|

|

|

|

|||||

|

|

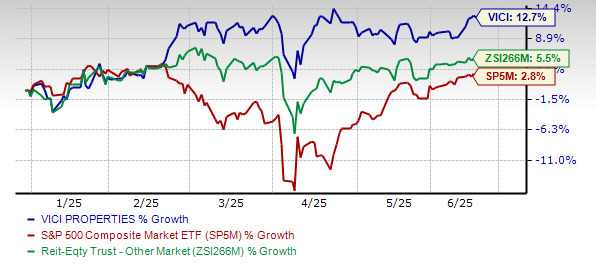

VICI Properties Inc. VICI, which specializes in gaming and entertainment properties, has seen its stock gain 12.7% year to date. This decent performance has outpaced the 5.5% rise of the Zacks REIT and Equity Trust - Other industry it belongs to and the 2.8% growth of the S&P 500 composite over the same time frame.

In April 2025, VICI came up with its first-quarter 2025 results that reflected continued benefits from its expansion efforts and strategic investments. After the quarter ended, VICI entered into an agreement to provide up to $510 million of development funds through a delayed draw term loan facility for the development of the North Fork Mono Casino & Resort located near Madera, CA. This project will be developed and managed by affiliates of Red Rock Resorts.

With VICI outperforming, individuals may rush to buy the stock based on the growth prospects. However, before making any hasty decision, it would be prudent to also consider the current concerns that could significantly affect the company's long-term performance. The idea is to help investors make a more insightful decision.

Image Source: Zacks Investment Research

Solid dividend payouts remain the biggest attraction for REIT investors, and VICI Properties has remained committed to that, with a compelling 5.5% dividend yield. Since 2018, the company has delivered an impressive 7.4% compounded annualized dividend growth rate, outpacing many triple-net REIT peers like Agree Realty Corporation ADC, Essential Properties Realty Trust, Inc. EPRT and Four Corners Property Trust, Inc. FCPT. VICI is committed to distributing 75% of its adjusted funds from operations (AFFO) to shareholders, ensuring a consistent income stream. This positions it as an appealing option for dividend-focused investors who seek stability alongside long-term growth. Check VICI Properties’ Dividend History.

What is encouraging is that this payout rests on a solid and reliable footing as VICI Properties has cemented itself as a premier experiential real estate investment trust (REIT) with a high-quality portfolio of gaming and entertainment assets. With iconic properties such as Caesars Palace Las Vegas, MGM Grand, the Venetian Resort Las Vegas and other market-leading gaming and experiential properties across North America, VICI is well-poised for growth amid the resiliency of the American consumer, especially in their demand for experiential activities.

VICI owns a diverse portfolio, comprising 54 gaming and 39 experiential assets across the United States and Canada, all secured by long-term triple-net leases with a weighted average lease term of 40.7 years. With a 100% occupancy rate, VICI’s properties are essential to its tenants, who encounter substantial regulatory and financial challenges if they were to relocate. This stability translates into reliable rental income, reinforcing the company's ability to sustain consistent dividend payments.

Moreover, VICI Properties expects a rent toll of 42% with CPI-linked escalation in 2025, which is further projected to rise to 90% by 2035. This inflation-linked rent increase enables the company to maintain its purchasing power and enhance revenue growth, even in inflationary environments. Additionally, 74% of VICI’s rent roll comes from S&P 500 tenants, enhancing income stability and creditworthiness.

Since its inception in 2017, VICI has expanded its adjusted EBITDA by 365%, growing beyond gaming properties to include experiential assets such as Chelsea Piers and Lucky Strike Entertainment. This diversification reduces sector-specific risks and enhances revenue stability. Moreover, the company enjoys financial resilience with $3.21 billion in liquidity as of March 31, 2025, giving it ample financial flexibility to navigate market fluctuations. VICI’s last quarter annualized net leverage ratio stood at 5.3, within its long-term target range of 5.0-5.5.

VICI Properties faces its share of challenges. Despite efforts to diversify, gaming properties continue to be VICI’s primary revenue driver. This concentration makes the company vulnerable to industry-specific risks, including regulatory shifts, economic downturns impacting discretionary spending and unfavorable developments within the gaming sector. Any financial distress among its key tenants could potentially strain VICI’s cash flows.

As a REIT, VICI is highly sensitive to interest rate movements. Elevated rates increase borrowing costs and make its dividend yield less attractive compared to risk-free Treasury yields. The company also carries a substantial debt burden, with its total debt of approximately $17.2 billion as of March 31, 2025.

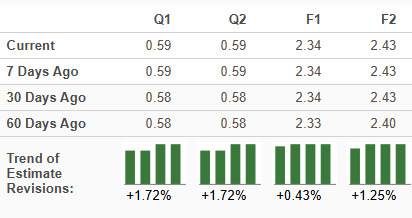

The estimate revision trends reflect analysts’ positive sentiments. The Zacks Consensus Estimate for 2025 AFFO per share has increased by a cent over the past two months, while the same for 2026 has also moved north by three cents over the same time frame.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

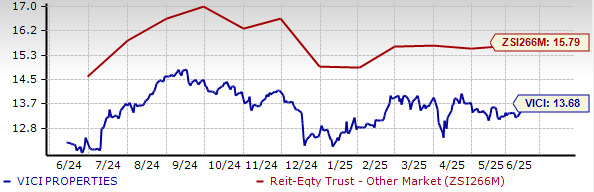

In terms of valuation, VICI Properties stock still looks cheap as it is trading at a forward 12-month price-to-FFO of 13.68X, below the REIT-Other industry average of 15.73X, but slightly higher than its one-year median of 13.60X. It is also trading at a discount to triple-net REIT peers, including ADC, EPRT and FCPT.

Image Source: Zacks Investment Research

VICI Properties’ compelling dividend payout, backed by its high-quality portfolio, inflation-linked rent growth and disciplined expansion strategy makes it an appealing investment. Despite short-term headwinds such as macroeconomic uncertainty, as well as gaming properties concentration, VICI’s long-term outlook remains solid.

For investors looking to gain exposure to the experiential REITs, the company’s financial stability presents a compelling opportunity to invest in the stock. VICI Properties stock is also trading at a discount relative to its industry, and the current valuation presents a buying opportunity. Existing shareholders may choose to stay invested, given the company’s strong track record of paying growing dividends and focusing on high-demand property sectors.

At present, VICI Properties carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite