|

|

|

|

|||||

|

|

Dover Corporation DOV has reported second-quarter 2025 adjusted earnings per share (EPS) from continuing operations of $2.44, beating the Zacks Consensus Estimate of $2.39. In the year-ago quarter, the company reported an adjusted EPS of $2.10 (excluding after-tax purchase accounting expenses and after-tax gain on disposition of a minority-owned equity method investment).

On a reported basis, Dover has delivered an EPS of $1.74 in the quarter, down 15% year over year.

Total revenues in the second quarter increased 5.2% year over year to $2.05 billion. The top line surpassed the Zacks Consensus Estimate of $2.04 billion. Organic growth was 1% in the quarter.

Dover Corporation price-consensus-eps-surprise-chart | Dover Corporation Quote

Cost of sales grew 2.9% year over year to $1.23 billion in the reported quarter. Gross profit increased 8.7% year over year to $818 million. The gross margin was 39.9% compared with the year-ago quarter’s 38.6%.

Selling, general and administrative expenses rose 8.1% to $4634 million from the prior-year quarter. Adjusted EBITDA grew 10% year over year to $514 million. The adjusted EBITDA margin was 25.1% in the quarter compared with the prior-year quarter’s 24%.

The Engineered Products segment’s revenues fell 3.3% year over year to $276 million in the quarter. The reported figure surpassed our estimate of $259 million. The segment’s adjusted EBITDA grew 3.2% year over year to $58.6 million. The figure topped our estimate of $45 million.

The Clean Energy & Fueling segment’s revenues were $546 million compared with the prior-year quarter’s $463 million. The figure topped our estimate of $508 million. The segment’s adjusted EBITDA was $117 million, up from the prior-year quarter’s $95 million. The figure topped our estimate of $105 million.

The Imaging & Identification segment’s revenues inched up 1.6% year over year to $292 million. The reported figure missed our estimate of $293 million. The segment’s adjusted EBITDA was $81 million, up from the year-ago quarter’s $79 million. The figure missed our estimate of $82.5 million.

The Pumps & Process Solutions segment’s revenues increased 9.1% year over year to $520 million in the second quarter. The figure missed our estimate of $521 million. The adjusted EBITDA of the segment totaled $173 million compared with the year-ago quarter’s $150 million. The reported figure came in line with our estimate.

The Climate & Sustainability Technologies segment’s revenues decreased to $416 million from the $437 million reported in the year-earlier quarter. We predicted revenues of $443 million for this segment. The segment’s adjusted EBITDA totaled $84.98 million compared with $86 million in second-quarter 2024. The figure missed our estimate of $87.9 million.

Dover’s bookings at the end of the second quarter were worth $2.01 billion compared with the prior-year quarter’s $1.88 billion. Total booking exceeded our estimate of $1.99 billion.

The company had a free cash inflow of $151 million in the second quarter compared with the year-ago quarter’s $220 million. The cash flow from operations amounted to $212 million in the quarter under review compared with the prior-year quarter’s $149 million.

Backed by a strong second-quarter performance, the company raised its 2025 outlook. It has raised the adjusted EPS view to $9.35-$9.55 for 2025 from $9.20-$9.40. The company anticipates year-over-year revenue growth of 4-6%.

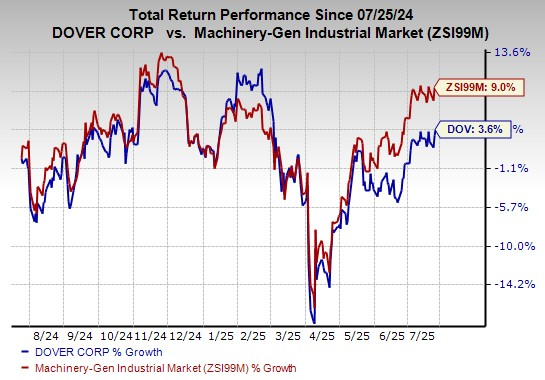

The company’s shares have gained 3.6% in the past year compared with the industry’s growth of 9%.

Dover currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Crane Company CR, scheduled to release second-quarter 2025 results on July 28, has a trailing four-quarter average surprise of 5.9%. The Zacks Consensus Estimate for Crane Company’s second-quarter 2025 earnings is pegged at $1.33 per share, suggesting year-over-year growth of 2.3%.

The Zacks Consensus Estimate for Crane Company’s top line is pegged at $569.5 million, indicating a decrease of 2% from the prior-year reported figure.

Ingersoll Rand Inc. IR is scheduled to release second-quarter 2025 results on July 31. The Zacks Consensus Estimate for Ingersoll Rand’s second-quarter 2025 earnings is pegged at 80 cents per share, suggesting a year-over-year fall of 3.6%.

The Zacks Consensus Estimate for Ingersoll Rand’s top line is pegged at $1.84 billion, implying an increase of 2.1% from the prior year’s actual. IR has a trailing four-quarter average surprise of 2.2%.

Gates Industrial Corporation plc GTES, scheduled to release second-quarter 2025 results on July 30, has a trailing four-quarter average surprise of 6.1%. The Zacks Consensus Estimate for Gates Industrial’s second-quarter 2025 earnings is pegged at 39 cents per share, suggesting year-over-year growth of 8.3%.

The Zacks Consensus Estimate for Gates Industrial’s top line is pegged at $874.8 million, indicating a decrease of 1.2% from the prior-year reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite