|

|

|

|

|||||

|

|

Amarin Corporation AMRN reported a loss of 3 cents per share for the second quarter of 2025, which was significantly narrower than the Zacks Consensus Estimate of a loss of 66 cents per share. The company had reported break-even earnings in the year-ago quarter.

Excluding stock-based compensation expense, licensing agreement fees and restructuring expense, the company recorded adjusted earnings of 4 cents per share in the second quarter of 2025 compared with adjusted earnings of 1 cent reported in the year-ago quarter.

Total revenues in the second quarter were $72.7 million, which also beat the Zacks Consensus Estimate of $46 million. The top line increased 8% from the year-ago quarter’s levels, owing to higher licensing and royalty revenues.

Shares of Amarin were up 2.2% on July 30 owing to the better-than-expected results.

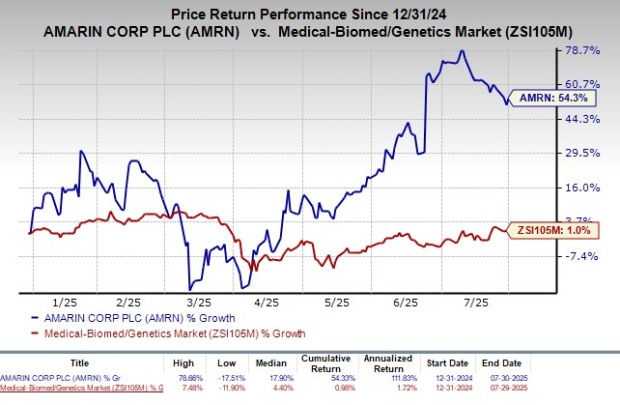

The stock has rallied 54.3% so far this year compared with the industry’s rise of 1%.

Net product revenues from Vascepa, the company’s sole marketed drug, in the second quarter were $46.6 million, down 2% year over year.

U.S. product revenues from Vascepa totaled $36.5 million, declining 17% from the year-ago quarter’s level as rising generic competition continued to hurt sales volumes and price. The drug’s U.S. sales beat our model estimate of $35.5 million.

Product revenues from Vazkepa (Vascepa’s brand name in Europe) in the European market totaled $6.6 million, surging 85% from the year-ago quarter. Revenues in the rest of the world were $3.5 million compared with $0.2 million reported in the year-ago quarter.

Licensing and royalty revenues came in at $26.1 million in the second quarter, increasing 31% on a year-over-year basis. The increase was driven by the recognition of an upfront payment under the European licensing and supply agreement with Recordati, along with higher royalty revenues from partners.

Selling, general and administrative expenses remained almost flat year over year at $38.7 million.

Research and development expenses totaled $4.9 million, up 4% year over year.

Amarin ended the second quarter with cash and investments of $298.7 million compared with $281.8 million as of March 31, 2025.

In June 2025, the company signed an exclusive long-term license and supply agreement with Italy-based pharma company, Recordati, to commercialize Vazkepa across 59 countries in the European Union.

Per management, the partnership with Recordati is expected to accelerate growth for Vazkepa across the European market.

The deal grants Recordati an exclusive license to market Amarin’s Vazkepa across Europe. In return, Amarin received an upfront payment of $25 million and is eligible to receive potential milestone payments of up to $150 million.

The deal with Recordati is likely to boost Amarin’s cash position.

Along with the Recordati licensing deal, the company initiated a global restructuring, which is expected to deliver approximately $70 million in cost savings over the next 12 months.

Amarin Corporation PLC price-consensus-eps-surprise-chart | Amarin Corporation PLC Quote

Amarin currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the biotech sector are Arvinas ARVN, CorMedix CRMD and Immunocore IMCR, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Arvinas’ 2025 loss per share have narrowed from $1.60 to $1.50. Loss per share estimates for 2026 have narrowed from $3.28 to $2.98 during the same period. ARVN stock has plunged 60.4% year to date.

Arvinas’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 82.09%.

In the past 60 days, estimates for CorMedix’s earnings per share have increased from 93 cents to 97 cents for 2025. During the same time, earnings per share estimates for 2026 have increased from $1.64 to $1.65. Year to date, shares of CRMD have rallied 42.4%.

CorMedix’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 25.82%.

In the past 60 days, estimates for Immunocore’s 2025 loss per share have narrowed from 86 cents to 68 cents. Loss per share estimates for 2026 have narrowed from $1.34 to $1.10 during the same period. IMCR stock has increased 13.6% year to date.

Immunocore’s earnings beat estimates in three of the trailing four quarters while missing the same on the remaining occasion, the average surprise being 76.18%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite