|

|

|

|

|||||

|

|

Ultragenyx Pharmaceutical RARE and partner, Mereo BioPharma MREO, have reported an update on the progress of the mid-to-late-stage Orbit study, which is evaluating UX143 (setrusumab) for the treatment of osteogenesis imperfecta (OI) in pediatric and young adult patients. According to RARE and MREO, the phase III portion of the Orbit study is on track for a final analysis by 2025-end, in line with the original timeline, instead of stopping the study early as the companies had hoped.

This caused the shares of Ultragenyx Pharmaceutical and Mereo BioPharma to crash substantially in the premarket hours today.

UX143 is a fully human monoclonal antibody that inhibits sclerostin. The independent Data Monitoring Committee has reviewed interim safety data and concluded that UX143 shows an acceptable safety profile, recommending that the study proceed to the final analysis, as planned.

While data from the separate phase III Cosmic study were not reviewed at this interim stage, both studies are reportedly progressing smoothly. Ultragenyx Pharmaceutical has cited feedback from investigators and participating families suggesting that UX143 treatment may increase bone mass, potentially leading to stronger bones, fewer fractures and enhanced physical function.

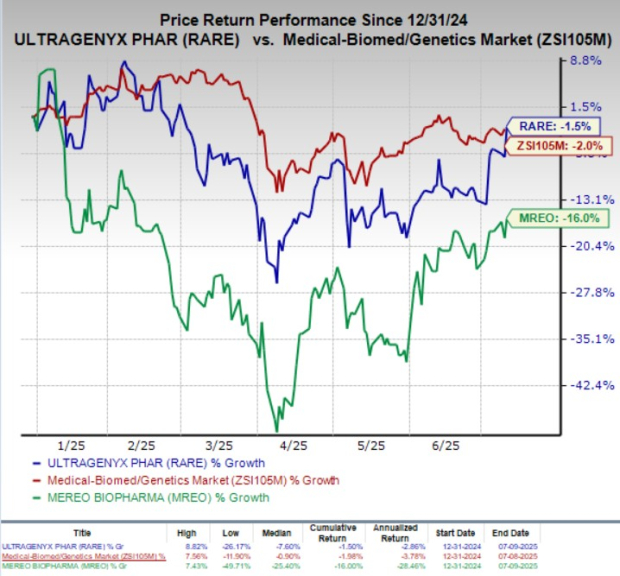

The final analyses for both the Orbit and Cosmic studies will take place once patients have completed at least 18 months of therapy. Year to date, shares of Ultragenyx Pharmaceuticals have lost 1.5%, and Mereo BioPharma has lost 16% compared with the industry’s 2% decline.

The intended patient population for Ultragenyx Pharmaceutical and Mereo BioPharma’s phase II/III Orbit and phase III Cosmic studies of UX143 are pediatric and young adult patients across OI sub-types I, III and IV.

The global Orbit study is assessing the impact of the candidate on fracture rates in patients aged 5 to 25 with OI. In phase II, 24 patients were randomized to receive one of two doses, helping determine 20 mg/kg as the optimal dose for phase III. The pivotal phase III portion enrolled 159 additional patients, with a 2:1 randomization to UX143 or placebo, the primary efficacy endpoint being to reduce the annualized clinical fracture rate. Following the primary analysis, all participants will move into an open-label extension period with the candidate.

Separately, the phase III Cosmic study is targeting a younger population aged two to under seven years. This study compares UX143 to intravenous bisphosphonates to evaluate fracture reduction. A total of 69 patients have been enrolled.

Ultragenyx Pharmaceutical Inc. price-consensus-chart | Ultragenyx Pharmaceutical Inc. Quote

Ultragenyx Pharmaceuticals originally signed a licensing agreement with Mereo BioPharma in 2020 to jointly develop UX143 for OI. Per the deal, RARE holds exclusive rights to develop and commercialize the therapy in the United States, Turkey and all other regions outside the European Economic Area, the United Kingdom, and Switzerland, where Mereo BioPharma retains rights. Ultragenyx Pharmaceuticals is leading global development across pediatric and adult populations. In 2024, the companies expanded their partnership through a manufacturing and supply agreement, making RARE responsible for supplying setrusumab to MREO in its territories, with Mereo BioPharma reimbursing a portion of development and future supply costs.

OI is a group of genetic disorders impacting bone metabolism that affects about 60,000 people in commercially accessible geographies, for which there is currently no approved treatment.

Mereo BioPharma Group plc - Sponsored ADR price-consensus-chart | Mereo BioPharma Group plc - Sponsored ADR Quote

Ultragenyx Pharmaceuticals and Mereo BioPharma carry a Zacks Rank #3 (Hold) each at present.

Some better-ranked stocks in the biotech sector are Verona Pharma VRNA and Bayer BAYRY, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 90 days, Verona Pharma’s bottom-line estimates for 2025 have significantly improved from a loss of 7 cents per share to earnings of 22 cents. During the same timeframe, estimates for 2026 earnings per share have improved from $2.21 to $2.88. VRNA stock has soared 125.6% so far this year.

Verona Pharma’s earnings beat estimates in one of the trailing four quarters and missed the mark on the other three occasions, delivering an average negative surprise of 6.76%.

BAYRY’s 2025 earnings per share estimate has increased from $1.20 to $1.32 for 2025 over the past 90 days, while that for 2026 has gone up from $1.28 to $1.37 over the same timeframe. Year to date, shares of Bayer have surged 64.8%.

BAYRY’s earnings beat estimates in one of the trailing four quarters, matched twice and missed on the remaining occasion, the average negative surprise being 13.91%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-09 | |

| Feb-09 | |

| Feb-07 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite