|

|

|

|

|||||

|

|

Bitcoin Depot Inc. BTM, which released second-quarter 2025 results on Aug. 12, reported a 183.3% year-over-year surge in profits as revenues grew 5% to $172.1 million. The increase in revenues was driven by higher kiosk deployment and median transaction size.

Further, total operating expenses declined 9.5% to $17 million on the back of lower depreciation, insurance and share-based compensation expenses as BTM continues to optimize its cost structure as a steady-state public company.

As of June 30, 2025, BTM had installed 8,978 BTM Kiosks across the USA, Canada and Australia, with a median transaction size of $300, up 30.4% from the prior year quarter. Additionally, the company added 25,007 new users during the quarter, up 19.2%. This was majorly driven by the Bitcoin rally amid uncertainties around tariff policies and a favorable regulatory backdrop.

Management expects third-quarter 2025 revenues to rise in the high-single digit range from the prior-year quarter and adjusted earnings before interest, tax, depreciation and amortization (EBITDA) to be in the 20-30% range.

Likewise, Bitcoin Depot’s peers, Coinbase Global Inc. COIN and BTCS, Inc. BTCS, posted impressive second-quarter revenue growth. Coinbase reported 3.3% revenue growth on a year-over-year basis, while BTCS, Inc.’s revenues soared 394%.

A solid Bitcoin rally, higher scale and expansion plans alongside market leadership offer Bitcoin Depot an edge over its peers. Given its strong financial performance, many investors must be tempted to buy BTM stock. But is it the right time? Let us delve deeper and analyze other factors at play.

Bitcoin Depot is set to benefit from the Trump administration’s supportive stance toward cryptocurrency.

In May 2025, Paul Atkins, chair of the Securities and Exchange Commission (SEC), stated his plans to overhaul cryptocurrency policies and establish guidelines for the distribution of crypto tokens that are securities, and consider whether additional exemptions are necessary.

In March 2025, the Federal Deposit Insurance Corporation (FDIC) clarified that FDIC-supervised institutions can engage in permissible crypto-related activities without receiving prior approval. Further, Donald Trump signed an executive order to establish a strategic crypto reserve.

These developments signify that the cryptocurrency space is likely to experience higher demand as countries embrace it and will likely be integrated into legal payment structures, favoring firms like Bitcoin Depot, Coinbase and BTCS to tap into the huge opportunity to expand.

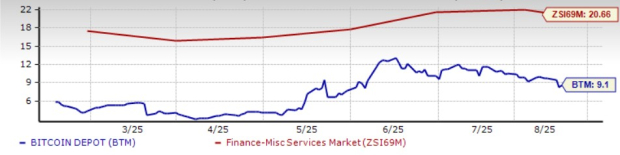

In terms of valuation, Bitcoin Depot’s 12-month forward price-to-earnings ratio (P/E) of 9.10X is lower than the industry's 20.66X. Thus, the stock is trading at a discount. This suggests that investors may pay a lower price than the company's expected earnings growth.

12-month Forward P/E Ratio

On the other hand, Coinbase and BTCS have a 12-month forward P/E ratio of 52.60X and 11.97X, respectively. This reflects that BTM stock is inexpensive compared with its peers.

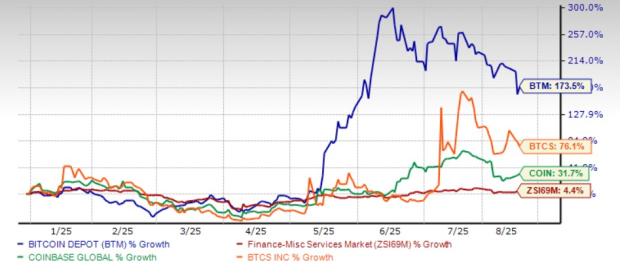

BTM shares have jumped 173.5% so far this year, outperforming the industry's 4.4% rise. Its peers, Coinbase and BTCS, rose 31.7% and 76.1%, respectively, over the same time frame.

YTD Price Performance

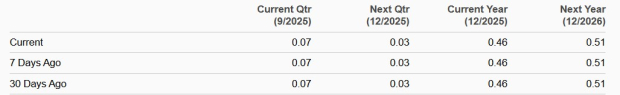

Over the past month, the Zacks Consensus Estimate for 2025 and 2026 earnings has remained unchanged at 46 cents and 51 cents, respectively. The Zacks Consensus Estimate for Bitcoin Depot’s 2025 and 2026 earnings implies year-over-year growth of 176.7% and 10.3%, respectively.

Estimates Revision Trend

Bitcoin Depot is well-positioned for growth, given its leadership in North America in BTM kiosks and focus on BTCheckout to enhance operating leverage. Further, favorable regulatory developments, significant cash circulation in the economy and growing interest in cryptocurrency among investors as an asset class are other tailwinds. Discounted valuation is another positive.

Moreover, a solid balance sheet position suggests financial stability. As of June 30, 2025, Bitcoin Depot's cash and cash equivalents were $48 million. It had a debt (including notes payable, current and non-current portion) of $66 million as of the same date.

However, expenses are expected to be elevated as the company intends to expand its kiosk network into different markets.

Also, the company is exposed to regular probes and litigations, which can create friction in operations and even hurt financially, if hefty fines are imposed. In February 2025, BTM’s subsidiaries were sued by the Iowa Attorney General for allegedly failing to prevent fraudulent use of their ATMs under the Iowa Consumer Fraud Act. The company denied the allegations and is defending the case. Also, intense competition within the industry can hurt its pricing power.

Thus, Bitcoin Depot stock remains a cautious bet for investors. Those who own it can continue holding the stock for long-term gains.

Currently, BTM carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 5 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite