|

|

|

|

|||||

|

|

As artificial intelligence reshapes global computing demand, infrastructure providers like Applied Digital APLD and CoreWeave CRWV are emerging as key enablers of the AI economy. Both companies have made strategic pivots from legacy models — crypto mining and generalized hosting — to focus on high-performance computing (HPC) and AI-optimized data centers. In doing so, they’ve positioned themselves at the heart of surging enterprise and hyperscaler demand for GPU-powered infrastructure.

While CoreWeave has scaled rapidly into a multi-hundred-million-dollar business with deep NVIDIA integration and a large network of data centers, Applied Digital is steadily building its AI footprint with targeted deployments and long-term client agreements. The following analysis examines their recent earnings and strategies for sustaining growth in an increasingly AI-driven landscape.

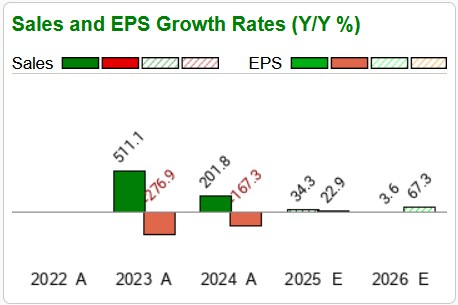

Applied Digital posted third-quarter fiscal 2025 revenues of $52.9 million, marking a significant year-over-year increase and reflecting strong progress in transitioning from a crypto-hosting model to HPC and AI infrastructure. Despite headwinds in the crypto space, the company has successfully diversified revenues by scaling its AI cloud services business, which contributed materially last reported quarter.

APLD’s fiscal 2025 revenues are estimated to cross $200 million, supported by multiple revenue streams — traditional data center hosting, AI cloud infrastructure and a fast-growing high-performance computing segment. Notably, the company’s Ellendale campus, its flagship AI data center, has begun onboarding customers, marking a key inflection point for recurring revenue growth.

Strategically, Applied Digital is focused on developing liquid-cooled, high-density data centers, optimized for AI workloads. These facilities have already attracted clients requiring compute-heavy infrastructure, including those aligned with NVIDIA GPU deployments. The company's infrastructure pipeline includes additional AI-focused campuses that could significantly scale revenues in fiscal 2026 and beyond.

To further solidify growth, APLD is signing long-term contracts with AI service providers, a move that reduces volatility and enhances visibility. Coupled with disciplined capex, cost optimization, and a pivot toward higher-margin services, these steps position Applied Digital to capitalize on the AI boom while mitigating exposure to crypto market cycles. Now, let us take a look at the consensus sales estimates for Applied Digital.

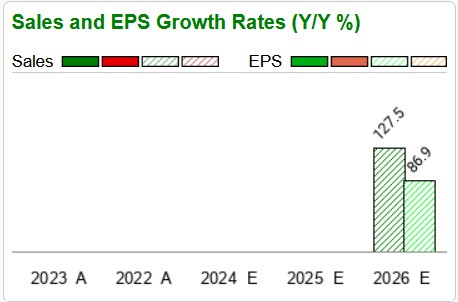

CoreWeave delivered an exceptional first-quarter 2025 performance, with revenues reaching $438 million, implying a 4x increase year over year. This was driven by explosive demand for AI workloads and accelerated compute, primarily powered by CoreWeave’s differentiated infrastructure offerings, including its NVIDIA GPU-accelerated cloud and ability to deploy compute at scale with low latency.

The company’s expansion strategy is paying off. CoreWeave now operates 33 purpose-built AI data centers across the United States and Europe. The firm also boasts industry-leading GPU availability, attracting enterprise-grade generative AI clients, model trainers, and hyperscalers seeking alternatives to traditional public cloud solutions.

A key growth lever is the company’s exclusive long-term contracts, including multi-year deals with AI-native firms and research labs. These agreements provide visibility and revenue stability while enabling the company to secure favorable GPU allocations. CoreWeave is also investing heavily in custom orchestration software, improving provisioning time and workload optimization — an advantage over slower-moving peers.

Looking ahead, management projects 2025 revenues to reach $5 billion, driven by the onboarding of large AI clients and the expansion of GPU capacity. Capital expenditures will remain elevated short term, but CRWV expects improving gross margins as scale efficiencies kick in.

With deep AI specialization and growing infrastructure dominance, CoreWeave is quickly cementing its place as a premier AI cloud infrastructure provider. Let us take a look at the consensus sales estimates for CoreWeave below.

In the past three months, shares of APLD have rallied 154.7%, while those of CRWV have surged 265.9%.

Applied Digital is trading at a forward sales multiple of 8.37, quite above its median of 1.53X over the last three years. CRWV’s forward sales multiple sits at 8.11. Applied Digital may seem pricey but its valuations also reflect its high growth expectations and improving profitability.

While both Applied Digital and CoreWeave are capitalizing on the AI infrastructure boom, the former presents a more compelling opportunity for investors seeking early-stage growth with significant upside potential. Unlike CoreWeave, which has already scaled and may face valuation saturation, APLD is in the early innings of its AI transition, leveraging purpose-built, liquid-cooled data centers and a diversified revenue model that includes hosting, HPC and AI cloud services. Its disciplined capex strategy, strong revenue visibility through long-term contracts, and growing customer base signal a favorable risk-reward profile.

For investors looking to enter the AI infrastructure space before valuations peak, APLD offers a more attractively positioned growth story with room to outperform. Applied Digital currently carries a Zacks Rank #2 (Buy) while CoreWeave has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 6 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite