|

|

|

|

|||||

|

|

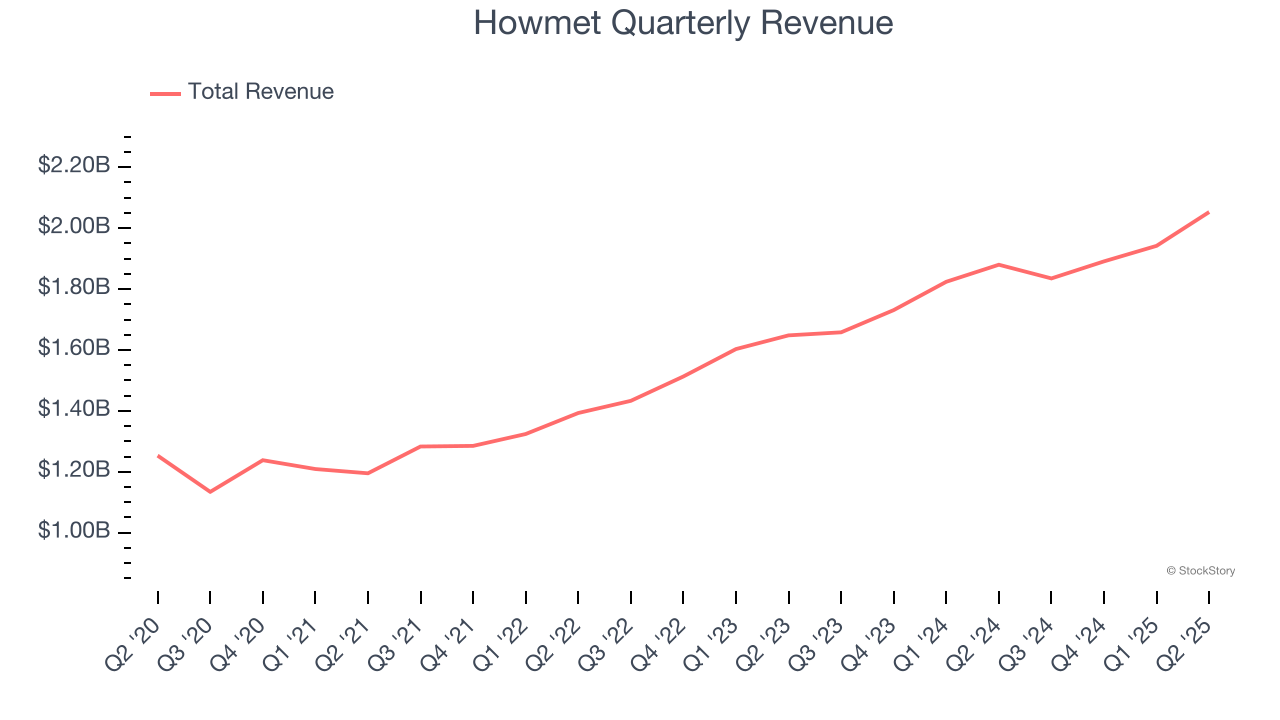

Aerospace and defense company Howmet (NYSE:HWM) announced better-than-expected revenue in Q2 CY2025, with sales up 9.2% year on year to $2.05 billion. The company expects next quarter’s revenue to be around $2.03 billion, close to analysts’ estimates. Its non-GAAP profit of $0.91 per share was 4.2% above analysts’ consensus estimates.

Is now the time to buy Howmet? Find out by accessing our full research report, it’s free.

Inventing the first forged aluminum truck wheel, Howmet (NYSE:HWM) specializes in lightweight metals engineering and manufacturing multi-material components used in vehicles.

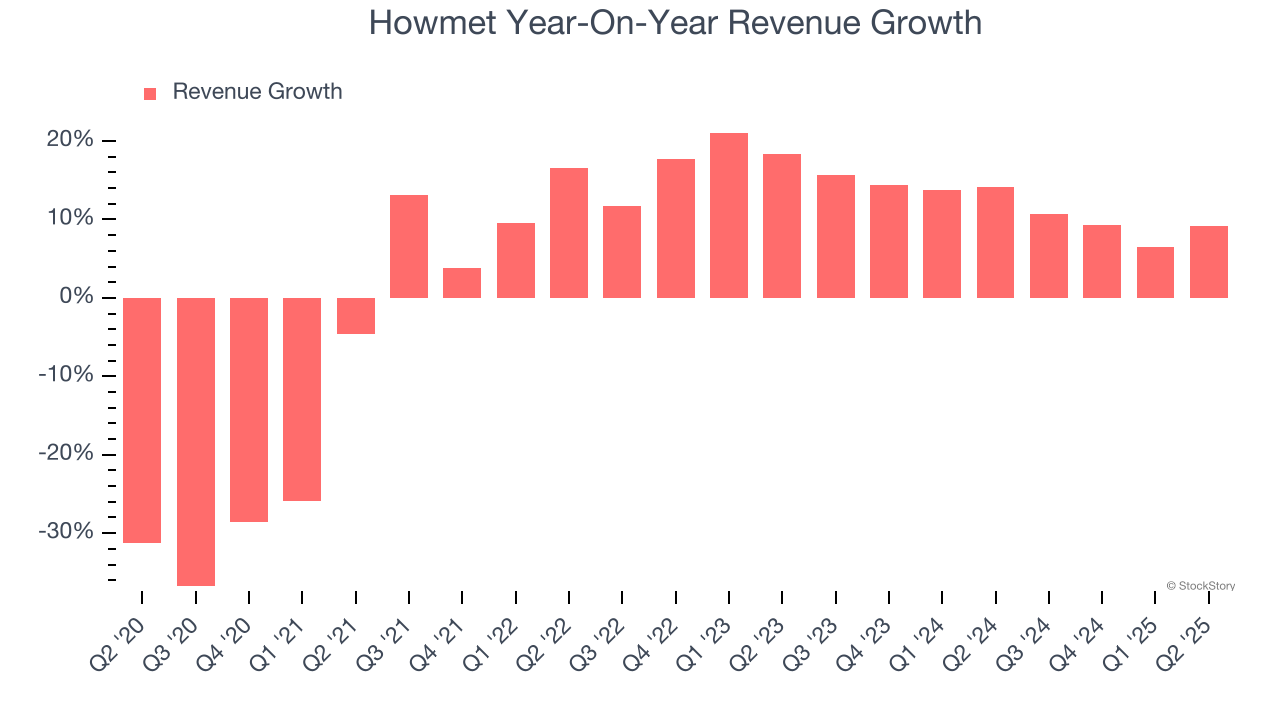

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Howmet’s 3.8% annualized revenue growth over the last five years was sluggish. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Howmet.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Howmet’s annualized revenue growth of 11.6% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Engine products and Fastening systems, which are 51.4% and 21% of revenue. Over the last two years, Howmet’s Engine products revenue (aircraft engines, industrial turbines) averaged 14.5% year-on-year growth while its Fastening systems revenue (connector products and tools) averaged 16.2% growth.

This quarter, Howmet reported year-on-year revenue growth of 9.2%, and its $2.05 billion of revenue exceeded Wall Street’s estimates by 2.5%. Company management is currently guiding for a 10.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10% over the next 12 months, a slight deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and implies the market is forecasting success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

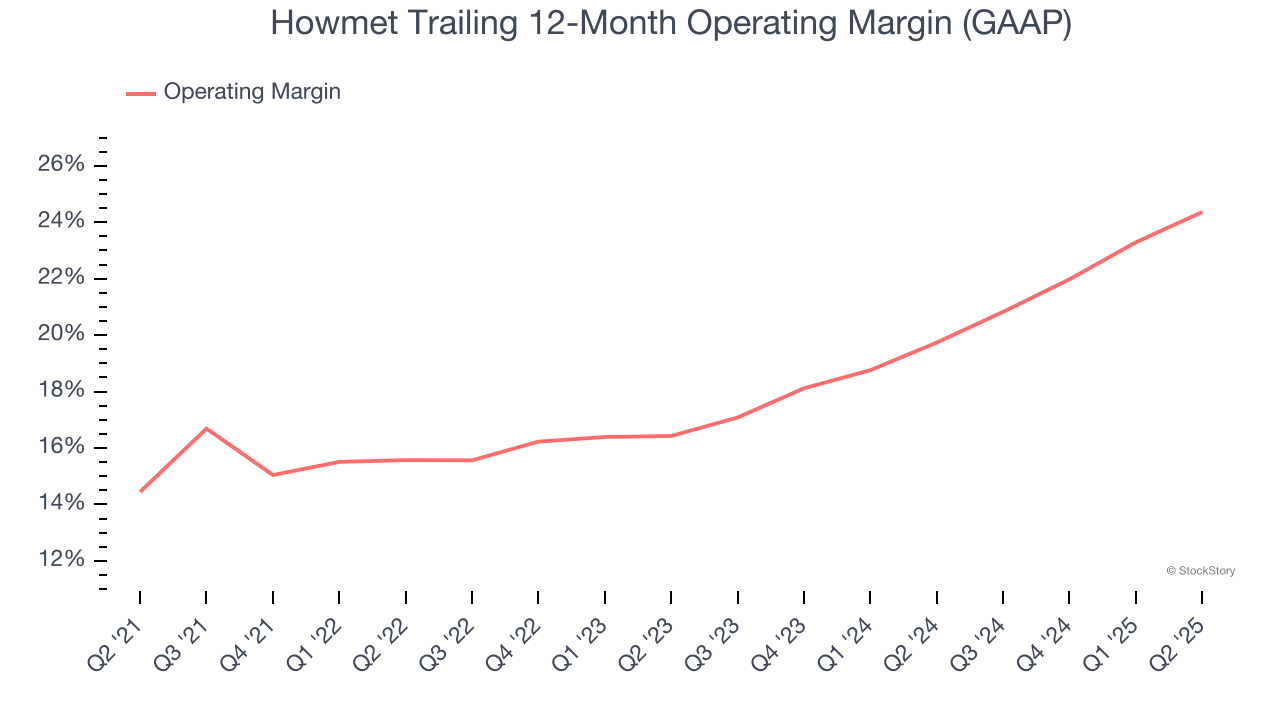

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Howmet has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.7%.

Looking at the trend in its profitability, Howmet’s operating margin rose by 9.9 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Howmet generated an operating margin profit margin of 25.4%, up 4.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

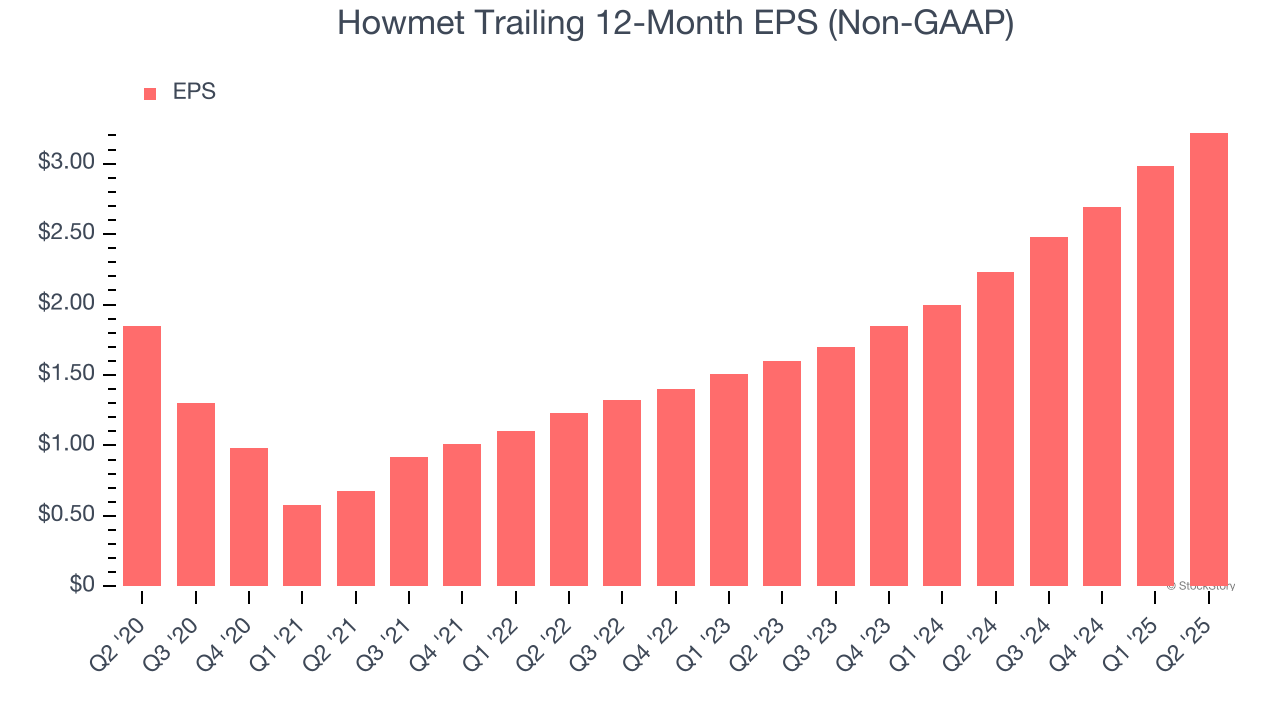

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Howmet’s EPS grew at a solid 11.7% compounded annual growth rate over the last five years, higher than its 3.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

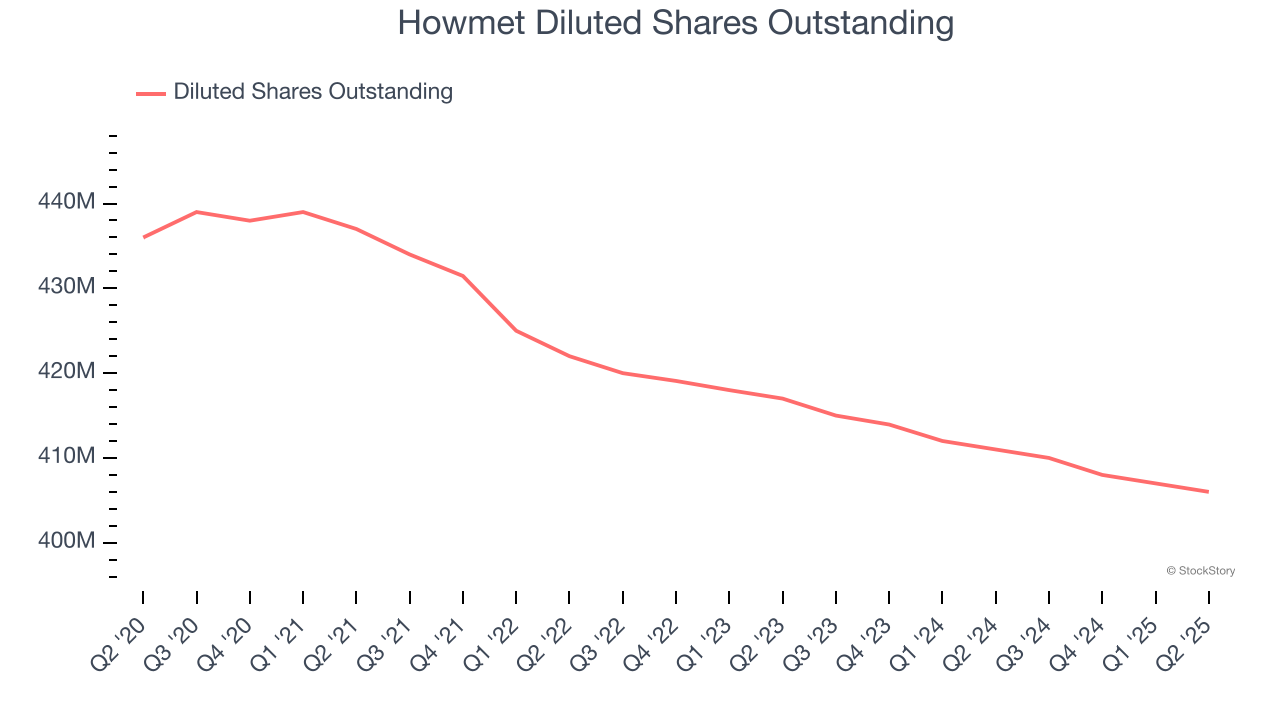

Diving into Howmet’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Howmet’s operating margin expanded by 9.9 percentage points over the last five years. On top of that, its share count shrank by 6.9%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Howmet, its two-year annual EPS growth of 41.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, Howmet reported adjusted EPS at $0.91, up from $0.67 in the same quarter last year. This print beat analysts’ estimates by 4.2%. Over the next 12 months, Wall Street expects Howmet’s full-year EPS of $3.22 to grow 17.7%.

This was a beat and raise quarter, which is always impressive. We specifically liked that Howmet blew past analysts’ Engine products revenue expectations this quarter. We were also glad its total revenue and EPS outperformed Wall Street’s estimates, leading the company to raise full-year guidance for both key metrics. Overall, this print was good. The stock traded up 1.4% to $194.94 immediately after reporting.

Sure, Howmet had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite