|

|

|

|

|||||

|

|

Marvell Technology MRVL and Astera Labs ALAB are two semiconductor giants that specialize in networking products and AI connectivity. While MRVL plays a key role in the custom silicon and data center connectivity space, ALAB has turned out to be first to market with PCIe 6.0 Smart Fabric Switches, namely Scorpio, targeting AI-specific workloads.

With the AI boom to continue driving growth for the semiconductor industry, the question remains: Which stock makes for a better investment pick today? Let’s dive into the fundamentals, valuations, growth outlook and risks for each company.

Marvell Technology is benefiting from AI-data centers, high performance computing clients and hyperscalers’ increasing reliance on custom silicon for AI workloads. Marvell Technology’s connectivity businesses, encompassing its optics division, are experiencing robust growth as the industry is transitioning to 1.6 Terabit optical interconnects.

Marvell Technology’s advanced optical interconnects, like the 1.6T PAM DSP, are enabling data centers to move faster while consuming less power, providing a critical advantage as AI infrastructure scales. Marvell Technology’s Silicon Photonics Light Engines support speeds up to 6.4T by combining several parts into compact modules, making them ideal for both plug-in and co-packaged uses.

The company, in its first-quarter fiscal 2026 earnings, reported that its electro-optics products used in AI and cloud computing are experiencing massive traction. Its latest introduction, the co-packaged optics solutions, which feature higher interconnect densities, longer reach and scalable networking architecture, are an upgrade over the slower previous generation.

The transition from older-generation copper-based networking to high-speed optical connectivity in AI infrastructure represents a massive opportunity. Marvell Technology’s Co-Packaged Optics technology and development of the industry's first 2nm silicon IP for cloud and AI workloads solidify its position in next-generation networking.

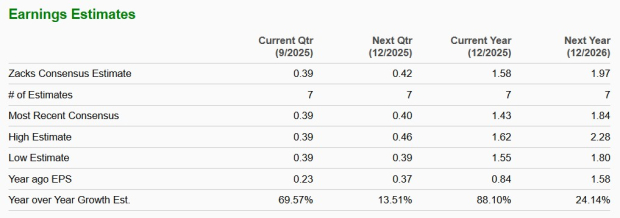

Based on all these factors, the Zacks Consensus Estimate for Marvell Technology’s 2026 revenues is pegged at $8.2 billion, indicating year-over-year growth of 42.6%. The consensus mark for earnings is pegged at $2.79 per share, suggesting a whopping 77.7% year-over-year increase.

The growing speed requirements and system complexities of AI and cloud infrastructure bode well for Astera Labs. Increasing accelerator cluster sizes, faster interconnect requirements, and overall system complexity challenges are driving demand for ALAB’s solutions. The company has emerged as a key player in next-generation data center connectivity, with a full-stack portfolio spanning PCIe 6.0, Ultra Accelerator (UA) Link, and CXL 3.0.

Astera Labs is benefiting from the industry shift toward open standards-based rack-scale AI platforms. As AI workloads demand higher network efficiency, Astera Labs’ Scorpio P-Series PCIe 6.0 scale-out, Scorpio X-Series scale-up interconnect solutions are gaining traction. Astera Labs’ close collaboration with NVIDIA for its NVLink Fusion and AMD’s UALink and other products like Aries retimers, Taurus AECs, Leo CXL controllers are also positioning ALAB strongly as AI gains popularity.

To stay ahead in the AI-connectivity space, Astera Labs is investing heavily in research and development and plans to provide a broad portfolio of connectivity solutions for the entire AI rack through purpose-built silicon hardware and software to support computing platforms based on both custom ASICs and merchant GPUs. In the second quarter of 2025, ALAB’s R&D jumped 66.4% year over year to $66.7 million.

Despite heavy investments in R&D, Astera Labs is able to maintain its bottom-line growth. The consensus mark for ALAB’s 2025 earnings is pegged at $1.58 per share, suggesting a whopping 88.5% year-over-year increase.

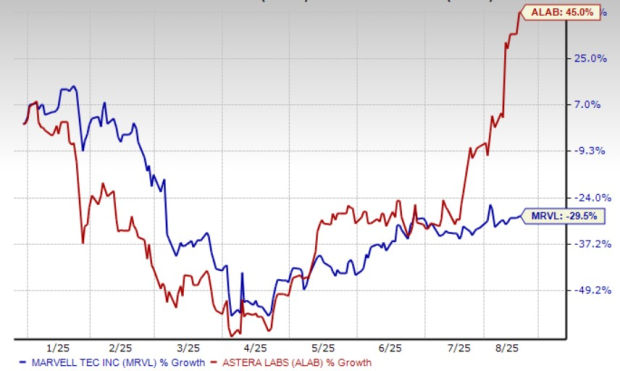

Year to date, MRVL shares have plunged 29.5%, whereas ALAB shares have jumped 45%.

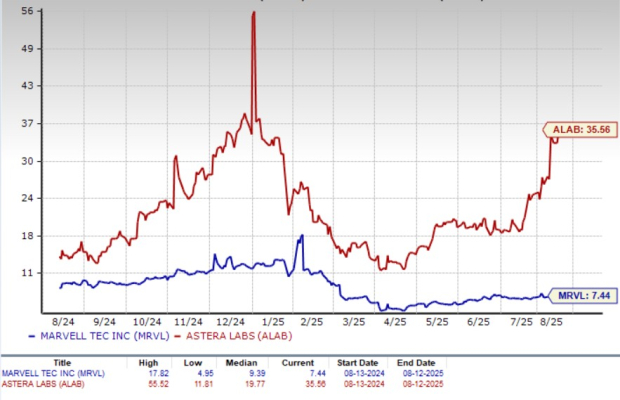

MRVL is trading at a forward sales multiple of 7.44X, below its median of 9.39X, over the past three years. ALAB’s forward sales multiple sits at 35.56X, above its median of 19.77X over the past year.

While both Marvell Technology and Astera Labs are benefiting from the proliferation of AI, ALAB has strong upside due to its specialization in the AI-connectivity space. ALAB’s strong partnerships, innovative efforts and upcoming products make it a strong player in the connectivity space.

While Marvell Technology carries a Zacks Rank #2 (Buy), ALAB flaunts a Zacks Rank #1 (Strong Buy), making ALAB a stronger buy among the two. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite