|

|

|

|

|||||

|

|

Reddit RDDT operates a community-driven social media platform with more than 100,000 active subreddits, generating over 90% of its revenue through digital advertising. RDDT reported first-quarter revenues of $392 million, marking 61% year-over-year growth. However, Reddit continues to face pressure in a highly competitive advertising space, where scale, automation and platform maturity play a significant role in attracting ad dollars.

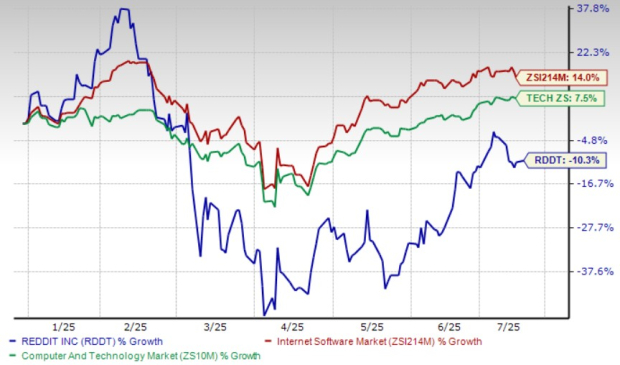

RDDT shares have declined 10.3% year to date attributed to rising competitive pressure and a challenging macroeconomic environment following U.S. President Donald Trump's decision to levy tariffs on trading partners. Higher tariffs is expected to hurt discretionary spending negatively impacting ad spending. The stock has underperformed both the broader Zacks Computer & Technology sector and the Zacks Internet Software industry, which have appreciated 7.5% and 14%, respectively, over the same period.

Reddit operates within an increasingly competitive digital advertising environment dominated by established technology platforms. Meta Platforms META and Alphabet GOOGL control substantial portions of the global digital advertising market, possessing sophisticated advertising infrastructure and extensive advertiser relationships that Reddit cannot easily match.

Meta Platforms continues to expand its advertising capabilities across Facebook, Instagram and WhatsApp through enhanced cross-platform integration. The company's Ads Manager enables businesses to manage marketing strategy across all platforms, with AI systems optimizing advertising budgets across placements. Meta Platforms plans to introduce Business AI for personalized product recommendations and advanced WhatsApp business messaging features.

Alphabet dominates search advertising while strengthening its market position through AI-powered advertising solutions. The company's AI Overview and Circle to Search features enhance user engagement, making its advertising inventory more valuable to marketers. Reddit's advertising technology remains less sophisticated than Meta Platforms and Alphabet, with limited measurement tools and targeting options, potentially affecting its ability to compete for advertiser budgets.

Reddit shares are overvalued, as suggested by the Value Score of F.

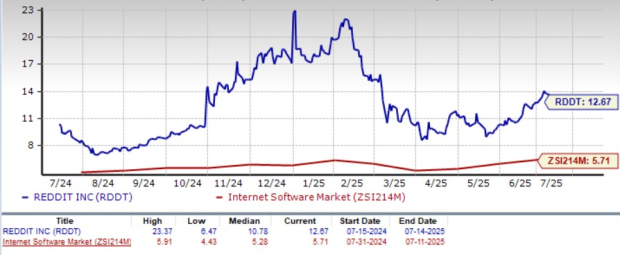

In terms of forward 12-month P/S, RDDT stock is trading at 12.67X compared with the Zacks Internet - Software industry’s 5.71X. The stock is expensive than competitors, including Meta Platforms and Alphabet.

Shares of META and GOOGL are currently trading at P/S ratios of 9.1 and 6.36, respectively.

For 2025, the Zacks Consensus Estimate for revenues is pegged at $1.85 billion, indicating year-over-year growth of 42.07%.

Reddit Inc. price-consensus-chart | Reddit Inc. Quote

The consensus mark for Reddit’s 2025 earnings is pegged at $1.21 per share, unchanged over the past 30 days. The figure marks an improvement over 2024’s loss of $3.33 per share.

Reddit has continued expanding its platform to support advertiser adoption and user activity. Reddit Answers, an AI-powered search tool, reached one million weekly users in the first quarter and launched in Australia and the U.K., with plans for deeper integration into core search. Dynamic Product Ads received updates aimed at onboarding larger product catalogs and improving machine learning models. Reddit Pro usage has more than doubled, supported by integration with Google Tag Manager to streamline tracking and support campaign-level attribution.

In May 2025, Reddit introduced Reddit Community Intelligence, a tool that analyzes real-time discussions to generate marketing insights across categories like gaming and tech. Other updates included AI-powered feed ranking and guided contribution flows to encourage user participation. These changes are part of ongoing efforts to modify user experience and expand advertiser-facing tools.

Improving engagement has been driving user growth for RDDT. Daily Active and Weekly Active Uniques both increased 31% year over year and reached 108.1 million and 401 million, respectively, in the reported quarter. The Zacks Consensus Estimate for Daily Active and Weekly Active Uniques is pegged at 110.15 million and 407.56 million, respectively, for the second quarter.

Reddit's growing product suite, building user engagement and strong partner ecosystem offer long-term promise. The platform's AI-powered tools and expanding international reach demonstrate potential for sustainable growth in the evolving digital advertising landscape.

However, given RDDT's premium valuations, intensifying competition and broader market uncertainties, near-term gains may be limited. The company's current trading multiples exceed industry standards while facing formidable competitors with superior resources and infrastructure. Combined with macroeconomic headwinds and the stock's recent underperformance, these factors create a cautious environment, which may limit near-term upside.

Reddit currently carries a Zacks Rank #4 (Sell), suggesting that investors should avoid the stock at current levels.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 20 min | |

| 30 min | |

| 32 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite