|

|

|

|

|||||

|

|

With summer considered the prime season for construction, investors may be wondering if it’s time to buy stocks that offer exposure to the housing market.

To that point, homebuilder stocks are usually of interest, along with home improvement retailers such as Home Depot HD, which reported mixed Q1 results on Tuesday.

Furthermore, spring and early summer are generally peak seasons for homebuying as more homes are listed for sale, giving buyers a wider selection to choose from. According to Zillow Z, late summer can offer better deals, as sellers may start lowering prices before the fall.

However, while the summer is often the busiest time for homebuilders as well, high demand can drive up material costs. Of course, higher tariffs will also have an adverse effect in regard to rising material costs.

This makes it a worthy topic, of which housing and construction-related stocks are worthy of investors' consideration as the summer approaches.

Optimistically, Home Depot should be able to avoid a significant impact from tariffs, highlighting in its Q1 report that more than 50% of the company’s supply purchases are sourced from the United States. Having a favorable global sourcing strategy, Home Depot’s Q1 sales were up 9% year over year to $39.85 billion and topped estimates of $39.4 billion.

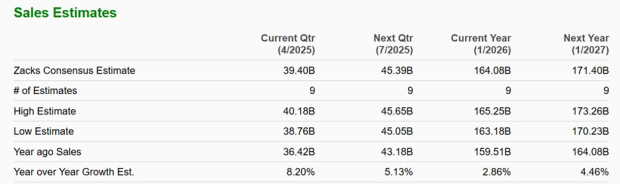

That said, Q1 EPS of $3.56 dipped from $3.63 in the prior period and missed expectations of $3.59 per share. Still, Home Depot reaffirmed its fiscal 2025 guidance, expecting total sales growth of approximately 2.8%, which is roughly in line with Zacks' estimates (Current Year below). Based on Zacks' projections, Home Depot’s total sales are forecasted to rise another 4% in FY26 to $171.4 billion.

Home Depot stock currently lands a Zacks Rank #3 (Hold) and should remain a viable long-term investment going into the peak home improvement season, although better buying opportunities could still be ahead following the Q1 earnings miss.

Notably, Zillow’s latest home value and sales report from April suggests a mix of growth and challenges in the housing market. Zillow’s latest forecast calls for home values to decrease by 1.9% this year from previous estimates of -0.6%, although existing home sales are expected to increase 3.3% to 4.2 million in 2025.

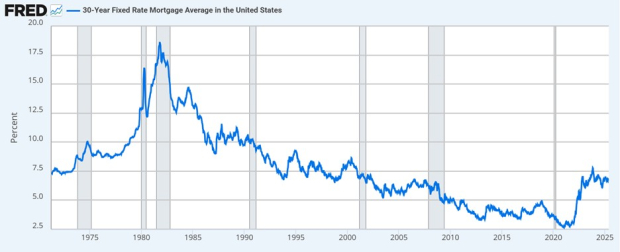

Newly pending listing sales in April fell 2.5% from a year ago, despite lower average mortgage rates. New home listings did rise 7.6%, with Zillow stating sellers are more enthusiastic. Unfortunately, Zillow stock has a Zacks Rank #4 (Sell) based on a trend of declining earnings estimate revisions (EPS) over the last 60 days. Also, the volatility in mortgage rates will be something to keep an eye on, with Zillow expecting the average fixed 30-year rate to settle near 6.5% by year-end.

Among homebuilders, Dream Finders Homes DFH stock is standing out with a Zacks Rank #2 (Buy). While many homebuilders are struggling to meet their lofty growth expectations, the risk-to-reward looks favorable to invest in Dream Finders with DFH trading at $22 a share and just 7X forward earnings. Dream Finders' annual earnings are expected to dip 3% this year but are projected to rebound and rise 8% in FY26 to $3.49 per share, with single-digit sales growth on the horizon.

Comfort Systems USA FIX and AAON Inc. AAON are worthy of consideration as providers and manufacturers of comprehensive heating and air conditioning systems. With the warmer months approaching, both sport a Zacks Rank #2 (Buy) and are expected to post considerable top and bottom-line growth in FY25 and FY26. Similarly, Limbach LMB is very intriguing as a provider of building systems and currently boasts a Zacks Rank #1 (Strong Buy) as EPS estimates have soared in the last two months. Limbach constructs and services mechanical, plumbing, air conditioning, electrical, and control systems.

Thanks to their stellar expansion, Limbach, Comfort Systems, and AAON’s stock have been three of the market’s top performers in recent years, with LMB skyrocketing over +2000% in the last three years and FIX and AAON sitting on gains of more than +400% and +200%, respectively.

For now, many of the renowned homebuilder stocks aren’t as appealing even with peak construction season approaching, but there is still an abundance of opportunity in the broader housing market, with air conditioning and building systems providers standing out in particular.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 4 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Comfort Systems Is Trading At A Record High As It Constructs An AI Future

FIX

Investor's Business Daily

|

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite