|

|

|

|

|||||

|

|

Solventum SOLV reported second-quarter 2025 adjusted earnings per share (EPS) of $1.69, which beat the Zacks Consensus Estimate of $1.45 by 16.6%. The bottom line gained 8.3% year over year.

GAAP EPS in the quarter was 51 cents, flat year over year.

The company reported revenues of $2.16 billion, up 3.9% reportedly from the prior-year recorded number. Organically, sales were up 2.8%. The metric beat the Zacks Consensus Estimate by 1.9%. Organic sales growth was primarily driven by positive performance from all segments, primarily MedSurg and HIS.

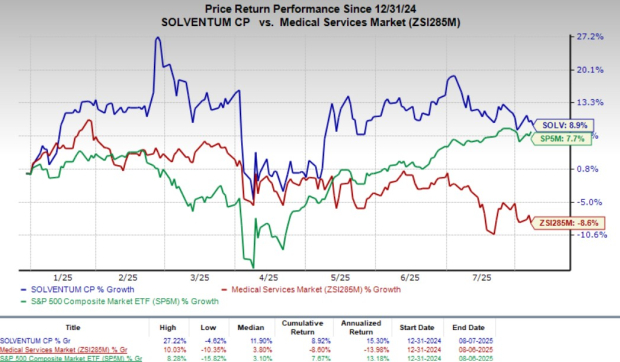

Shares of the company were up 5% during after-hours trading on Aug. 7, following strong quarterly results. The stock has risen 8.9% so far this year against the industry’s decline of 8.6%. The S&P 500 Index has gained 7.7% in the same period.

MedSurg

Revenues from this segment totaled $1.23 billion, up 4.8% reportedly and up 3.9% organically year over year. Organic growth was driven by differentiated brands, new product launches and commercial restructuring efforts.

Dental Solutions

Revenues totaled $338 million, up 2.3% year over year reportedly and up 0.7% organically. The growth was driven by new product innovations and increased sales channel specialization.

HIS

Revenues from this segment amounted to $339 million, up 3.4% reportedly and 3.2% organically on a year-over-year basis. The growth was driven by partnership with Ensemble, a leading end-to-end provider of RCM services as well as its leadership position in AI-driven solutions for healthcare operation.

Purification and Filtration

Revenues from this segment amounted to $252 million, up 3.4% year over year reportedly and up 3.1% organically. Growth was driven by strong demand for bioprocessing solutions and expanded capacity for industrial business.

Adjusted gross profit was $1.21 billion, up 4.1% year over year. As a percentage of revenues, the adjusted gross margin was 56%, up approximately 20 bps from the prior-year quarter’s figure.

Selling, general and administrative expenses totaled $772 million, up 10.1% year over year.

Research and development expenses totaled $189 million, down 1.6% on a year-over-year basis.

Adjusted operating income totaled $474 million, up 10.2% year over year. As a percentage of revenues, the adjusted operating margin was 21.9%, up approximately 120 bps from the prior-year quarter’s figure.

Solventum exited the second quarter with cash, cash equivalents and investments of $492 million compared with $534 million in the previous quarter.

Total assets increased to $15.07 billion from $14.52 billion in the previous quarter.

Solventum raised its sales guidance for 2025. Solventum now expects organic sales growth of 2-3% (2.5-3.5% excluding ~50bps of SKU Exit impact), up from the previous guidance of 1.5-2.5%. The Zacks Consensus Estimate for the same is pegged at $8.43 billion.

SOLV now expects adjusted EPS to be in the band of $5.80-$5.95 (previously $5.45-$5.65). The Zacks Consensus Estimate for earnings is pinned at $5.58 per share.

Solventum Corporation price-consensus-eps-surprise-chart | Solventum Corporation Quote

Solventum exited the second quarter on a strong note, with both the top and bottom lines beating their respective Zacks Consensus Estimate. The organic growth at SOLV’s largest segment (in terms of revenues), MedSurg, looks promising. The trend is likely to continue in the upcoming quarters as well due to continued demand for its products. Strong adoption of 360 Encompass revenue cycle management is likely to aid sales growth for the HIS segment in the future.

SOLV is undergoing a three-phase restructuring program after its separation from 3M in 2023. Phase 1 is expected to be completed within 12-24 months, focusing on debt reduction, portfolio optimization and operational efficiency. These initiatives fuel the company’s long-term prospects.

Solventum currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Medpace Holdings, Inc. MEDP, West Pharmaceutical Services, Inc. WST and Boston Scientific Corporation BSX.

Medpace Holdings, sporting a Zacks Rank #1 (Strong Buy) at present, reported second-quarter 2025 EPS of $3.10, which beat the Zacks Consensus Estimate by 3.3%. Revenues of $603.3 million outpaced the consensus mark by 11.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace Holdings has a long-term estimated growth rate of 11.4%. MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.9%.

West Pharmaceutical reported second-quarter 2025 adjusted EPS of $1.84, which beat the Zacks Consensus Estimate by 21.9%. Revenues of $766.5 million surpassed the Zacks Consensus Estimate by 5.4%. It currently flaunts a Zacks Rank #1.

West Pharmaceutical has a long-term estimated growth rate of 8.5%. WST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.8%.

Boston Scientific reported second-quarter 2025 adjusted EPS of 75 cents, which beat the Zacks Consensus Estimate by 4.2%. Revenues of $5.06 billion surpassed the Zacks Consensus Estimate by 3.5%. It currently carries a Zacks Rank #2 (Buy).

Boston Scientific has a long-term estimated growth rate of 14%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 8.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite