|

|

|

|

|||||

|

|

PVH Corporation PVH is likely to post a year-over-year decline in its top and bottom lines when it reports fourth-quarter fiscal 2024 results on March 31, after market close. The Zacks Consensus Estimate for quarterly revenues is pegged at $2.3 billion, indicating a drop of 6.1% from the prior-year number.

The consensus estimate for earnings is pegged at $3.19 per share, which indicates a decline of 14.3% year over year. The consensus mark has remained stable in the past 30 days.

In the last reported quarter, the company delivered an earnings surprise of 16.1%. It has a trailing four-quarter earnings surprise of 17.3%, on average.

PVH Corp. price-consensus-eps-surprise-chart | PVH Corp. Quote

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

PVH Corp’s fourth-quarter fiscal 2024 results are expected to reflect the impacts of a challenging operating backdrop due to the calendar shift, which includes the loss of the 53rd week. The company has been witnessing sluggishness in its Heritage Brands segment for quite some time now, owing to the decline in the sale of the Heritage Brands women's intimates business. Higher raw material costs and currency headwinds are likely to have been concerning.

In addition, the wholesale channel remains under pressure, with anticipated softness in orders from retail partners. The company is also dealing with a more promotional retail environment, which is expected to weigh on profitability in the to-be-reported quarter. Elevated freight costs, due to disruptions in key sourcing locations, further add to the margin pressures.

On its last earnings call, management anticipated revenues to decline 6-7% (down 4-5% on a constant currency basis) year over year for the fiscal fourth quarter. This included a 1% reduction related to the Heritage Intimate business sale. The fourth-quarter operating margin is expected to contract 200 basis points to 10%.

Gross margin is forecasted to decline nearly 200 basis points, thanks to a moderately higher promotional backdrop, elevated freight costs owing to the disruptions in its major sourcing locations and the mix of wholesale shipments within the second half of the fiscal year. PVH envisioned adjusted earnings per share (EPS) to be $3.05-$3.20 compared with $3.72 in the year-ago quarter, including an unfavorable currency impact of 9 cents a share.

Management further anticipated a mid-single-digit revenue decrease in the wholesale business, including a 2% decline from the sale of the Heritage Intimates business. On a reported basis, including the 53rd week, wholesale revenues are anticipated to be down in the high-single digits. In Europe, the company foresees a high-single-digit revenue decline in euros, reflecting ongoing macroeconomic challenges. The Zacks Consensus Estimate for Tommy Hilfiger and Calvin Klein sales is currently pegged at $1.3 billion and $1.02 billion, respectively, indicating a year-over-year drop of 1.4% and 3.2%.

While these factors raise concern about the outcome, PVH Corp’s PVH+ Plan appears encouraging. The plan mainly aims at accelerating growth by boosting its core strengths and connecting Calvin Klein and TOMMY HILFIGER brands with the consumers. PVH strives to create the best products across its significant growth categories. It expects to strengthen its presence in the global demand spaces where its iconic labels resonate well with consumers. Gains from these efforts are likely to have provided some cushion to the quarterly performance.

Our proven model does not conclusively predict an earnings beat for PVH Corp this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

PVH Corp has an Earnings ESP of -0.56% and a Zacks Rank of 4 (Sell). You can uncover the best stocks before they're reported with our Earnings ESP Filter.

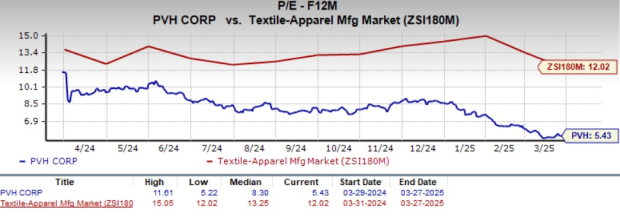

From a valuation perspective, PVH Corp’s shares present an attractive opportunity, trading at a discount relative to historical and industry benchmarks. With a forward 12-month price-to-earnings ratio of 5.43, below the five-year median of 9.21x and the Textile - Apparel industry’s average of 12.02x, the stock offers compelling value for investors seeking exposure to the sector.

Here are some companies that, according to our model, have the right combination of elements to post an earnings beat this season:

Snap-on Incorporated SNA presently has an Earnings ESP of +0.09% and a Zacks Rank of 3. The company is likely to register growth in the top and bottom lines when it reports first-quarter fiscal 2025 results. The consensus mark for SNA’s quarterly revenues is pegged at $1.2 billion, which indicates 1.4% growth from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here

The consensus mark for Snap-on quarterly earnings has moved down a penny in the past 30 days to $4.82 per share. The consensus estimate indicates an increase of 1.5% from the year-ago quarter’s actual.

Planet Fitness PLNT currently has an Earnings ESP of +0.73% and a Zacks Rank of 3. PLNT is likely to register top-line growth when it reports first-quarter fiscal 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $288.1 billion, indicating 16.2% growth from the figure reported in the year-ago quarter.

The consensus estimate for PLNT’s quarterly earnings has moved down a penny in the past 30 days to 61 cents per share. The consensus estimate indicates a rise of 15.1% from the year-ago quarter’s actual.

Rogers Communication RCI currently has an Earnings ESP of +5.56% and a Zacks Rank of 3. RCI is likely to register a decline in its top line when it reports first-quarter fiscal 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $3.4 billion, indicating a 5.7% dip from the figure reported in the year-ago quarter.

The consensus estimate for Rogers Communication’s earnings has been stable at 72 cents per share in the past 30 days. The consensus estimate indicates a decline of 1.4% from the year-ago quarter’s actual.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 14 hours | |

| 14 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite