|

|

|

|

|||||

|

|

One of the companies discussed in this article is using AI to win a bigger share of the lucrative digital advertising market.

The other company in focus in this piece is enabling the AI revolution through its semiconductor manufacturing equipment, and it seems well-positioned to accelerate its growth.

Artificial intelligence (AI) is projected to have a profound impact on the global economy in the long run by driving up productivity levels, spurring customers and businesses to spend money on AI-related applications. According to market research firm IDC, AI could account for 3.5%, or almost $20 trillion, of the global gross domestic product (GDP) by the end of the decade.

This explains why investors have been betting big on AI stocks over the past three years, and that's why many of the names benefiting from the rapid adoption of this technology are now trading at expensive multiples. Hardware giants such as Nvidia and Broadcom sport rich earnings multiples, while software specialists such as Palantir and Snowflake are also expensive.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

However, if you have missed the AI-fueled rally in shares of the above-mentioned companies in the past year, it would be a good time to take a closer look at Meta Platforms (NASDAQ: META) and Lam Research (NASDAQ: LRCX). These companies are making the most of the global AI rollout, and importantly, they are trading at attractive multiples right now.

Let's look at the reasons why buying these two AI stocks right now could turn out to be a smart long-term move.

Image source: Getty Images.

AI is turning out to be a nice catalyst for digital advertising giant Meta Platforms, which has been offering its AI-powered advertising tools to advertisers and brands to improve audience targeting and reduce costs simultaneously. On the company's latest earnings conference call, management pointed out that AI tools have led to a 5% jump in ad conversions on Instagram, along with a 3% improvement on Facebook.

Moreover, Meta's users are now spending more time on its apps thanks to AI-powered content recommendations. The time users spent on Facebook and Instagram increased by 5% and 6%, respectively, in the previous quarter. These factors explain why Meta reported a solid increase of 22%, to $47.5 billion, in its Q2 revenue. Its bottom-line growth was even better, with adjusted earnings per share jumping by 38% year over year to $7.14 per share.

The numbers crushed Wall Street's expectations, fueling a big jump in Meta's stock price following the release of its results on July 30. Meta benefited from a 9% year-over-year jump in the average price per ad served during the quarter. Also, the AI-driven improvement in user engagement led to an 11% increase in ad impressions delivered by the company in the previous quarter.

Additionally, more advertisers on Meta's platform are now using its generative AI ad tools to create and optimize the performance of their campaigns. Meta says that almost 2 million advertisers are now using its AI video generation tools, while the adoption of its text generation tools is also improving. Looking forward, Meta's AI ad tools are likely to be adopted by more advertisers, as the company reports they significantly boost advertising returns.

A study conducted by the company earlier this year revealed that its AI advertising tools are delivering a "22% improvement in return on ad spend for advertisers." It won't be surprising to see advertisers funneling those savings back into Meta's advertising solutions to reach a bigger audience, thereby leading to further growth in the social media giant's revenue and earnings.

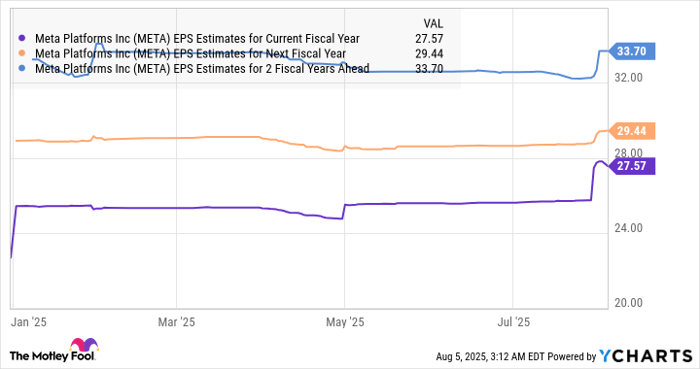

As such, it is easy to see why analysts have increased their earnings growth expectations for Meta.

META EPS Estimates for Current Fiscal Year data by YCharts. EPS = earnings per share.

The best part is that investors can buy this tech stock at an extremely attractive 27 times earnings, which is lower than the tech-laden Nasdaq-100 index's earnings multiple of almost 33. Buying Meta at this valuation looks like a no-brainer, as the company can gain a bigger share of the digital ad market thanks to the AI-powered gains it is delivering to advertisers.

Semiconductors are powering the AI revolution. Complex chip systems capable of tackling huge workloads are necessary to train and deploy AI models in data centers. This is why companies such as Nvidia, Broadcom, AMD, and Taiwan Semiconductor Manufacturing Company (TSMC) have seen healthy growth in their revenue and earnings in the past couple of years.

However, the chips that the companies mentioned above design and fabricate wouldn't have been possible without the semiconductor manufacturing equipment sold by the likes of Lam Research. The company sells wafer and fabrication equipment (WFE) to foundries such as TSMC and Intel and to memory manufacturers like Samsung, Micron, and SK Hynix.

These companies have been increasing their capital expenditure budgets to make more AI-focused chips. Unsurprisingly, industry association SEMI is projecting a 6.2% increase in WFE spending in 2025, followed by a bigger jump of 10.2% in 2026. It is worth noting that SEMI increased its WFE spending guidance last month.

The good part is that Lam is already benefiting from the improved spending on semiconductor equipment. The company released its fiscal 2025 results on July 30. It reported a 23% year-over-year increase in annual revenue to $18.4 billion. Its diluted earnings per share increased at a faster pace of 43% to $4.15 per share last fiscal year.

The stronger WFE spending forecast going forward explains why Lam's outlook was a solid one. It is expecting $5.2 billion in revenue in the current quarter, which is well ahead of the $4.63 billion consensus estimate. That would translate into a year-over-year increase of 25% in its top line. Lam seems capable of sustaining this healthy momentum throughout the year on the back of an increase in AI-focused semiconductor capacity.

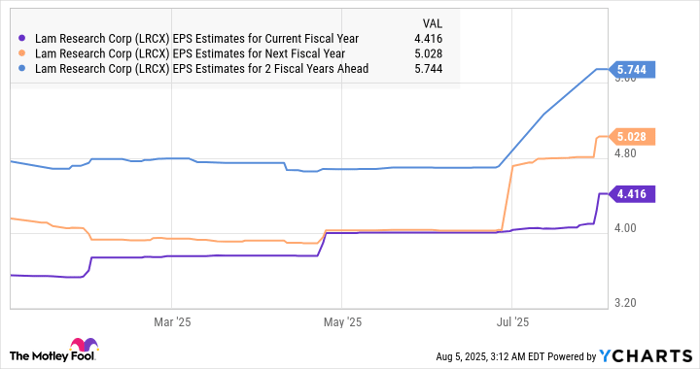

As such, don't be surprised to see Lam's revenue growth in the current fiscal year exceeding the 8% increase that analysts are projecting. The following chart tells us that Wall Street analysts expect Lam to clock healthy double-digit earnings growth rates. That looks reasonable, considering the 24% annual growth that the AI chip market is expected to clock over the next five years, which should ideally lead to more investments in semiconductor manufacturing capacity.

LRCX EPS Estimates for Current Fiscal Year data by YCharts. EPS = earnings per share.

In the end, there is a possibility that Lam will grow at a stronger pace than Wall Street's expectations in the long run, and this should pave the way for more upside in this AI stock. With Lam trading at just 23 times trailing earnings, investors are getting a great deal on this stock right now, and they may not want to miss it, considering the AI-fueled gains it could deliver.

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,563!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,108,033!*

Now, it’s worth noting Stock Advisor’s total average return is 1,047% — a market-crushing outperformance compared to 181% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 4, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, Lam Research, Meta Platforms, Nvidia, Palantir Technologies, Snowflake, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: short August 2025 $24 calls on Intel. The Motley Fool has a disclosure policy.

| 6 min | |

| 9 min | |

| 28 min | |

| 30 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 3 hours | |

| 4 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite