|

|

|

|

|||||

|

|

About the Industry

The Internet Software & Services industry is a relatively small industry, primarily involved in enabling platforms, networks, solutions and services for online businesses and facilitating customer interactions with the use of Internet-based services.

Top Themes Driving the Industry

Zacks Industry Rank Indicates Improving Prospects

The Zacks Internet – Software & Services industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #100, which places it in the top 41% of nearly 245 Zacks-classified industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates that the growth prospects are improving. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The aggregate estimate revision trend reflects an improving situation. That is because, despite some ups and downs over the past year, the estimates for both fiscal years 2025 and 2026 are showing a net improvement. The 2025 estimate dropped between January and April before moving up again. The 2026 estimate dipped in May before shooting back up in the following month. Overall, the 2025 estimate is up 7.8% over the past year while the 2026 estimate is up 15.5%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry's Stock Market Performance Is Strong

The Zacks Internet – Software & Services Industry has traded at a premium to both the broader Zacks Computer and Technology Sector and the S&P 500 since the beginning of 2025.

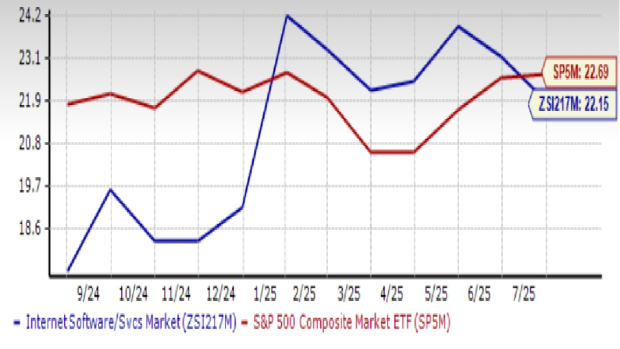

Overall, the industry returned 41.8% over the past year, compared with the broader sector’s return of 29% and the S&P 500’s 20.3%.

One-Year Price Performance

Industry's Valuation Is Attractive

On the basis of forward 12-month price-to-earnings (P/E) ratio, we see that the industry is currently trading at its median level of 22.15X, which is a 2.4% discount to the S&P 500 and a 21.3% discount to the technology sector. Technology stocks usually trade at a higher multiple because investors pay a higher premium for innovation. In this case, it appears that valuations have come down considerably of late, making the industry quite attractive.

The industry has traded in the range of 17.47X to 24.19X over the past year, as the chart below shows.

Forward 12 Month Price-to-Earnings (P/E) Ratio

2 Stocks Worth Considering

Globant S.A. (GLOB): Globant is a technology services provider with global operations. It provides a broad range of solutions including some combination of software and services spanning digital, enterprise technology, ecommerce, AI and other solutions and services directly, as well as through collaborations with AWS, Google Cloud, Microsoft, Oracle, SalesForce, SAP and ServiceNow technology solutions. Its focus industries include banks, financial services and insurance; consumer, retail and manufacturing; travel and hospitality, professional services; technology and telecommunications; healthcare; and others. Globant is headquartered in Luxembourg.

Globant’s works with some of the leading brands in the world including American Express, Santander, Google, EA, LinkedIn, Petrobas, Johnson&Johnson, British Airways, Embraer, Royal Caribbean, Ferrari, FIFA, Warner Brothers, Disney, Puma, Adidas, Loreal and many more. It serves its elite client base through domain specific Studio networks.

The corporate world is speedily moving from mere digitization to AI adoption and Globant is one of the most comprehensive providers across the spectrum. Its current focus on AI-related opportunities through its industry-specialized AI Studios, powered by AI Pods and the Globant Enterprise AI agentic innovation platform is reaping the desired results. IDC expects that by 2028, generative AI will have reached a five-year CAGR of 73.5% while Gartner expects that nearly half of the $7.4 trillion in IT spending by that year will be on software and services. Clearly, Globant is in the industry sweet spot. The fact that its offerings are delivered through a subscription model is a bonus, because it leads to relatively steady inflows that allow it to bypass, to an extent, the macroeconomic and geopolitical gyrations.

Globant has recorded very impressive growth in the last 10 years. While its revenues went from a 28.3% CAGR from 2014 to 2024, customer concentration improved significantly (top ten contributed 44% in 2014 versus 29% in 2024). This was achieved while growing average revenue per client by 23.2% for the top 10 and 23% for the top 20.

Clients contributing more than a million dollars jumped from 46 in 2014 to 341 in 2024. It therefore remains on track to achieve its 100-squared strategy, i.e. 100 customer accounts with $100 million plus revenue potential. Management intends to diversify its workforce, grow the sales team and make strategic tuck-in acquisitions as necessary in furtherance of these goals.

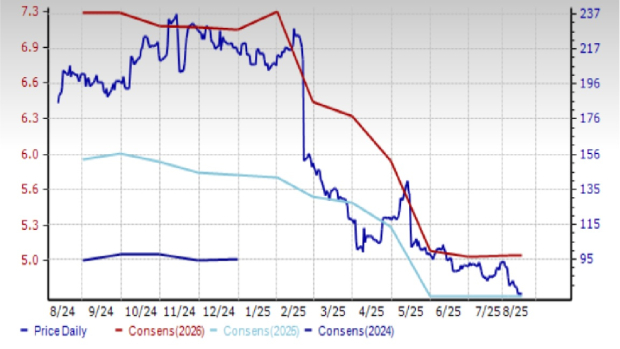

In the last-reported quarter, Globant missed the Zacks Consensus estimate by 5.7% on revenue that missed by 1.8%. The company grew revenues 7% from the year-ago quarter, but slower spending in lieu of macroeconomic uncertainty weighed on results. In this environment, management focus is on driving margins, cash flow and shareholder returns.

Shares of this Zacks Rank #2 (Buy) company are down 59.7% over the past year. In the last 30 days, its 2025 estimate has increased by a penny while the 2026 estimate dropped by a like amount. Analysts currently expect earnings to decline 4.1% this year on revenue that’s expected to grow 2.4%. In 2026, revenue and earnings are expected to grow a respective 5.9% and 6.7%.

Price and Consensus: GLOB

NetEase, Inc. (NTES): Hangzhou-based NetEase provides online services focusing on diverse content, including games, music, other services and education (dictionary, translation and including a range of smart devices) in China. Its products and services are focused on community, communication and commerce, infusing play with culture, and education with technology.

NetEase has one of the largest in-house R&D teams in gaming with a very broad focus across mobile, PC and console channels. This is generating tremendous momentum in its business right now. In the last quarter for instance, its Identity V, Where Winds Meet, Marvel Rivals and several other newly launched titles did very well. The strength in gaming, its largest segment by far, offset softness in other segments where the company is pursuing more profitable business. Fresh content is also driving its international business.

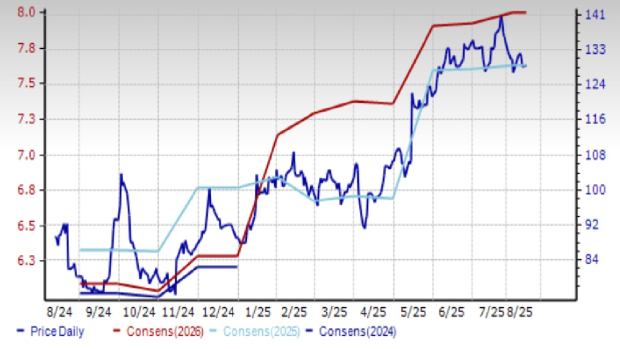

Shares of this Zacks Rank #2 (Buy) company have gained 43.8% over the past year. NetEase’s earnings for the March quarter came in 23.5% ahead of the Zacks Consensus Estimate with revenues also beating by 2.8%. The Zacks Consensus Estimate for 2025 has increased a couple of cents to $8.53 in the last 30 days while that for 2026 has increased 5 cents to $8.97. Analysts currently expect current year revenue and earnings to grow a respective 8.7% and 20.1%. Estimates for the following year are currently expected to grow 6.1% and 5.2%.

Price and Consensus: NTES

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite