|

|

|

|

|||||

|

|

Biogen BIIB reported fourth-quarter 2025 adjusted earnings per share (EPS) of $1.99, which beat the Zacks Consensus Estimate of $1.61. Earnings declined 42% year over year.

Total revenues during the quarter came in at $2.28 billion, down 7% year over year on both a reported and constant-currency basis. This decline was due to soft sales performance of key multiple sclerosis (MS) drugs like Tecfidera and Tysabri, as well as spinal muscular atrophy (SMA) drug Spinraza, partially offset by higher revenues from new drugs. Yet, revenues beat the Zacks Consensus Estimate of $2.21 billion.

Product sales in the quarter were $1.67 billion, down 9% year over year on both a reported and a constant currency basis.

Revenues from anti-CD20 therapeutic programs rose 12% to $521 million. The revenues include royalties on sales of Roche’s RHHBY Ocrevus and Biogen’s share of Roche’s drugs, Rituxan, Gazyva and Lunsumio.

Contract manufacturing and royalty revenues declined 66% year over year to $44 million. Alzheimer’s collaboration revenues were $47 million compared with $27 million in the year-ago quarter.

Alzheimer’s collaboration revenues include Biogen’s 50% share of net product revenues and cost of sales (including royalties) from Alzheimer’s disease (AD) drug Leqembi (lecanemab), which has been developed in collaboration with Eisai. Eisai recorded nearly $134 million in global revenues from Leqembi sales in the fourth quarter, higher than $121 million in the previous quarter. The drug’s U.S. sales rose 13% quarter over quarter to $78 million.

Biogen’s MS revenues totaled $917 million, down 14% on a reported basis and 15% on a constant-currency basis, due to generic competition for Tecfidera and rising competitive pressure in the MS market.

Vumerity recorded $181 million in sales, up around 3% year over year. This metric missed the Zacks Consensus Estimate of $183 million.

Tecfidera sales declined 51% to around $112 million, owing to continued generic erosion of the drug in Europe. The drug’s sales also missed the Zacks Consensus Estimate of $120 million.

Tysabri sales fell 4% year over year to $397.5 million, owing to a decline in sales across ex-U.S. territories. Yet, this drug’s sales beat the Zacks Consensus Estimate of $362 million.

Combined interferon revenues (Avonex and Plegridy) declined 4% year over year during the quarter to about $226 million.

Sales of Spinraza declined more than 15% to $356 million. The figure missed the Zacks Consensus Estimate of $380 million.

Rare disease drug Skyclarys generated sales of more than $133 million, up nearly 31% year over year, driven by continued demand growth in the United States and geographic expansion outside ex-U.S. markets.

Qalsody added sales of $25 million compared with about $12 million in the year-ago period, primarily driven by growth in ex-U.S. territories.

New drug Zurzuvae (for postpartum depression) recorded sales of nearly $66 million in the quarter, up 19% on a sequential basis, driven by an increase in demand.

Biogen has a collaboration with Supernus Pharmaceuticals SUPN for Zurzuvae. Both companies equally share profits and losses for the drug’s commercialization in the United States. At the same time, outside U.S. markets, Biogen records product sales (excluding Japan, Taiwan and South Korea) and pays royalties to Supernus. Zurzuvae was approved for a similar indication in the EU last September.

Biosimilar revenues declined 16% year over year at $170 million during the quarter.

Adjusted research and development (R&D) expenses declined 6% year over year to $478 million, driven by the company’s cost-saving initiatives under its “Fit for Growth” program and savings from the R&D portfolio prioritization efforts.

Adjusted selling, general and administrative (SG&A) expenses rose 1% to $678 million due to higher costs to support the new product launches, partially offset by cost savings under the “Fit for Growth” program.

Biogen generated revenues of $9.89 billion in 2025, which beat the Zacks Consensus Estimate of $9.82 billion. Revenues rose 2% year over year on both reported and constant currency basis, better than the company’s guidance of being stable or growing 1% (in constant currency terms).

Earnings were $15.28 a share, down 7% year over year. Yet, this metric beat the Zacks Consensus Estimate of $14.92 and also exceeded the guidance range of $14.50-$15.00.

Total revenues are expected to decline by a mid-single-digit percentage in constant currency terms in 2026 from the 2025 level. A further decline in MS revenues (excluding Vumerity) is expected to be partially offset by higher revenues from new products.

Adjusted EPS is expected in the range of $15.25 to $16.25, which represents an improvement over the 2025 levels at the mid-point. The guidance was well above the Zacks Consensus Estimate of $14.87 per share.

The gross margin is expected to be flat in 2026. Combined adjusted R&D and SG&A costs are expected to be roughly consistent year over year.

Biogen delivered better-than-expected fourth-quarter results, despite continued pressure on its multiple sclerosis (MS) franchise and declining Spinraza sales. The weakness in legacy products was partially offset by strong momentum in newer therapies, particularly Leqembi, Skyclarys and Zurzuvae, which continue to gain commercial traction.

Notably, the company’s 2026 adjusted EPS guidance came in well ahead of consensus expectations, signaling improving operating leverage despite a projected decline in total revenues. This upbeat outlook was likely the primary catalyst behind the stock’s pre-market gains following the earnings release today.

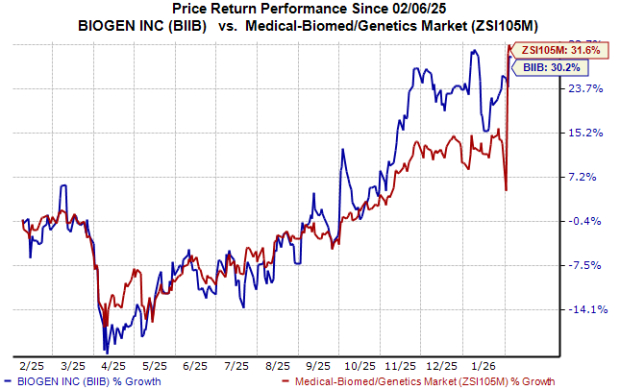

In the past year, the stock has risen 30% compared with the industry’s 32% growth.

While Biogen’s MS drugs and Spinraza are seeing rising competitive pressure, the company’s newer products — Leqembi, Zurzuvae, Skyclarys and Qalsody — have the potential to revive growth in the long term. BIIB is making significant progress toward building a multi-franchise portfolio through both internal development and collaborations.

The company believes that its four key pipeline products — litifilimab (for lupus), dapirolizumab pegol (for SLE), felzartamab (for kidney-related diseases) and BIIB080 (for AD) — have $14 billion of peak revenue potential.

Biogen Inc. price | Biogen Inc. Quote

Biogen currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 hours | |

| 14 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite