lower expected sales volumes are likely to impact costs in the quarter. Higher costs are expected to weigh on the company's margins.

Freeport’s copper sales volumes tumbled approximately 29% year over year in the fourth quarter to 709 million pounds, and fell from 977 million in the prior quarter. The company sold 80,000 ounces of gold in the fourth quarter, down around 77% year over year. The downside primarily resulted from the temporary suspension of operations since the mud rush incident at the Grasberg Block Cave mine in Indonesia in September 2025, which led to the suspension of operations.

Freeport’s outlook for copper sales volumes for the first quarter of 2026 assumes minimal contribution from its Indonesian operations due to the Grasberg mine incident. FCX expects copper sales volumes of 640 million pounds, indicating a 10% sequential and 27% year-over-year decline.

The company has issued weaker guidance for gold sales volume of 60,000 ounces, suggesting sequential and year-over-year decreases. Lower sales volumes are expected to weigh on its top line in the first quarter. FCX remains on track to start a phased restart of the Grasberg Block Cave underground mine beginning in second-quarter 2026.

Freeport’s earnings estimates have been going up over the past 60 days. The Zacks Consensus Estimate for 2026 and 2027 earnings has been revised up over the same time frame.

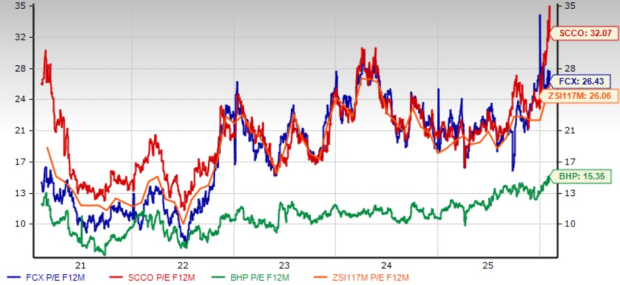

FCX is currently trading at a forward price/earnings of 26.43X, a 1.4% premium to the industry average of 26.06X. The FCX stock is trading at a discount to Southern Copper and at a premium to BHP Group.

FCX stands to benefit from progress in expansion projects that should lift production capacity. Its solid balance sheet supports continued investment in growth projects and shareholder returns. Rising earnings estimates and supportive copper prices are the other positives. Still, softer sales volume expectations and higher projected unit costs suggest caution. Retaining this Zacks Rank #3 (Hold) stock will be prudent for investors who already own it.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite