|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The Leisure and Recreation Services industry has been gaining from optimizing business processes, consistent partnerships and digital initiatives. Robust demand for concerts, easing trade tension and strong bookings for cruise operators are supporting the industry.

Investor sentiment improved following the easing of the trade tussle between the United States and China. This development has sparked optimism that trade agreements with other countries may follow. The combination of easing global trade tensions and signs of slowing inflation has helped ease concerns about a potential slowdown in the U.S. economy.

The cruise industry is benefiting from strong demand for cruising and accelerating booking volumes. Strong pricing (on closer-in-demand) and solid onboard spending bode well for the industry. Moreover, the theme park industry is benefiting from robust demand. Theme Park operators have been gaining from improving visitation.

At this stage, we have narrowed our search to five leisure and recreation stocks that offers solid near-term price upside. These are: Carnival Corporation & plc CCL, Manchester United plc MANU, The Marcus Corp. MCS, Madison Square Garden Sports Corp. MSGS and Pursuit Attractions and Hospitality Inc. PRSU. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Rank #2 Carnival is benefiting from sustained demand strength, increased booking volumes, higher onboard revenues and cost discipline. With solid performance in every area, CCL raised its full-year 2025 guidance, supported by operational efficiency and strategic growth initiatives. Also, CCL’s focus on new ship additions and fleet optimization, along with investing in new marketing campaigns on the back of global demand trends, bodes well.

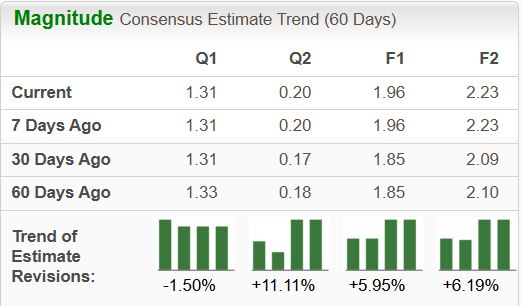

Carnival has an expected revenue and earnings growth rate of 5.4% and 38%, respectively, for the current year (ending November 2025). The Zacks Consensus Estimate for current-year earnings has improved 5.9% in the last 30 days.

Carnival has a P/E ratio of 15.1X compared with 21.7X of the industry and 19.4X of the S&P 500. It has a P/S ratio of 1.4X compared with 1.2X of the industry and 3.1X of the S&P 500. CCL has a PEG ratio of 0.9 compared with 2 of the industry and 2.4 of the S&P 500. A PEG ratio below 1 indicates that the stock has strong near-term value.

Zacks Rank #1 Manchester United operates a professional sports team in the United Kingdom. MANU is involved in marketing and sponsorship relationships with international and regional companies to commercialize its brand. It also markets and sells sports apparel, training and leisure wear, and other clothing; and other licensed products, such as coffee mugs and bed spreads featuring the Manchester United brand and trademarks.

MANU distributes these products through Manchester United branded retail centers and e-commerce platforms, and through partners' wholesale distribution channels. In addition, MANU distributes live football content directly, as well as through commercial partners, TV rights relating to the Premier League, Union of European Football Associations club competitions, and other competition.

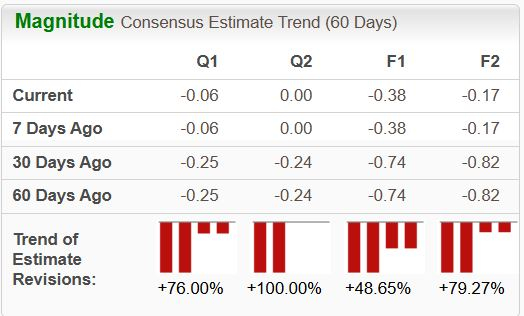

Manchester United has an expected revenue and earnings growth rate of 9.6% and 56.6%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for current-year earnings has improved more than 100% in the last 30 days.

The short-term average price target of brokerage firms for the stock represents an increase of 26.8% from the last closing price of $17.32. The brokerage target price is currently in the range of $16.90-$26. This indicates a maximum upside of 50.1% and a downside of 2.4%.

Zacks Rank #2 The Marcus is engaged in the lodging and entertainment industries. MCS operates through two segments: Movie Theatres, and Hotels and Resorts. MCS’ movie theatre division owns or manages screens at locations in several states, as well as a family entertainment center.

MCS’ lodging division owns or manages hotels and resorts in several states, as well as a vacation club. MCS also provides hospitality management services, including check-in, housekeeping, and maintenance for a vacation ownership development.

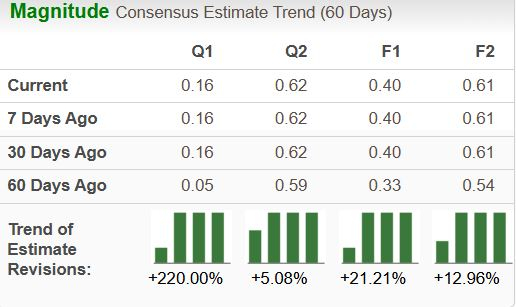

The Marcus has an expected revenue and earnings growth rate of 5.2% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 21.2% in the last 60 days.

The short-term average price target of brokerage firms for the stock represents an increase of 46.7% from the last closing price of $16.82. The brokerage target price is currently in the range of $24-$25. This indicates a maximum upside of 48.6% and no downside.

Zacks Rank #2 Madison Square Garden operates as a professional sports company in the United States. MSGS owns and operates a portfolio of assets that consists of the New York Knickerbockers of the National Basketball Association (NBA) and the New York Rangers of the National Hockey League.

MSGS other professional franchises include development league teams, the Hartford Wolf Pack of the American Hockey League and the Westchester Knicks of the NBA G League. MSGS also owns Knicks Gaming, an esports franchise that competes in the NBA 2K League. In addition, MSGS operates professional sports team performance centers, including the Madison Square Garden Training Center in Greenburgh.

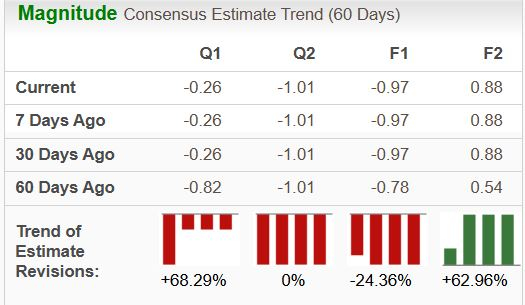

Madison Square Garden has an expected revenue and earnings growth rate of 6.5% and more than 100%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for current-year earnings has improved 63% in the last 60 days.

The short-term average price target of brokerage firms for the stock represents an increase of 24.8% from the last closing price of $204.78. The brokerage target price is currently in the range of $215-$314. This indicates a maximum upside of 53.3% and no downside.

Zacks Rank #1 Pursuit Attractions and Hospitality is an attraction and hospitality company that owns and operates hospitality destinations in the United States, Canada, and Iceland. PRSU operates various attractions and lodges with integrated restaurants, retail, and transportation facilities.

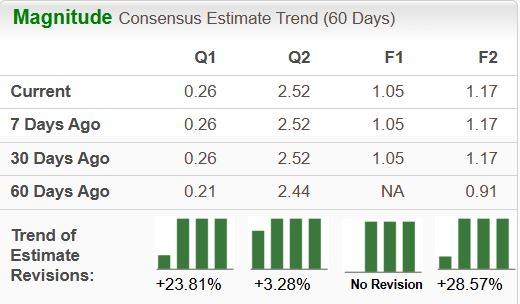

PRSU has an expected revenue and earnings growth rate of 6.2% and 11%, respectively, for the next year. The Zacks Consensus Estimate for next-year earnings has improved 28.6% in the last 60 days.

The short-term average price target of brokerage firms for the stock represents an increase of 44.4% from the last closing price of $30.13. The brokerage target price is currently in the range of $38-$55. This indicates a maximum upside of 8.5% and no downside.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 11 min | |

| 5 hours | |

| 5 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite