|

|

|

|

|||||

|

|

Steel wire manufacturer Insteel (NYSE:IIIN) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 23.4% year on year to $179.9 million. Its GAAP profit of $0.78 per share was 15.6% above analysts’ consensus estimates.

Is now the time to buy Insteel? Find out by accessing our full research report, it’s free.

Growing from a small wire manufacturer to one of the largest in the U.S., Insteel (NYSE:IIIN) provides steel wire reinforcing products for concrete.

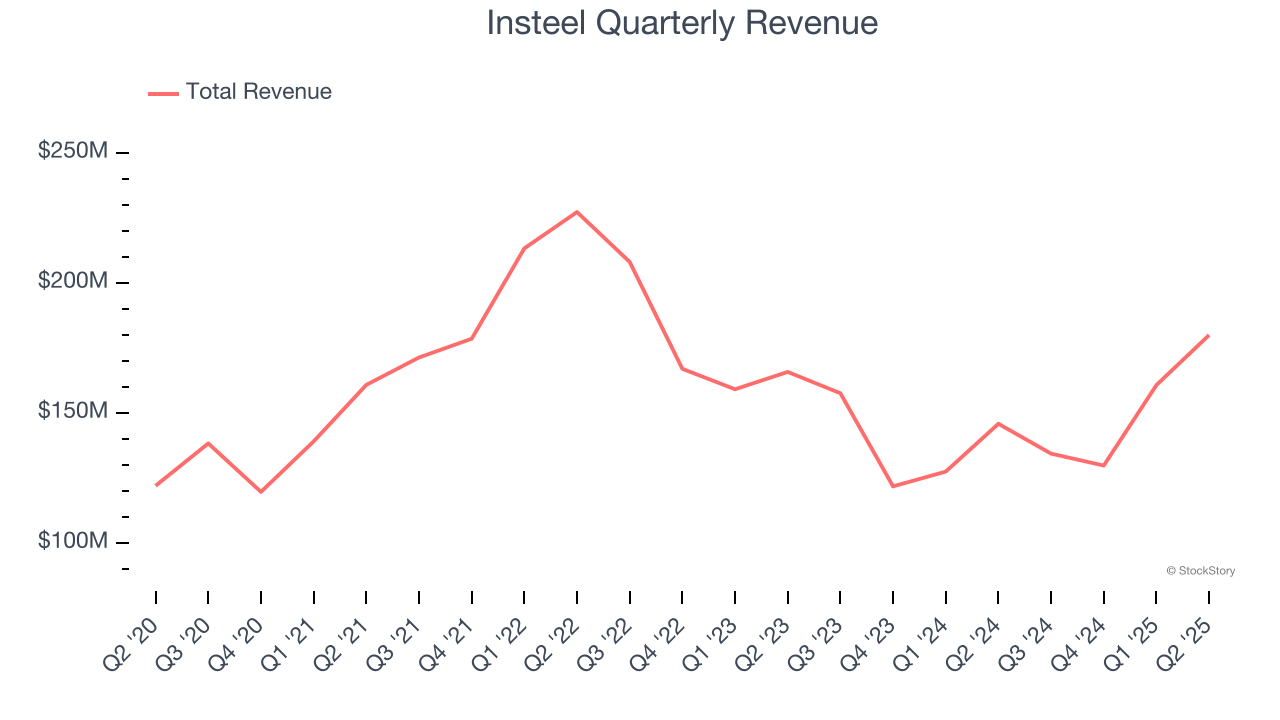

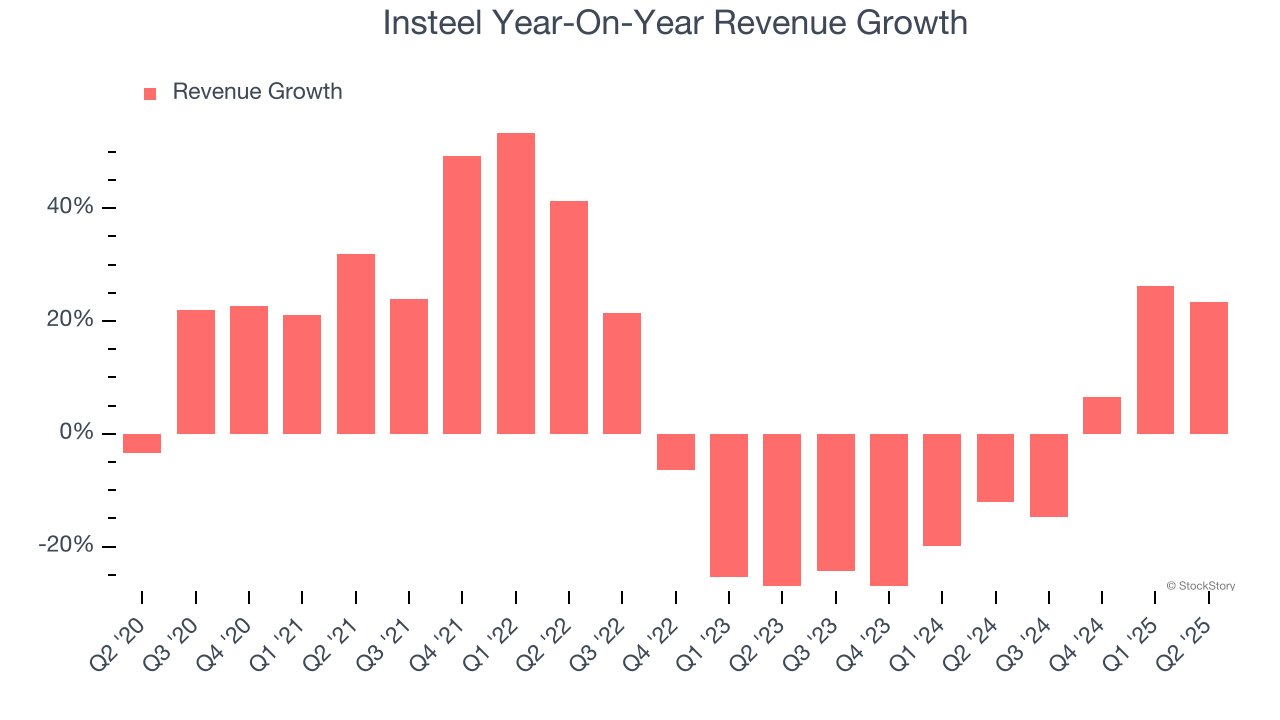

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Insteel grew its sales at a mediocre 6.2% compounded annual growth rate. This was below our standard for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Insteel’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 7% annually. Insteel isn’t alone in its struggles as the Commercial Building Products industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Insteel reported robust year-on-year revenue growth of 23.4%, and its $179.9 million of revenue topped Wall Street estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to grow 13.4% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and suggests its newer products and services will spur better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

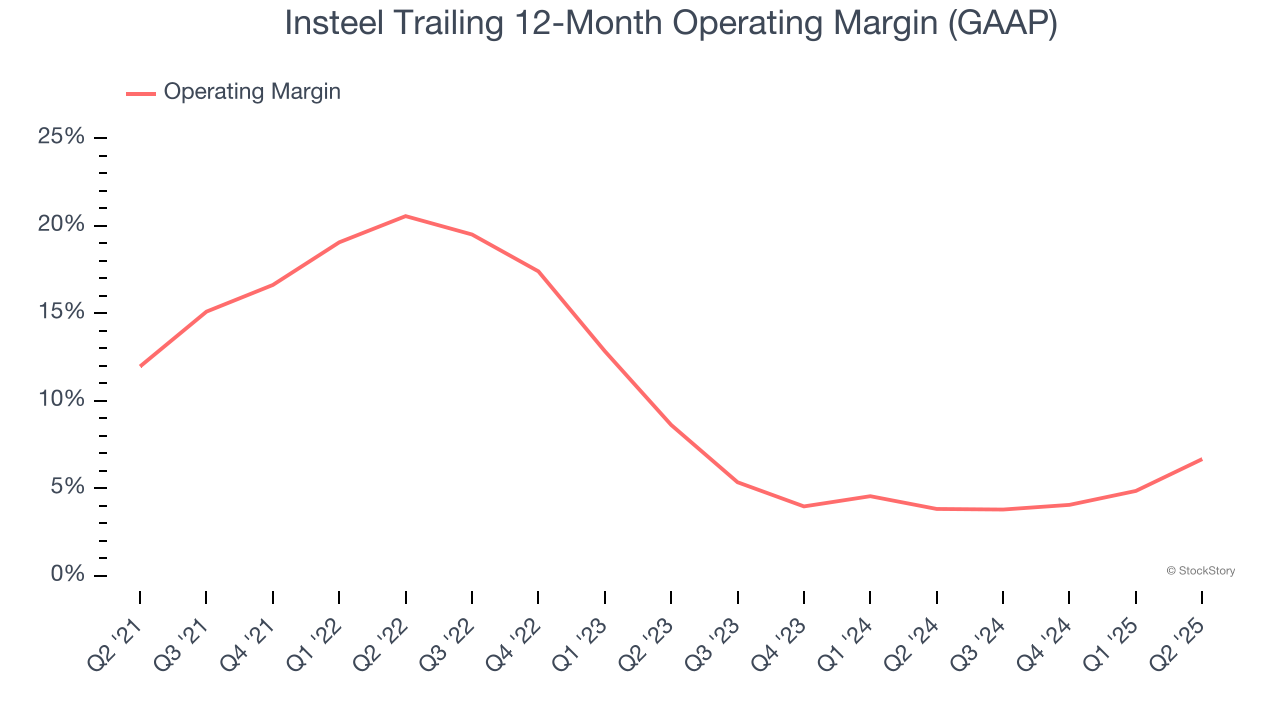

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Insteel has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.9%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Insteel’s operating margin decreased by 5.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q2, Insteel generated an operating margin profit margin of 11.2%, up 6.1 percentage points year on year. The increase was driven by stronger leverage on its cost of sales (not higher efficiency with its operating expenses), as indicated by its larger rise in gross margin.

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Insteel’s EPS grew at an astounding 25.7% compounded annual growth rate over the last five years, higher than its 6.2% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Insteel, its two-year annual EPS declines of 21.7% mark a reversal from its (seemingly) healthy five-year trend. We hope Insteel can return to earnings growth in the future.

In Q2, Insteel reported EPS at $0.78, up from $0.34 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Insteel’s full-year EPS of $1.60 to grow 61.9%.

We were impressed by how significantly Insteel blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $38.52 immediately following the results.

Insteel put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-10 | |

| Feb-09 | |

| Feb-05 | |

| Feb-04 | |

| Jan-22 | |

| Jan-21 | |

| Jan-16 | |

| Jan-15 | |

| Jan-15 | |

| Jan-15 | |

| Jan-15 | |

| Jan-15 | |

| Jan-15 | |

| Jan-13 | |

| Dec-29 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite