|

|

|

|

|||||

|

|

The Kraft Heinz Company KHC is partnering with Uber Eats to spotlight restaurants that serve HEINZ products through a newly launched program, HEINZ Verified. Debuting in Chicago, Dallas, Denver, Los Angeles, Miami and Pittsburgh, the program helps consumers easily find restaurants offering the unmistakable taste of HEINZ Ketchup, favored by more than 84% of diners.

For a limited time, Uber Eats users can get $5 off on orders of $30 or more from HEINZ Verified restaurants (taxes and fees apply). These verified locations are specially marked in the app, giving them increased visibility and helping to drive new customer traffic.

Participating restaurants benefit from a range of exclusive support provided by Kraft Heinz, including access to consumer insights and trend data, free product samples, branded HEINZ merchandise, co-branded digital and promotional materials, and free marketing support, all designed to help grow their business and build stronger customer connections.

HEINZ Verified is led by Kraft Heinz’s Away From Home business unit, a key growth driver. With this initiative, KHC aims to support restaurant operators in delivering elevated dining experiences, reinforcing its longstanding commitment to quality and community. By helping restaurants thrive, the program also contributes to stronger local communities.

The partnership with Uber Eats brings added visibility to restaurants that serve HEINZ products, making it easier for consumers to discover trusted local favorites on the platform. This collaboration enhances value for participating restaurants while tapping into the strong brand loyalty associated with HEINZ. To build consumer excitement, Kraft Heinz will also debut a branded content series called “Daytrippin’,” hosted by comedian and content creator Steven He.

Kraft Heinz has been implementing effective pricing strategies to enhance its performance amid low volumes and inflationary pressures. In the first quarter of 2025, the company’s pricing increased 0.9 percentage points year over year. The favorable pricing was a result of adjustments in certain categories to address higher input costs, mainly in coffee. This upside was driven by increases in the North America and Emerging Markets segments.

Kraft Heinz has been strategically increasing its investments in value-driving initiatives, reflected in a narrowing price gap with private label brands. These efforts are part of a broader commitment to delivering exceptional consumer value while laying the groundwork for sustainable brand growth. Central to this strategy is the company’s Brand Growth System, a structured framework designed to identify high-potential opportunities, inform data-driven investments and prioritize future initiatives.

Despite its strategic wins, Kraft Heinz has been experiencing weak volume performance over the past few quarters, with the trend continuing into the first quarter of 2025. During this period, the company’s volume/mix dropped 5.6 percentage points from the prior-year levels, with declines across all segments. Kraft Heinz has also been facing margin pressure, as witnessed in the first quarter, wherein adjusted gross margin contracted 10 bps to 34.4%.

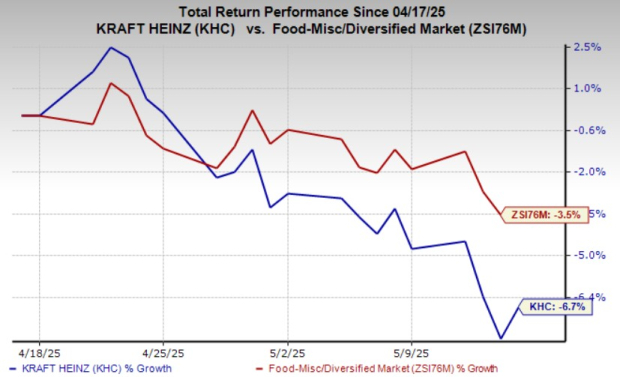

In the past month, shares of this Zacks Rank #4 (Sell) company have lost 6.7% compared with the industry’s decline of 3.5%.

Nomad Foods Limited NOMD manufactures, markets and distributes a range of frozen food products in the United Kingdom and internationally. It currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nomad Foods' current fiscal-year sales and earnings implies growth of 5% and 7.3%, respectively, from the prior-year levels. NOMD delivered a trailing four-quarter earnings surprise of 3.2%, on average.

Mondelez International, Inc. MDLZ manufactures, markets and sells snack food and beverage products in Latin America, North America, Asia, the Middle East, Africa and Europe. It presently carries a Zacks Rank of 2 (Buy). MDLZ delivered a trailing four-quarter earnings surprise of 9.8%, on average.

The Zacks Consensus Estimate for Mondelez International’s current financial-year sales indicates growth of 4.9% from the year-ago numbers.

Oatly Group AB OTLY, an oatmilk company, provides a range of plant-based dairy products made from oats. It presently carries a Zacks Rank of 2. OTLY delivered a trailing four-quarter earnings surprise of 25.1%, on average.

The consensus estimate for Oatly Group’s current fiscal-year sales and earnings implies growth of 2.7% and 56.6%, respectively, from the year-ago figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite