|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Altria Group Inc. MO posted second-quarter 2025 results, wherein both top and bottom lines beat the Zacks Consensus Estimate and increased year over year.

The company's continued progress toward its long-term vision in the second quarter, supported by the strength of the core businesses. Growth in the oral tobacco segment was driven primarily by strong performance from the on! brand. Moreover, the company narrowed its full-year 2025 adjusted earnings guidance.

Altria’s second-quarter adjusted earnings were $1.44 per share, which rose 8.3% year over year and beat the Zacks Consensus Estimate of $1.37. This upside was driven by reduced shares outstanding and increased adjusted operating companies' income (“OCI”).

The company posted net revenues of $6,102 million, which declined 1.7% year over year. This was due to a decrease in net revenues in the smokeable products segment, partially offset by an increase in net revenues in the oral tobacco products segment. Revenues, net of excise taxes, increased 0.2% to $5,290 million. The top line beat the consensus mark, which was pegged at $5,190 million.

Altria Group, Inc. price-consensus-eps-surprise-chart | Altria Group, Inc. Quote

Smokeable Products: Net revenues in the category fell 2.5% year over year to $5,357 million due to reduced shipment volume. These were somewhat offset by higher pricing. Revenues, net of excise taxes, fell 0.4%.

Domestic cigarette shipment volumes tumbled 10.2% due to the industry’s decline rate and retail share losses. The industry’s decline was a result of the continued growth of flavored disposable e-vapor products and persistent discretionary income challenges for Adult Tobacco Consumers (“ATC”). Altria’s reported cigar shipment volumes increased 3.7%.

Adjusted OCI in the segment jumped 4.2% to $2,947 million due to improved pricing, reduced per-unit settlement charges and lower costs. This was somewhat negated by reduced shipment volume. The adjusted OCI margins grew 2.9 percentage points to 64.5%.

Oral Tobacco Products: Net revenues of the segment rose 5.9% to $753 million. The upside was primarily driven by higher pricing, partially offset by an increased percentage of on! shipment volume compared with the MST year over year (mix change) and the reduced shipment volume. Revenues excluding excise taxes rose 6%.

Domestic shipment volumes fell 1%, due to retail share losses and other factors. This was partly negated by the industry’s growth rate and trade inventory movements.

Adjusted OCI in the segment increased 10.9%, driven by increased pricing and lower costs, partially offset by a change in mix and a decline in shipment volumes. The adjusted OCI margin grew 3.1 percentage points to 68.7%.

This Zacks Rank #3 (Hold) company ended the quarter with cash and cash equivalents of $1,287 million, long-term debt of $23,651 million and a total stockholders’ deficit of $3,256 million.

In the second quarter of 2025, the company bought back 4.7 million shares, totaling $274 million. As of June 30, 2025, $400 million remained under its $1 billion authorized share repurchase program, which is likely to be completed by Dec. 31, 2025. Altria paid dividends worth $1.7 billion in the second quarter.

The company now expects 2025 adjusted earnings per share (EPS) in the range of $5.35 to $5.45, indicating year-over-year growth of 3% to 5% from a base of $5.19 in 2024. Earlier, the metric was expected in the $5.30-$5.45 per share range, implying 2-5% growth. The guidance also indicates the absence of the prior year’s one-time benefit from the expiration of the Master Settlement Agreement legal fund in the fourth quarter of 2024.

The company’s 2025 guidance implies the currently estimated cost impact of increased tariffs, based on the most recent available information. It also assumes minimal disruption to combustible and e-vapor product volumes from ongoing enforcement actions targeting the illicit e-vapor market. In addition, the guidance range factors in the reinvestment of expected cost savings from the Optimize & Accelerate initiative, along with lower forecasted net periodic benefit income.

As the external landscape remains dynamic, Altria continues assessing economic factors like inflation and tariffs, ATC dynamics (such as purchasing patterns and the adoption of smoke-free products), illegal e-vapor enforcement and regulatory developments.

The bottom-line view also considers planned investments associated with enhanced smoke-free product research, development and marketplace activities to support MO’s smoke-free products.

Altria continues to expect a 2025 adjusted effective tax rate of 23-24%, capital expenditures of $175-$225 million, and depreciation and amortization expenses of approximately $290 million.

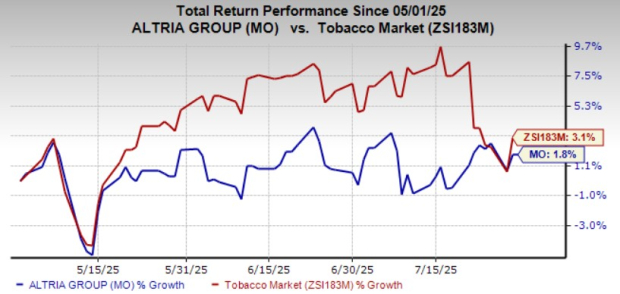

Shares of MO have gained 1.8% in the past three months compared with the industry’s 3.1% growth.

Post Holdings, Inc. POST operates as a consumer-packaged goods holding company in the United States and internationally. It currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Post Holdings’ current fiscal-year sales and earnings indicates growth of 2.7% and 7.3%, respectively, from the prior-year levels. POST delivered a trailing four-quarter earnings surprise of 22.9%, on average.

The Chefs' Warehouse, Inc. CHEF distributes specialty food and center-of-the-plate products in the United States, the Middle East and Canada. It currently carries a Zacks Rank of 2 (Buy). CHEF delivered a trailing four-quarter earnings surprise of 10.2%, on average.

The Zacks Consensus Estimate for The Chefs' Warehouse’s current fiscal-year sales and earnings indicates growth of 6% and 12.2%, respectively, from the prior-year levels.

Nomad Foods NOMD, which manufactures frozen foods, holds a Zacks Rank # 2 at present. NOMD delivered a trailing four-quarter earnings surprise of 3.2%, on average.

The Zacks Consensus Estimate for Nomad Foods’ current financial-year sales and earnings implies growth of 6.7% and 8.8%, respectively, from the year-ago number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite