|

|

|

|

|||||

|

|

Mastercard Incorporated MA recently partnered with MoonPay to make use of MA-branded cards and enable seamless payments and disbursements through stablecoins across global markets. The collaboration will allow businesses and fintechs to utilize the abovementioned cards linked to users’ stablecoin balances, which they can spend at more than 150 million Mastercard-accepting locations worldwide. Cardholders will be able to make purchases using their stablecoins, which will be instantly converted into fiat currency.

The partnership will witness integration of Mastercard’s globally trusted payments network and digital asset expertise with MoonPay-acquired Iron’s API-based stablecoin infrastructure.

The resultant benefit will be reaped by businesses, neobanks and other payment providers, with the seamless conversion of crypto wallets into next-generation digital bank accounts, followed by enhanced stablecoin-enabled payments and streamlined payouts and disbursements. Additionally, it will allow companies to offer stablecoin-based payments to gig workers, freelancers and content creators.

Therefore, the ulterior motive behind the latest move is to enhance the efficiency of cross-border money transfers and create faster, more user-friendly payment solutions for consumers and merchants.

The recent initiative reinforces Mastercard’s efforts to promote widespread adoption of stablecoins, expand payment capabilities and bolster its presence in the growing crypto ecosystem. Stablecoins are part of this ecosystem. The technology company in the global payments industry makes continuous efforts to roll out services and capabilities aimed at making crypto easily accessible and more secure for consumers. The partnership with MoonPay also seems to be a timely opportunity on MA’s part since the digital asset sector holds sound growth potential amid a rapidly growing digital economy, the emergence of advanced technologies and the rising Internet penetration.

And MoonPay seems to be the apt partner for complementing Mastercard’s endeavor since its expansive ecosystem includes integrations with more than 500 leading crypto platforms, spanning major wallets and exchanges, reaching more than 100 million active crypto users.

Therefore, MoonPay is likely to be well-positioned to effectively scale the reach of Mastercard cards powered by stablecoins across the worldwide payments and commerce landscape. This, in turn, is expected to lead to increased usage of the MA-branded cards and boost the net revenues that it derives from its payment network by charging fees to customers based on the gross dollar volume of the cards. Payment network net revenues improved 13% year over year in the first quarter of 2025.

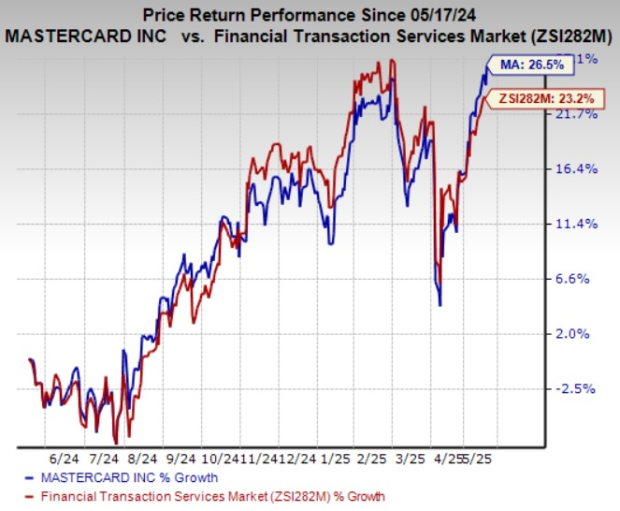

Shares of Mastercard have gained 26.5% in the past year compared with the industry’s growth of 23.2%. MA currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Business Services space are AppLovin Corporation APP, Huron Consulting Group Inc. HURN and Duolingo, Inc. DUOL. While AppLovin sports a Zacks Rank #1 (Strong Buy), Huron Consulting and Duolingo carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of AppLovin outpaced estimates in each of the last four quarters, the average beat being 22.86%. The Zacks Consensus Estimate for APP’s 2025 earnings indicates an improvement of 85.2% from the year-ago reported figure. The same for revenues implies growth of 22.6% from the year-ago reported number. The consensus mark for APP’s 2025 earnings has moved 1.7% north in the past seven days.

Huron Consulting’s earnings outpaced estimates in each of the trailing four quarters, the average being 22.81%. The Zacks Consensus Estimate for HURN’s 2025 earnings indicates an improvement of 14.2% from the year-ago reported figure. The same for revenues implies growth of 9.3% from the year-ago reported number. The consensus mark for HURN’s 2025 earnings has moved 3.4% north in the past 30 days.

The bottom line of Duolingo outpaced estimates in three of the last four quarters and missed the mark once, the average being 22.78%. The Zacks Consensus Estimate for DUOL’s 2025 earnings indicates an improvement of 55.3% from the year-ago reported figure. The same for revenues implies growth of 33.4% from the year-ago actuals. The consensus mark for DUOL’s 2025 earnings has moved 10.2% north in the past 30 days.

Shares of AppLovin, Huron Consulting and Duolingo have gained 338.7%, 73.4% and 197.2%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 6 hours | |

| 9 hours | |

| 15 hours | |

| Mar-08 | |

| Mar-08 | |

| Mar-07 | |

| Mar-07 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite