|

|

|

|

|||||

|

|

Comparable clinic revenues increase 5.7% vs prior year period

Net losses decrease 10% vs. prior year period

VIRGINIA BEACH, VA / ACCESS Newswire / August 14, 2025 / Inspire Veterinary Partners, Inc. (Nasdaq:IVP) ("Inspire" or the "Company"), an owner and provider of pet health care services throughout the U.S., today reported financial results for the second quarter ended June 30, 2025.

Second Quarter 2025 Financial Highlights Compared to Prior Periods

Total revenue of approximately $4.3 million, a sequential increase of 20% from Q1 2025 and a decrease of 2% from the prior year period. The decrease in revenue is attributed to the exclusion of the Hawaii clinic (KVC) from 2025 results

Services revenue of approximately $3.2 million, a sequential increase of 17% from Q1 2025 and a decrease of 1% from the prior year period

Product revenue of $1.1 million, a sequential increase of 21% from Q1 2025 and a decrease of 7% from the prior year period

Comparable clinic revenues increased 5.7% from the prior year period

Total operating expenses of $6.2 million, an increase of 5% from the prior year period

Net loss of $3.0 million, a decrease of $0.4 million from the prior year period

Entered an exclusive, non-binding Letter of Intent to acquire 100% ownership interest in one animal hospital located in New Jersey. Once completed, the acquisition could potentially add up to approximately $2.0 million in (unaudited) revenue

Entered into a securities purchase agreement for the issuance and sale of securities for up to $10M under a new convertible preferred stock transaction. The consideration, consisting of a combination of cash and transferred securities, was valued at $1.00 per share

Announced the launch of a company-wide incentive and recognition program, which provides vital new engagement tools and offers new avenues to wealth for all employees across their clinic network

Integrated a new artificial intelligence (AI) platform in partnership with leading software provider Covetrus into the Company's medical software. The Company believes this is the only AI platform being offered among publicly traded veterinary clinic networks

Acquired 100% ownership interest in one animal hospital located in central Florida (DeBary). The acquisition is expected to add up to approximately $1.8 million in (unaudited) revenue, and brings the Company's Florida holdings up to 5 clinics

For the second quarter of 2025, total revenue was approximately $4.3 million, a decrease of 2% from the prior year period but an increase of 20% from Q1 2025. Comparable clinic revenues increased 5.7% from the prior year period.

Second Quarter 2025 Operational Highlights

Entered an exclusive, non-binding Letter of Intent to acquire 100% ownership interest in one animal hospital located in New Jersey. Once completed, the acquisition could potentially add up to approximately $2.0 million in (unaudited) revenue

Entered into a securities purchase agreement for the issuance and sale of securities for up to $10M under a new convertible preferred stock transaction. The consideration, consisting of a combination of cash and transferred securities, was valued at $1.00 per share

Announced the launch of a company-wide incentive and recognition program, which provides vital new engagement tools and offers new avenues to wealth for all employees across their clinic network

Integrated a new artificial intelligence (AI) platform in partnership with leading software provider Covetrus into the Company's medical software. The Company believes this is the only AI platform being offered among publicly traded veterinary clinic networks

Acquired 100% ownership interest in one animal hospital located in central Florida (DeBary). The acquisition is expected to add up to approximately $1.8 million in (unaudited) revenue, and brings the Company's Florida holdings up to 5 clinics

Executive Commentary

"During the second quarter of 2025, we started to see the rewards of our new initiatives, processes, and hard work over the past 18 months with sequential revenue growth of 20% and year over year organic growth of 5.7%.," said Kimball Carr, Inspire ‘s Chairman, President and Chief Executive Officer. "We also grew our portfolio of clinics to 14 with the recently announced acquisition in Florida while significantly improving our liquidity and capital structure with the recently announced preferred stock transaction. I believe this quarter will mark the turning point for our business model and that our top line growth will accelerate going forward.

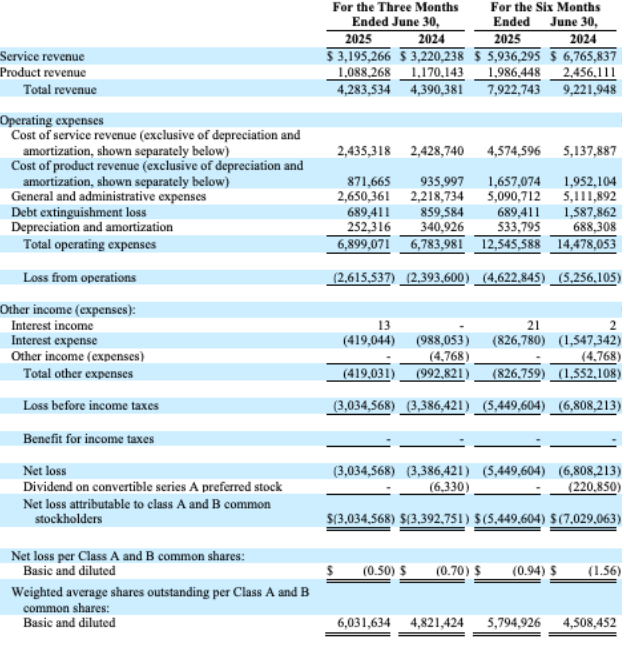

Second Quarter 2025 Financial Overview

All comparisons are made relative to the same period in 2024 unless otherwise stated.

For the second quarter of 2025, total revenue was approximately $4.3 million, a decrease of 2% from the prior year period but an increase of 20% from Q1 2025. Comparable clinic revenues increased 5.7% from the prior year period.

Service revenue for the second quarter of 2025 decreased $25,000 or 1%, to $3.2 million. The decrease in service revenue is mainly attributed to the exclusion of KVC from 2025 results and reduced practitioner capacity. These decreases were partially offset by the acquisition of the DeBary animal clinic during Q2 2025.

Product revenue for the second quarter 2025 decreased $82,000, or 7%, to $1.1 million. The overall decrease was a result of customers purchasing less products per visit and the exclusion of KVC from 2025 results partially offset by the acquisition of the DeBary animal clinic during Q2 2025.

Total operating expenses increased $285,000 or 5%. The increase is primarily due to increased costs of consulting agreements relating to customer outreach and public company costs.

Net loss for the first quarter of 2025 decreased $352,000, or 10%, to $3.0 million. The decline in net loss is primarily attributable to the reduction of interest expense and the exclusion of the operating expenses associated with KVC.

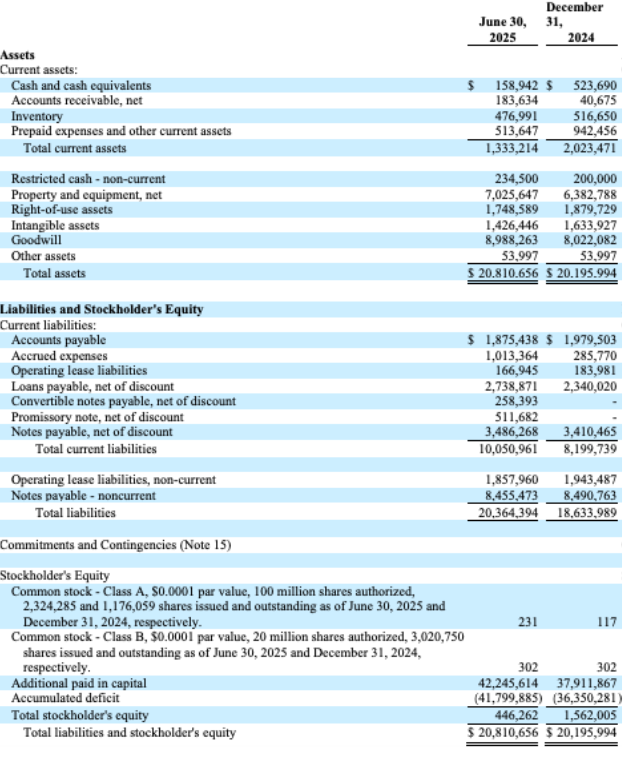

Balance Sheet

As of June 30, 2025, the Company had cash and cash equivalents of approximately $0.2 million.

About Inspire Veterinary Partners, Inc.

Inspire Veterinary Partners is an owner and provider of pet health care services throughout the US. As the Company expands, it expects to acquire additional veterinary hospitals, including general practice, mixed animal facilities, and critical and emergency care.

For more information, please visit: www.inspirevet.com.

Connect with Inspire Veterinary Partners, Inc.

https://www.facebook.com/InspireVeterinaryPartners/

https://www.linkedin.com/company/inspire-veterinary-partners/

Forward-Looking Statements

This press release includes certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding management's expectations of future financial and operational performance and expected growth and business outlook. These forward-looking statements include, but are not limited to, plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts and statements identified by words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" or words of similar meaning. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, risks associated with our limited operating history and history of losses; our ability to continue operating as a going concern; our ability to raise additional capital; our ability to complete additional acquisitions; our ability to recruit and retain skilled veterinarians; our ability to retain existing customers and add new customers; the continued growth of the market in which we operate; our ability to manage our growth effectively over the long-term to maintain our high level of service; the price volatility of our Class A common stock; our ability to continue to have our Class A common stock listed on the Nasdaq Stock Market; the impact of geopolitical conflicts, inflation, and macroeconomic instability on our business, the broader economy, and our ability to forecast our future financial performance; and other risks set forth under the caption "Risk Factors" in our SEC filings. We assume no obligation to update any forward-looking statements contained in this document as a result of new information, future events or otherwise.

Investors

CoreIR

516-386-0430

General Inquiries

Morgan Wood

[email protected]

Inspire Veterinary Partners, Inc. and Subsidiaries

Consolidated Balance Sheet

Inspire Veterinary Partners, Inc. and Subsidiaries

Consolidated Statements of Operation

Inspire Veterinary Partners, Inc. and Subsidiaries

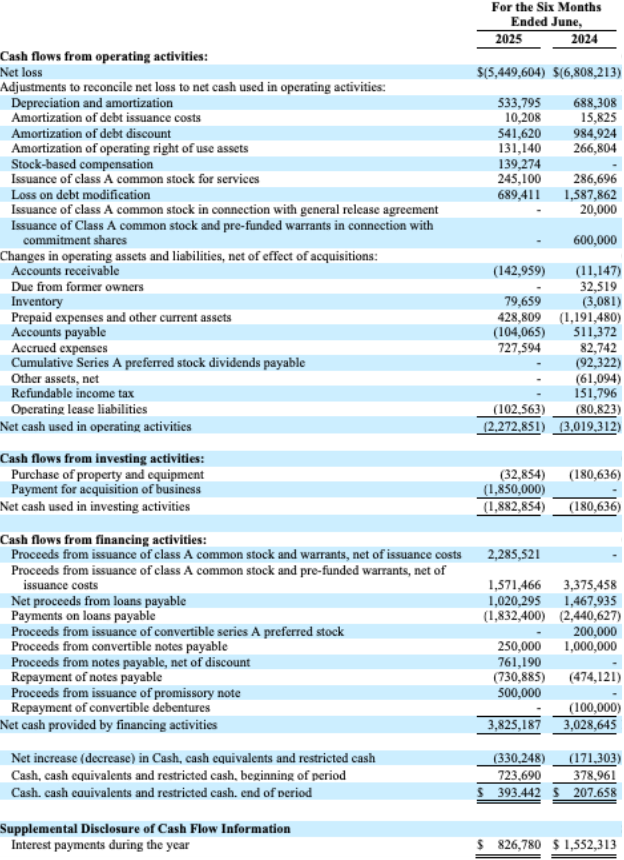

Consolidated Statements of Cash Flows

SOURCE: INSPIRE VETERINARY PARTNERS, INC.

| Jan-21 | |

| Jan-20 |

Nvidia Invests $150 Million in AI Inference Startup Baseten

The Wall Street Journal

|

| Jan-14 | |

| Dec-11 | |

| Dec-11 | |

| Dec-05 | |

| Dec-02 |

Prediction Market Kalshi Hits $11 Billion Valuation in New Funding Round

The Wall Street Journal

|

| Nov-21 |

Accounting platform Numeric raises funding in Series B round

International Accounting Bulletin

|

| Nov-12 | |

| Nov-11 | |

| Nov-11 | |

| Oct-22 | |

| Oct-21 | |

| Sep-18 | |

| Sep-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite